Imagine the thrill of predicting market movements with precision, unlocking the secrets of stock market volatility. Enter gamma spikes options trading, a strategy that empowers you to harness the power of rapid price changes for substantial gains. Join us on an enlightening journey as we delve into the intricacies of this dynamic trading technique.

Image: www.youtube.com

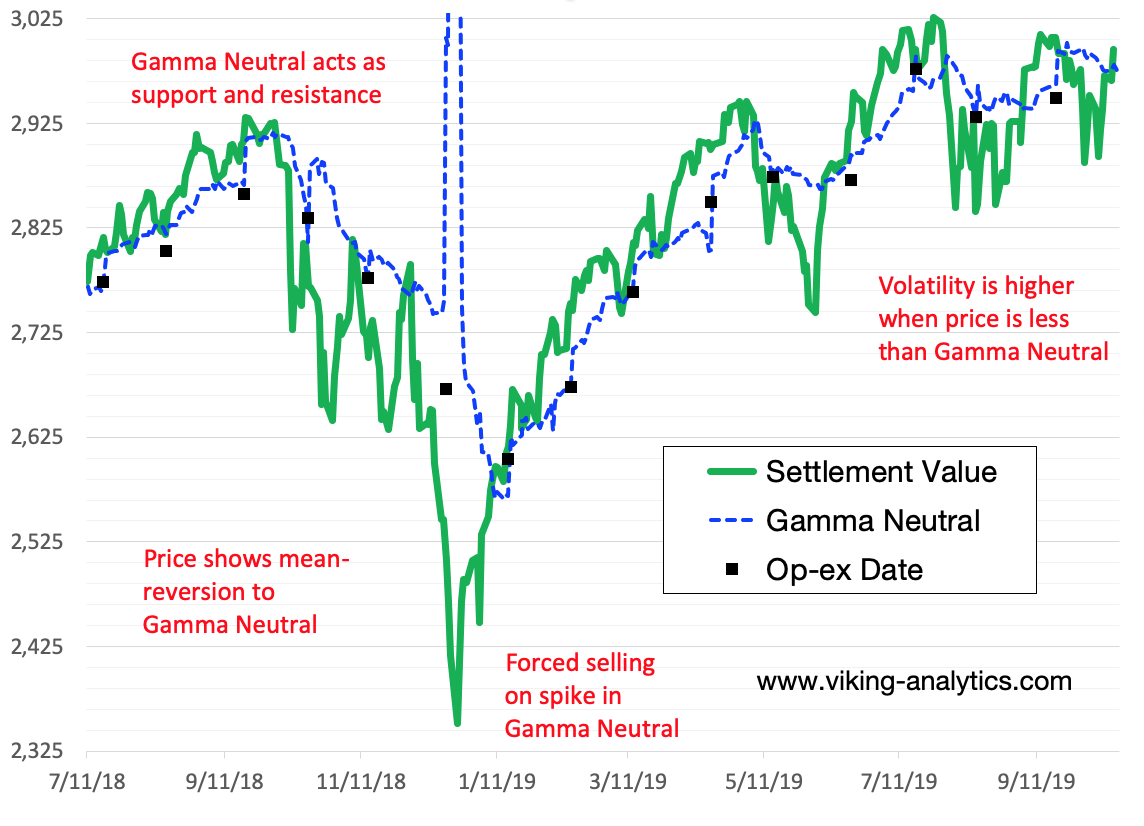

Gamma spikes options trading capitalizes on the heightened sensitivity of options to changes in the underlying asset’s price. As the price of the asset fluctuates, the gamma of an option, a measure of its rate of change, experiences a surge. By capturing these gamma spikes, traders can amplify their profits exponentially.

To master gamma spike trading, a solid foundation of options basics is crucial. Options are contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Unlike stocks, options have a limited lifespan, adding another layer of complexity to the trading equation.

