In a world where uncertainty prevails, harnessing the power of financial markets can be an invaluable tool for securing your financial well-being. Options trading stands out as a sophisticated yet accessible strategy that empowers you to navigate market fluctuations with greater confidence and control. This comprehensive guide will shed light on the intricacies of EZ options trading, providing you with the knowledge and practical strategies to enhance your financial literacy and pursue your investment goals.

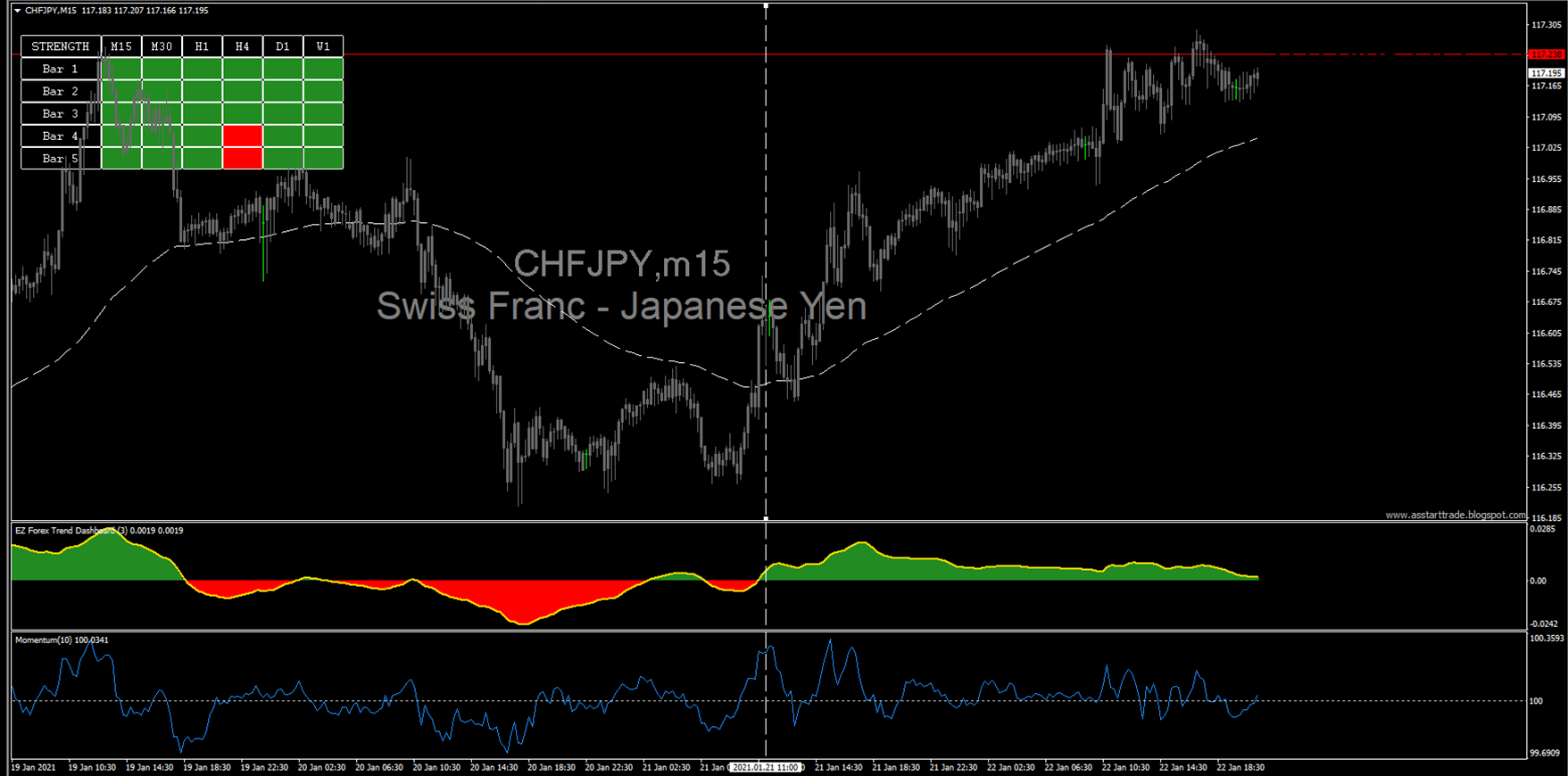

Image: www.pinterest.com

Demystifying EZ Options Trading

Options, financial instruments that derive their value from underlying assets like stocks or bonds, offer traders unparalleled flexibility and the potential for exceptional returns. EZ options trading simplifies this complex arena, empowering novice investors and experienced traders alike to delve into the world of options with confidence. These user-friendly platforms streamline the options trading process, providing intuitive interfaces, educational resources, and advanced charting tools to empower traders of all levels.

The Pillars of EZ Options Trading

Mastering EZ options trading requires a foundational understanding of its core concepts:

- Options Contracts: Legal agreements that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a particular date (expiration date).

- Call Options: Give the holder the right to buy an underlying asset. They provide profit potential when the asset’s price rises above the strike price.

- Put Options: Grant the holder the right to sell an underlying asset. Traders benefit from put options when the asset’s price falls below the strike price.

