Introduction

Image: www.happiestpost.com

Futures options are sophisticated financial instruments that enable traders to speculate on the future movement of underlying assets, such as commodities, currencies, indices, and stocks. Navigating this complex market demands a robust and reliable trading software that empowers traders with advanced analytical tools, intuitive interfaces, and seamless execution capabilities. This article delves into the world of futures options trading software, exploring its history, core concepts, and the latest advancements that drive success in today’s markets.

History of Futures Options Trading Software

The advent of electronic trading platforms in the 1980s revolutionized the futures options market, ushering in the era of futures options trading software. These early platforms provided traders with real-time market data, charting capabilities, and order entry functionality, vastly improving trading efficiency and decision-making.

Basic Concepts of Futures and Options Trading

Futures are standardized contracts that obligate the buyer to purchase (or the seller to deliver) a specific quantity of an underlying asset at a predetermined price on a future date. Options, on the other hand, provide the buyer with the right (but not the obligation) to buy or sell an underlying asset at a specific price on or before a specified date. By utilizing options, traders gain the flexibility to manage risk and speculate on market fluctuations without directly owning the underlying asset.

Key Features of Modern Futures Options Trading Software

-

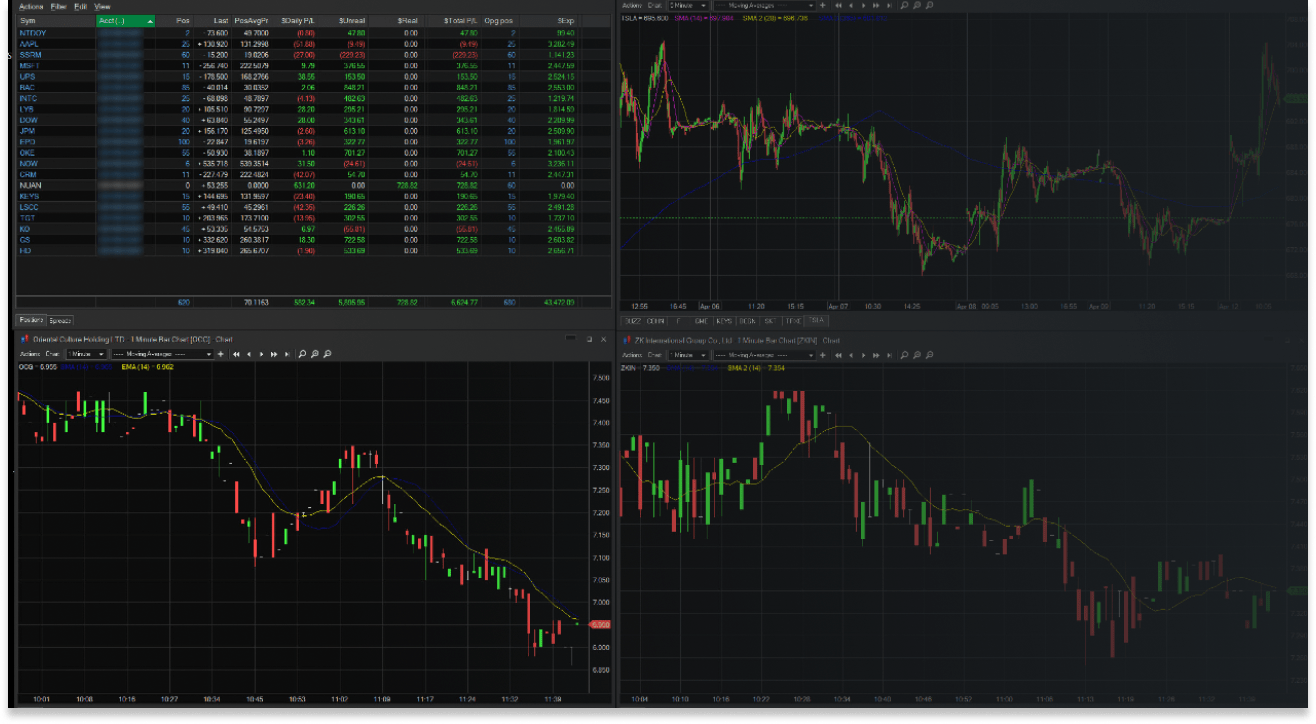

Advanced Charting Tools:

- Provide visual representations of price data and market trends

- Allow traders to identify patterns and technical indicators to support trading decisions

-

Real-Time Market Data:

- Display live quotes, volume, and market depth

- Help traders stay informed about current market conditions

-

Extensive Order Types and Trade Management:

- Offer a wide range of order types, including market orders, limit orders, and stop orders

- Enable traders to manage open positions efficiently and adjust trading strategies

-

Historical Data and Backtesting:

- Access historical market data to analyze market behavior and identify trading opportunities

- Backtest trading strategies to evaluate their profitability and risk profile before implementing them in live trading

-

Paper Trading Mode:

- Provide a risk-free environment to practice trading strategies and refine risk management techniques

-

Mobile and Cloud Support:

- Allow traders to monitor and manage their trades from anywhere with an internet connection

Choosing the Right Software for Your Trading Needs

Selecting the ideal futures options trading software depends on individual trading preferences and requirements. Factors to consider include:

- Trading style and strategy

- Preferred market and asset classes

- Platform features and functionality

- Access to historical data

- Customer support and technical assistance

Conclusion

Futures options trading software has become an indispensable tool for traders seeking to navigate the complexities of the derivatives market. By leveraging advanced features, real-time data, and sophisticated analytical tools, traders can make informed decisions, manage risk, and potentially maximize their returns. As technology continues to evolve, futures options trading software will continue to empower traders with cutting-edge capabilities, further enhancing their trading performance and unlocking new opportunities in the financial markets.

Image: www.cobratrading.com

Futures Options Trading Software

Image: brokerchooser.com