In today’s fast-paced financial markets, electronic FX options trading has emerged as a powerful tool for investors seeking both risk management and profit-making opportunities. With its unique advantages and flexibility, electronic FX options trading has become an increasingly popular choice for traders of all levels.

Image: devexperts.com

This comprehensive guide will delve into the world of electronic FX options trading, providing a thorough understanding of its intricacies and equipping you with the knowledge to navigate this dynamic and lucrative market.

Understanding Electronic FX Options Trading

Electronic FX options trading refers to the buying and selling of options contracts on foreign exchange (FX) pairs through an electronic platform. These contracts grant the buyer the right, but not the obligation, to buy or sell a specific currency at a specified price on a predetermined future date.

The primary advantage of electronic FX options trading is its liquidity. The electronic platforms facilitate the rapid execution of trades, ensuring tight spreads and minimal slippage. This liquidity allows traders to enter and exit positions quickly and efficiently, reducing transaction costs and enhancing risk management.

Key Features and Mechanisms

To fully comprehend electronic FX options trading, understanding its key features and mechanisms is crucial.

- Contracts: An FX options contract specifies the underlying currency pair, the strike price (the price at which the option can be exercised), the expiration date, and the premium (the cost of the option).

- Call and Put Options: Call options give the buyer the right to buy the underlying currency pair, while put options provide the right to sell it.

- Premiums: The premium is paid upfront by the buyer to the seller and represents the value of the contract.

- Expiration Date: The expiration date determines when the option expires and the buyer’s right to exercise it ceases.

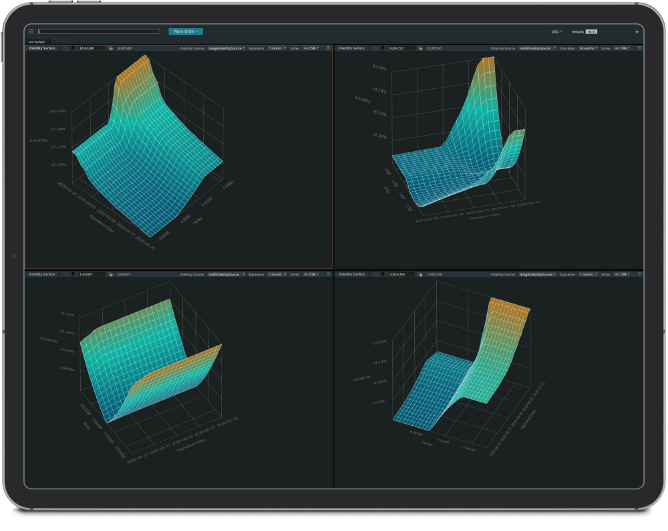

- Payoff Profile: The payoff profile graphically illustrates the potential profit or loss for different price movements of the underlying currency pair.

Latest Trends and Developments

The electronic FX options trading market is constantly evolving, fueled by advancements in technology and market dynamics. Here are some of the latest trends and developments:

- Automated Trading: Algorithmic and high-frequency trading strategies have become prevalent, offering faster execution and sophisticated risk management.

- Hybrid Models: Hybrid models combine electronic platforms with traditional over-the-counter (OTC) trading to provide greater flexibility and access to liquidity.

- Asia Pacific Growth: The Asia Pacific region has experienced significant growth in electronic FX options trading, driven by increased economic activity and market accessibility.

- Regulatory Landscape: Regulatory bodies are closely monitoring the electronic FX options trading market to ensure market stability and investor protection.

Image: www.youtube.com

Tips and Expert Advice

Whether you’re a seasoned trader or venturing into electronic FX options trading for the first time, these tips and expert advice can help you navigate this complex market:

- Define Your Goals: Determine your trading objectives and risk tolerance before entering the market.

- Understand the Underlying: Thoroughly research the currency pairs you plan to trade and stay informed about market dynamics.

- Choose a Reputable Broker: Select an established broker with a proven track record of reliability and low trading fees.

- Manage Risk: Use stop-loss orders and other risk management techniques to protect your capital.

- Stay Informed: Monitor market news and economic events that could impact currency prices.

Frequently Asked Questions

To clarify the intricacies of electronic FX options trading further, here’s a list of frequently asked questions with concise answers:

- Q: What is the difference between spot FX and options trading?

A: Spot FX involves the immediate exchange of currencies, while options trading involves contracts with specified terms and conditions.

- Q: How is the premium calculated?

A: The premium is determined by various factors, including the current price of the underlying, the strike price, the time until expiration, and market volatility.

- Q: Can I profit from both rising and falling currency prices?

A: Yes, with options, you can potentially profit from both upward and downward market movements.

- Q: Are there any risks involved in options trading?

A: Yes, options trading involves risks, including the potential loss of the entire premium paid.

Electronic Fx Options Trading

Image: forexstrategiesrevealedsimple1.blogspot.com

Conclusion

Electronic FX options trading has emerged as a highly versatile and dynamic market, offering opportunities for both risk management and profit generation. By understanding the concepts, strategies, and expert advice outlined in this guide, traders of all levels can confidently navigate this complex and rewarding market.

Are you eager to delve deeper into the fascinating world of electronic FX options trading? Explore the resources, forums, and educational materials available to empower yourself and capitalize on the opportunities this market presents.