Options trading on Robinhood has gained immense popularity as an accessible way to potentially earn substantial profits. While it offers immense opportunities, it’s crucial to approach options trading with a comprehensive understanding of its complexities and potential risks. In this comprehensive guide, we delve into the realm of options trading on Robinhood, providing you with the fundamental knowledge and strategies to navigate this dynamic market successfully.

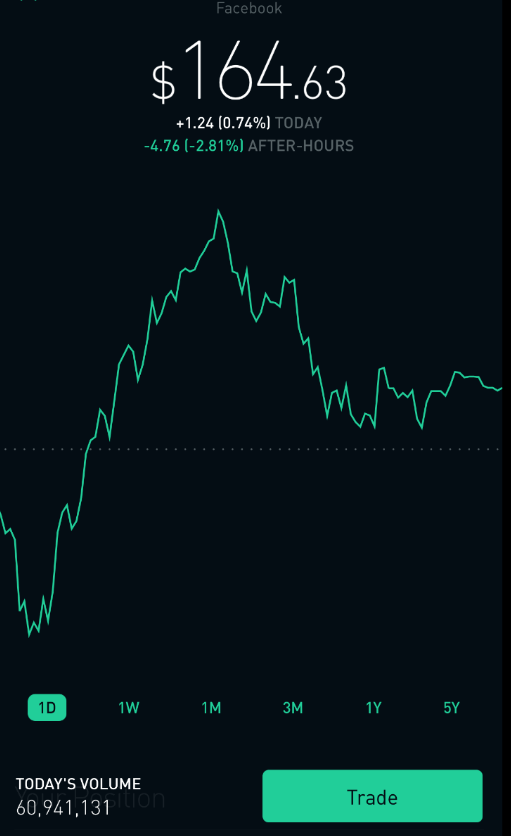

Image: tradeproacademy.com

Introduction to Options Trading on Robinhood

Options are financial instruments that derive their value from an underlying asset, such as stocks, indices, or commodities. They provide traders with the right but not the obligation to buy (call options) or sell (put options) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility allows traders to speculate on potential price movements and hedge against risks. Robinhood’s user-friendly platform and low commission structure have made options trading accessible to a broader audience, but it’s essential to recognize the associated risks before venturing into this field.

Understanding Options Basics

Before embarking on your options trading journey, it’s imperative to grasp the fundamentals. Options contracts consist of several key components:

- Buyer: The party who purchases the option contract.

- Seller: The party who sells the option contract.

- Premium: The price paid by the buyer to the seller for the option contract.

- Strike Price: The predetermined price at which the buyer can exercise their right to buy (call option) or sell (put option) the underlying asset.

- Expiration Date: The date after which the option contract becomes worthless.

Types of Options Trading Strategies

Options traders can employ various strategies to generate profits. Some common approaches include:

- Long Call: Buying a call option with the expectation that the underlying asset’s price will rise.

- Long Put: Buying a put option with the expectation that the underlying asset’s price will fall.

- Short Call: Selling a call option, believing that the underlying asset’s price will stay below the strike price.

- Short Put: Selling a put option, believing that the underlying asset’s price will stay above the strike price.