Executing Options Strategies

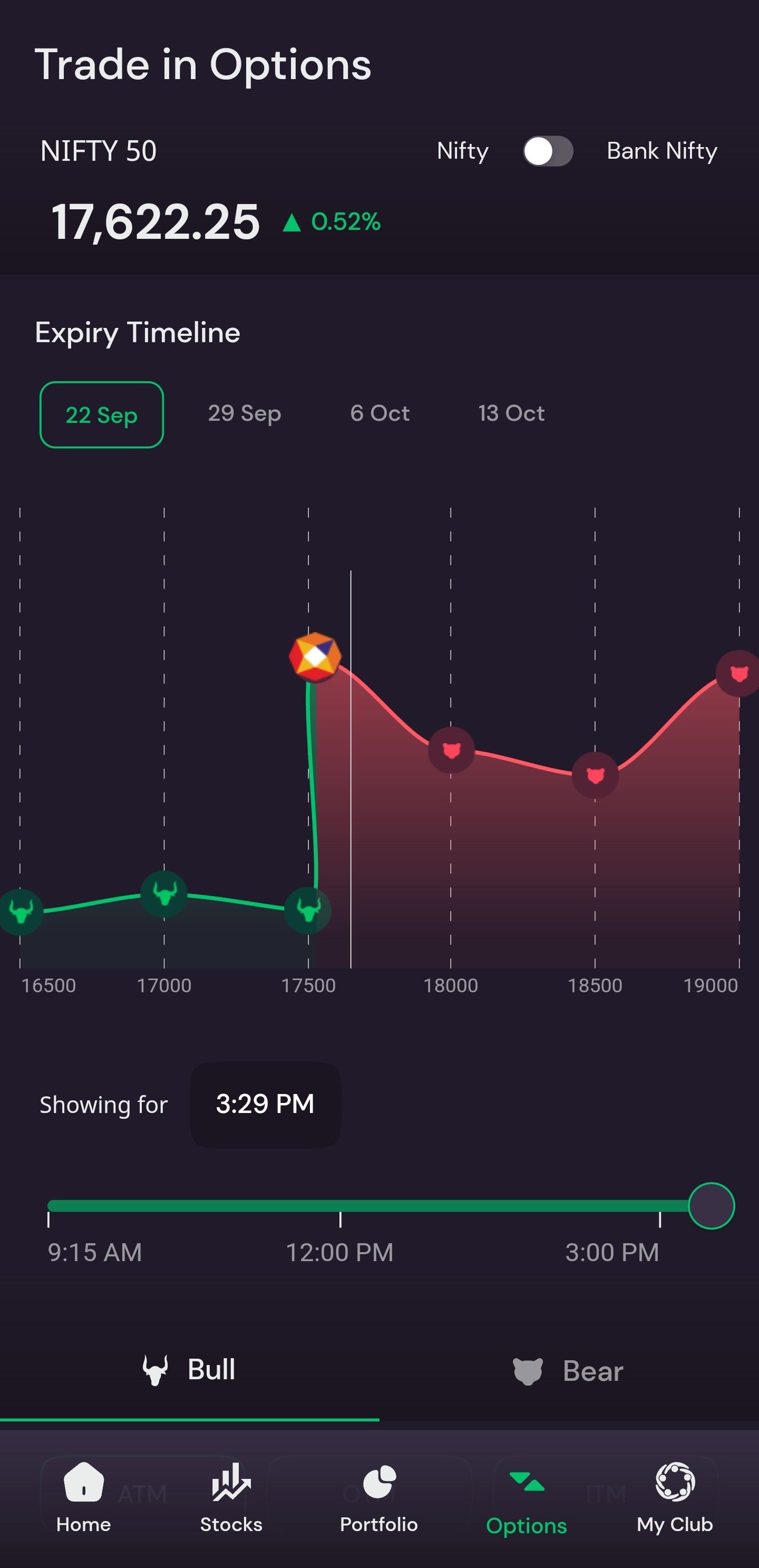

The beauty of EZ options trading lies in the diverse strategies it offers. Here are a few popular approaches:

- Bullish Strategies: Leverage call options to capitalize on rising asset prices.

- Bearish Strategies: Employ put options to profit from declining asset values.

- Neutral Strategies: Implement a combination of call and put options to hedge against market volatility.

- Covered Call Strategies: Generate additional income by selling (or “writing”) call options against underlying assets you already own.

- Protective Put Strategies: Protect your portfolio from potential downturns by buying put options that provide downside protection.

Image: superezforex.com

Navigating Market Risks

While options trading has the potential to deliver lucrative returns, it is crucial to acknowledge the inherent risks involved. Options are highly leveraged, amplifying market movements and potentially leading to significant financial losses. Thorough research, understanding your risk tolerance, and employing prudent risk management measures are essential for mitigating potential pitfalls.

Expert Insights and Actionable Tips

“The key to successful options trading lies in understanding the dynamics of the underlying asset and selecting appropriate strategies that align with your investment goals,” advises renowned options trader, Emily Jones.

- Start Small: As a beginner, trade with modest amounts of capital to minimize risks.

- Educate Yourself: Dedicate time to studying options trading principles, strategies, and market trends.

- Practice on Paper: Simulate real-world trading scenarios using paper trading accounts until you gain confidence and proficiency.

- Stay Informed: Monitor market news and economic indicators that could influence the behavior of underlying assets.

- Consider Seeking Professional Advice: Consult with a financial advisor to ensure your options trading strategy complements your broader financial plan.

Ez Options Trading

Image: blog.stratzy.in

Empowering Your Financial Future

Embrace the transformative power of EZ options trading. With the knowledge and strategies presented in this guide, you will be well-equipped to:

- Grow Your Investments: Harness the potential for substantial returns by leveraging the right options strategies.

- Mitigate Risks: Protect your portfolio from market downturns while maximizing profit opportunities.

- Gain Financial Independence: Pursue your financial aspirations and achieve long-term financial stability.

Remember, investing in options requires a balanced approach. Tread carefully, manage risks judiciously, and continue to expand your knowledge as the market landscape evolves. By empowering yourself with the insights and strategies presented in this article, you will embark on a journey towards financial success and a promising future.