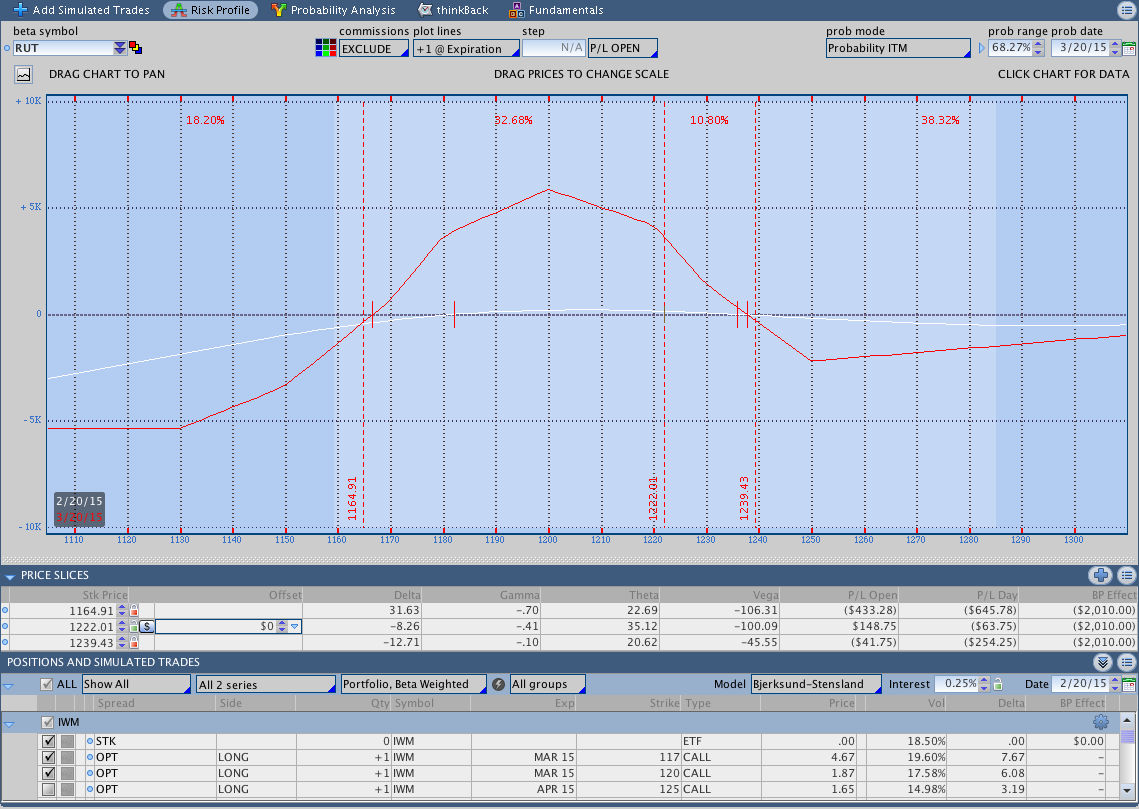

In the realm of gamma spikes, Delta Neutral Options take center stage. These options have a delta near zero, meaning their price changes almost proportionally to the underlying asset. By constructing Delta Neutral positions, traders aim to minimize their net delta exposure, allowing them to focus on capturing gamma spikes while limiting potential losses.

Now, the million-dollar question: How do we identify gamma spikes? Technical indicators, such as the Greeks Volatility Index (GVI), can provide valuable insights. A spike in GVI often signals increased market volatility, creating fertile ground for gamma spike possibilities. Additionally, monitoring option chains can reveal potential gamma concentrations, guiding you toward promising trading opportunities.

The timing of entry and exit is paramount in gamma spikes options trading. Entering too early can diminish your profit potential, while waiting too long may result in missed opportunities. Strike price selection is equally important. Choosing strikes with high implied volatility and sufficient time to expiration allows for optimal gamma exposure.

To enhance your gamma spike trading prowess, consider consulting experts in the field. Renowned traders often share their valuable insights and strategies through webinars, online forums, and books. By tapping into their wisdom, you can accelerate your learning curve and increase your chances of success.

In conclusion, gamma spikes options trading unveils a lucrative path for traders seeking to capitalize on market volatility. By understanding options dynamics, constructing Delta Neutral positions, identifying gamma spikes, and timing entry and exit strategically, you equip yourself with a powerful tool to navigate market fluctuations profitably. Remember, the path to trading mastery is adorned with continuous learning and prudent risk management. Embrace the thrill of gamma spikes options trading and unlock your potential for financial freedom.

Image: ryfanumakip.web.fc2.com

Gamma Spikes Options Trading

Image: seekingalpha.com