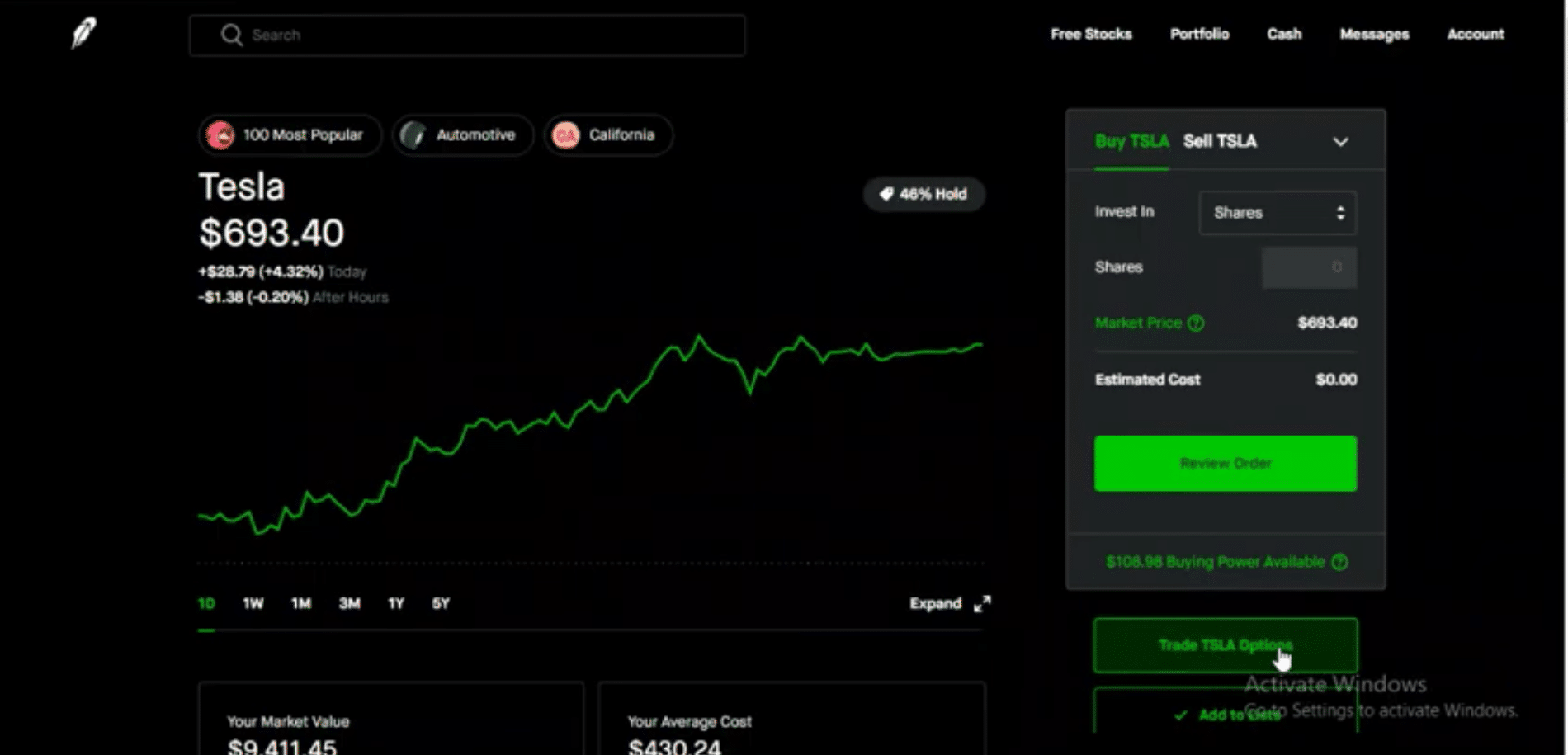

Image: moneymorning.com

Risk Management in Options Trading

While options trading offers significant earning potential, it’s critical to manage risks effectively. Here are some strategies to mitigate potential losses:

- Set Stop-Loss Orders: Place orders to automatically sell options when they reach a predetermined price level, limiting potential losses.

- Use Limit Orders: Execute trades only when specific price levels are met, ensuring that trades are executed at favorable prices.

- Monitor Options Regularly: Keep a close watch on the performance of your options positions, especially when approaching expiration dates.

How To Make Money Options Trading On Robinhood

Image: marketxls.com

Conclusion

Options trading on Robinhood presents an exciting opportunity to potentially earn substantial profits. However, it’s crucial to proceed with caution, recognizing the associated risks. By gaining a deep understanding of options basics, employing effective strategies, and implementing sound risk management practices, you can increase your chances of success in this dynamic and potentially lucrative market. Embrace the learning curve, stay informed, and trade wisely to maximize your earnings from options trading on Robinhood.