As an ardent explorer of the financial markets, I’ve had the privilege of unearthing hidden gems within the vast universe of investment options. Among these, foreign exchange (FX) exotic options stand out as a captivating and often overlooked path to portfolio diversification and yield enhancement.

Image: www.financialtrading.com

Stepping into the Realm of FX Exotic Options

Exotic options, as their name suggests, deviate from the vanilla options contracts that are ubiquitous in the market. They provide investors with a spectrum of alternative payoffs and risk-return profiles, catering to specific investment objectives or hedging needs. Specifically, FX exotic options offer the ability to trade fluctuations in currency exchange rates, akin to their vanilla counterparts, but with added flexibility and sophistication.

Beyond Vanilla Options: Unlocking Complexities

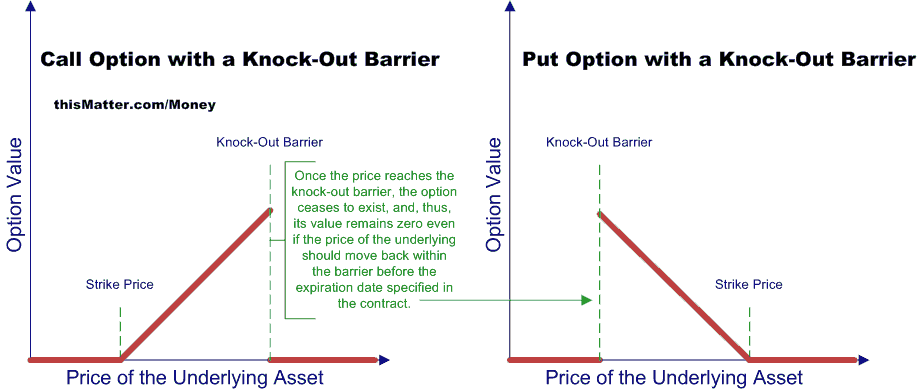

The defining feature of exotic options lies in their diverse payoff functions. Unlike vanilla options, which offer a straightforward payoff at maturity, exotic options incorporate non-linear payoffs that are often sensitive to multiple underlying factors, such as the underlying asset’s volatility, correlation, or path dependency.

This complexity opens up a plethora of possibilities for investors seeking tailored risk-return profiles. For instance, butterfly spreads, straddles, and calendar spreads are just a few examples of exotic option strategies that offer distinct advantages in specific market conditions. Moreover, exotic options can be customized to suit individual investment goals and risk tolerance.

Navigating the Evolving Landscape

The world of FX exotic options is constantly evolving, driven by advancements in financial modeling and the ever-changing market dynamics. The integration of artificial intelligence (AI) and machine learning (ML) algorithms has enhanced the accuracy of exotic option pricing models, empowering investors with more precise risk assessments and informed decision-making.

Furthermore, the proliferation of social media platforms and online forums has fostered vibrant communities where investors and experts exchange insights and share their experiences with exotic options trading. These platforms serve as invaluable resources for staying abreast of market trends and refining trading strategies.

Image: www.dailyfx.com

Expert Guidance: Tips for Success

Embarking on FX exotic options trading requires a thorough understanding of the complexities involved. Seek guidance from experienced professionals or consult reputable sources to gain insights into the nuances of exotic option strategies. Backtesting and simulation tools can also prove invaluable in evaluating the performance of different strategies under varying market conditions.

Moreover, it’s crucial to exercise caution and manage risk prudently. Exotic options can amplify both potential gains and losses, so it’s imperative to establish clear risk limits and employ appropriate hedging techniques to mitigate potential drawdowns. Diversifying your portfolio across multiple exotic options strategies and underlying currencies can further enhance risk management.

FAQs: Addressing Common Questions

Q: Are exotic options suitable for all investors?

A: No, exotic options are not appropriate for all investors. They are complex instruments that require a high level of financial knowledge and risk tolerance. Only experienced investors who fully understand the risks involved should consider trading exotic options.

Q: How do I choose the right exotic option strategy?

A: The choice of exotic option strategy depends on your individual investment objectives and risk tolerance. It’s recommended to consult with a financial advisor or conduct thorough research to identify the strategy that best aligns with your financial goals.

Fx Exotic Options Trading

![[PDF] Exotic Options Trading | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/4a29685a5c709343f0d5f24d647434ae6ea65cd6/30-Figure2.5-1.png)

Image: www.semanticscholar.org

Conclusion: Embracing the Untapped Potential

FX exotic options offer a compelling avenue for investors seeking alternative investment horizons and yield enhancement. By delving into the realm of these sophisticated instruments, investors can unlock opportunities that extend beyond traditional vanilla options. However, it’s paramount to approach exotic options trading with caution and ensure a thorough understanding of the risks involved.

Are you ready to explore the world of FX exotic options and potentially unlock new dimensions of financial success? Let the journey begin!