Navigate the Complexities of Energy Markets with Expert Insights

In the ever-evolving energy landscape, trading futures and options has become an indispensable tool for managing risk and capitalizing on market opportunities. The 3rd edition of “Fundamentals of Trading Energy Futures & Options” is a comprehensive and accessible guide that delves into the intricacies of this dynamic field.

Image: www.walmart.com

This meticulously crafted guide offers a holistic exploration of energy futures and options trading, equipping readers with foundational knowledge and practical strategies. From the basics of energy markets to advanced trading techniques, this essential resource covers all key aspects of the industry.

Understanding the Foundation: Energy Markets and Instruments

The book begins by laying a solid foundation with an in-depth analysis of energy markets, including their history, structure, participants, and key drivers. It then delves into the realm of energy futures and options, explaining their mechanisms, advantages, and applications in risk management and financial planning.

Mastering Trading Strategies: Navigating Energy Futures and Options

The heart of the book lies in its comprehensive exploration of trading strategies. Readers are introduced to a wide range of techniques, including hedging, speculation, and arbitrage, and learn how to develop tailored strategies based on market conditions. Specific chapters focus on trading crude oil, natural gas, and electricity futures and options, providing practical guidance for navigating these volatile and complex markets.

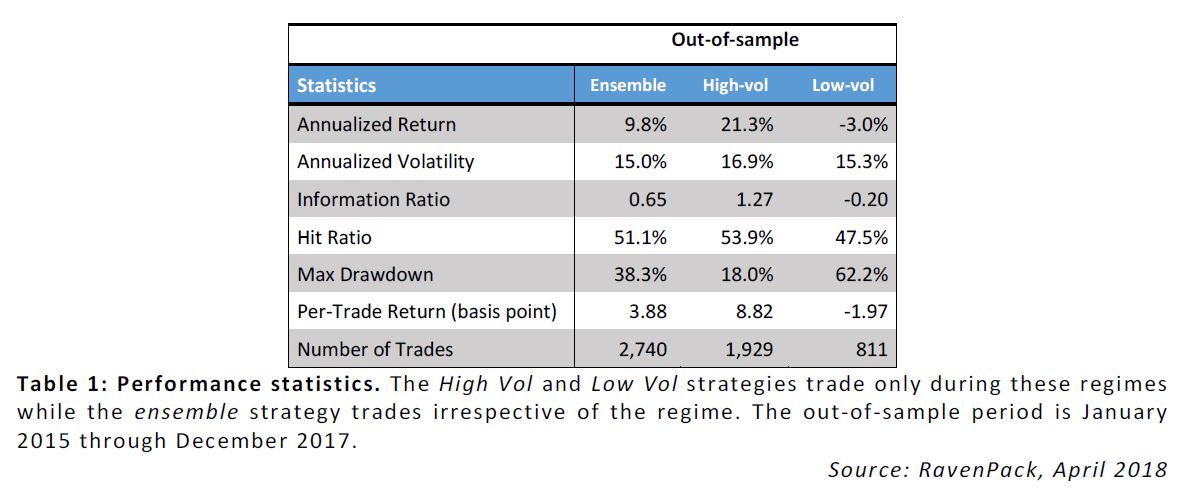

Advanced Concepts: Volatility Analysis and Risk Management

The book takes readers beyond the basics, delving into advanced concepts such as volatility analysis and risk management. It explores the role of implied volatility in pricing energy futures and options, and equips readers with tools for implementing effective risk management strategies to mitigate potential losses.

Image: www.ravenpack.com

Market Insight and Emerging Trends: Staying Ahead in the Energy Sector

The energy industry is constantly evolving, and this book ensures that readers remain at the forefront of knowledge and practice. It examines the latest trends and developments, including technological advancements, geopolitical factors, and emerging renewable energy markets. By staying informed about the industry landscape, traders can make informed decisions and adapt to changing conditions.

Fundamentals Of Trading Energy Futures & Options 3rd Edition

![[D.O.W.N.L.O.A.D] Energy Trading & Investing: Trading, Risk Managemen…](https://cdn.slidesharecdn.com/ss_thumbnails/energy-trading-investing-trading-risk-management-and-structuring-deals-in-the-energy-markets-second--200105215007-thumbnail-4.jpg?cb=1578261029)

Image: fr.slideshare.net

Conclusion: Unlock the Power of Energy Futures & Options

“Fundamentals of Trading Energy Futures & Options, 3rd Edition” concludes with a comprehensive summary of the key concepts covered in the book. It emphasizes the importance of balancing risk and opportunity, and encourages readers to continuously seek knowledge and experience to thrive in the ever-changing energy market.

Whether you’re an aspiring energy trader, a seasoned professional looking for advanced strategies, or an investor seeking a deeper understanding of the energy sector, this book is a comprehensive and authoritative guide. Its accessible writing style, real-world examples, and expert insights make complex concepts clear and actionable. By immersing yourself in its pages, you’ll gain the knowledge and skills necessary to navigate the complexities of energy futures and options trading and unlock the path to success in this dynamic field.