Introduction

In the ever-evolving financial landscape, the allure of generating passive income has captured the attention of countless individuals. Among the myriad of investment avenues, options trading stands out as a potentially lucrative and accessible option. Options, derivative instruments that grant traders the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specified date, have gained immense popularity in recent years. This comprehensive guide will delve into the intricacies of options trading, empowering you with the knowledge and strategies necessary to unlock the potential of earning 30 trading options.

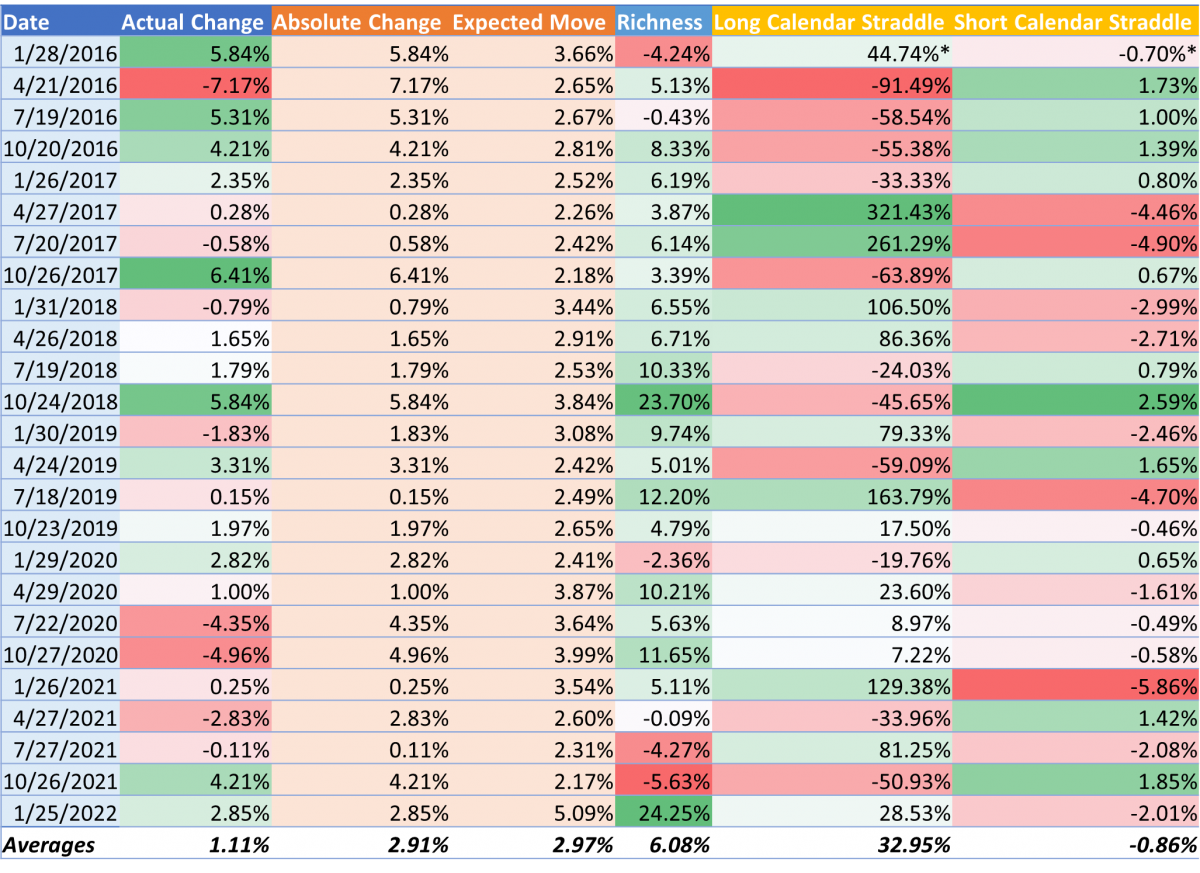

Image: quantcha.com

Understanding Options and Their Dynamics

Options are contracts between two parties, typically a buyer and a seller, that bestow upon the buyer the right to purchase (in the case of a call option) or sell (in the case of a put option) an underlying asset at a set strike price on or before a specific expiration date. The buyer of the option pays a premium to the seller in exchange for this privilege. Should the specified conditions be met, the option buyer may exercise their right to purchase or sell the underlying asset at a favorable price, potentially generating a profit.

Analyzing Option Strategies for Earning 30 Options

The profitability of options trading hinges upon the judicious selection and implementation of option strategies. Among the vast array of strategies available, some of the most commonly employed include:

1. Covered Call:

Involves selling a call option while simultaneously owning the underlying asset. It provides a consistent income stream from option premiums while limiting potential profits from price appreciation.

Image: www.youtube.com

2. Cash-Secured Put:

Similar to the covered call, it entails selling a put option backed by cash reserves. This strategy generates income by collecting option premiums and obligates the seller to buy the underlying asset at the strike price if the option is exercised.

3. Bull Put Spread:

Involves buying a lower-strike-price call option and simultaneously selling a higher-strike-price call option. This strategy benefits from limited downside risk while offering moderate profit potential.

4. Bear Put Spread:

Comprises buying a higher-strike-price put option and concurrently selling a lower-strike-price put option. It shields against potential market declines and earns income from option premiums.

Maximizing Earning Potential: Practical Considerations

To maximize earning potential in options trading, several key considerations come into play:

1. Underlying Asset:

Thoroughly research and select underlying assets that exhibit strong fundamentals and have a proven track record of performance.

2. Volatility:

Options premiums are highly influenced by market volatility. Higher volatility often translates to higher premiums, while low volatility can erode profit margins.

3. Time Decay:

As an option approaches its expiration date, its intrinsic value decays. This diminishing premium reduces the earning potential over time.

4. Risk Management:

Diligent risk management is paramount in options trading. Employ stop-loss orders, calculate risk-reward ratios, and avoid excessive leverage to mitigate potential losses.

Earning 30 Trading Options

Image: www.youtube.com

Conclusion

The pursuit of earning 30 trading options entails a comprehensive understanding of options dynamics, the judicious implementation of trading strategies, and a disciplined approach to risk management. By embracing these principles, traders can harness the power of options to generate meaningful income streams and navigate the financial markets with confidence. Remember, financial success often requires perseverance, continuous learning, and a willingness to adapt to ever-changing market conditions.