In the dynamic realm of financial markets, futures and options serve as powerful tools for discerning investors seeking to manage risk and enhance their returns. Harnessing the potential of these instruments requires robust trading software that provides comprehensive functionality, analytical capabilities, and seamless execution.

Image: www.cobratrading.com

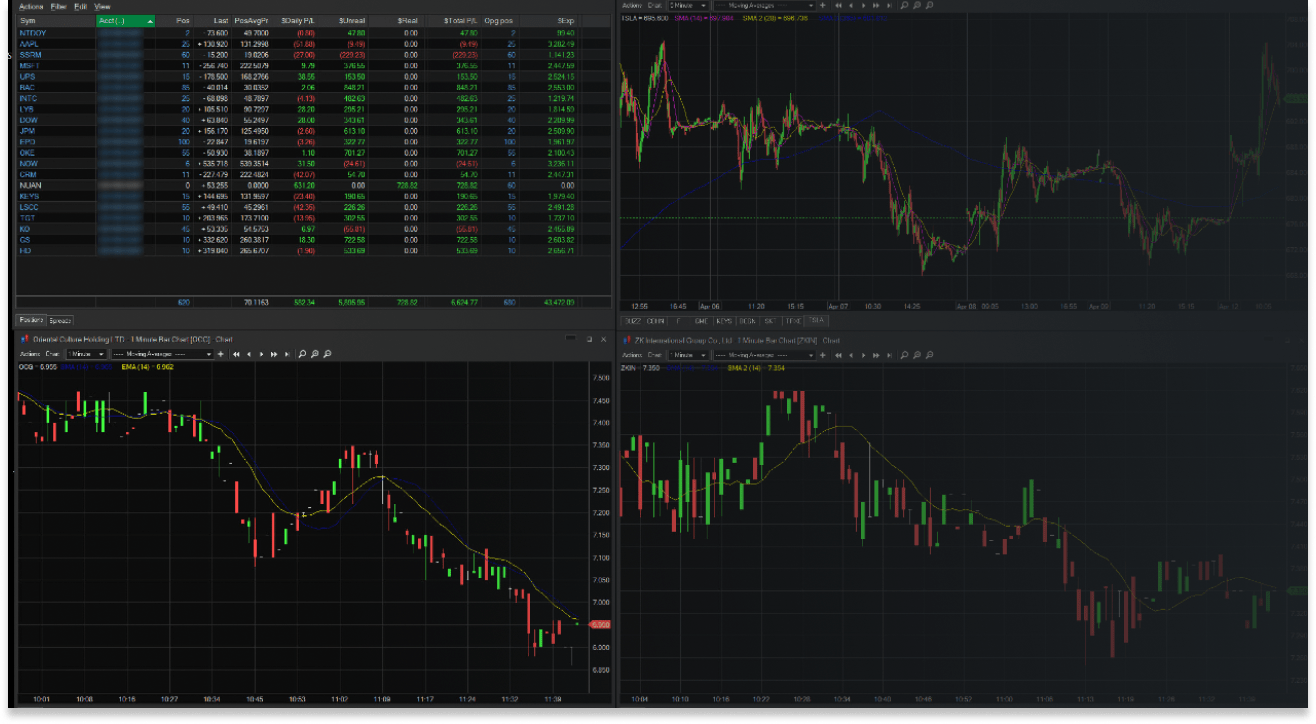

Futures and options trading software empowers traders with cutting-edge technologies that facilitate precise order placement, real-time market data visualization, and advanced risk management techniques. These platforms offer an array of features tailored to the specific needs of sophisticated investors, including real-time charting, technical indicators, market depth analysis, and automated trading capabilities.

Historical Evolution and Market Landscape

The origins of futures and options trading software can be traced back to the invention of the electronic trading platform in the 1980s. Since then, the software has undergone constant evolution, driven by technological advancements and the increasing sophistication of financial markets. Today’s software encompasses a vast ecosystem of providers, each offering unique features and catering to different market segments.

Essential Features for Success

Effective futures and options trading software should encompass a comprehensive range of features to meet the demands of all types of traders. Key considerations include:

- Real-Time Market Data: Continuous access to streaming market data, including bid-ask quotes, depth of market information, and historical data archives, ensures traders have up-to-date market intelligence at their fingertips.

- Charting Capabilities: Advanced charting tools allow traders to visualize market trends, identify patterns, and apply technical indicators to forecast price movements.

- Order Management: Sophisticated order management systems provide灵活and precise order placement, modification, and cancellation functionalities, critical for efficient trade execution.

- Risk Management: Built-in risk management tools enable traders to monitor their positions, set stop-loss orders, and manage their risk exposure effectively.

- Automated Trading: Programming interfaces (APIs) and proprietary programming languages within the software allow traders to develop and deploy custom automated trading strategies.

Advanced Capabilities

Beyond the essential features, the latest futures and options trading software also offers advanced capabilities that cater to the needs of professional and institutional traders:

- Market Depth Analysis: Real-time market depth data provides insight into order book liquidity, revealing the underlying supply and demand dynamics of the market.

- Trading Analytics: Comprehensive trading analytics tools enable traders to evaluate their performance, optimize their strategies, and identify areas for improvement.

- Sentiment Analysis: Sentiment analysis algorithms monitor market news and social media feeds to gauge market sentiment, providing traders with valuable insights into investor sentiment.

Image: www.wintick.com

Choosing the Right Software

Selecting the appropriate futures and options trading software is paramount for successful trading. Factors to consider include:

- Trading Style: Different software platforms are tailored to specific trading styles, ranging from scalping to swing trading.

- Asset Class: Certain software specializes in particular asset classes, such as stocks, commodities, or currencies.

- Cost and Functionality: Software pricing models vary depending on the features offered, with higher-end platforms often requiring subscription fees.

- Customer Support: Reliable customer support is essential to resolve any technical issues or inquiries promptly.

Futures And Options Trading Software

Image: insigniafutures.com

Conclusion

Futures and options trading software has revolutionized the way sophisticated investors manage financial risk and seek enhanced returns. By providing access to real-time market data, advanced charting tools, and risk management functionalities, these platforms empower traders to make informed decisions and execute their strategies effectively. Understanding the features, capabilities, and selection criteria of futures and options trading software is fundamental to leveraging its full potential for successful trading.