Do You Own a Stock in Options Trading? Demystifying the World of Options

Image: www.pinterest.com

Introduction

In the ever-evolving landscape of investing, options trading has emerged as a dynamic and potentially lucrative strategy. But before you dive into this complex arena, it’s crucial to understand whether you possess the knowledge and risk tolerance required to navigate its intricacies. In this article, we will delve into the depths of options trading, exploring its fundamental concepts, examining its risks and rewards, and providing expert insights to guide your decision-making process.

Understanding the Basics of Options Trading

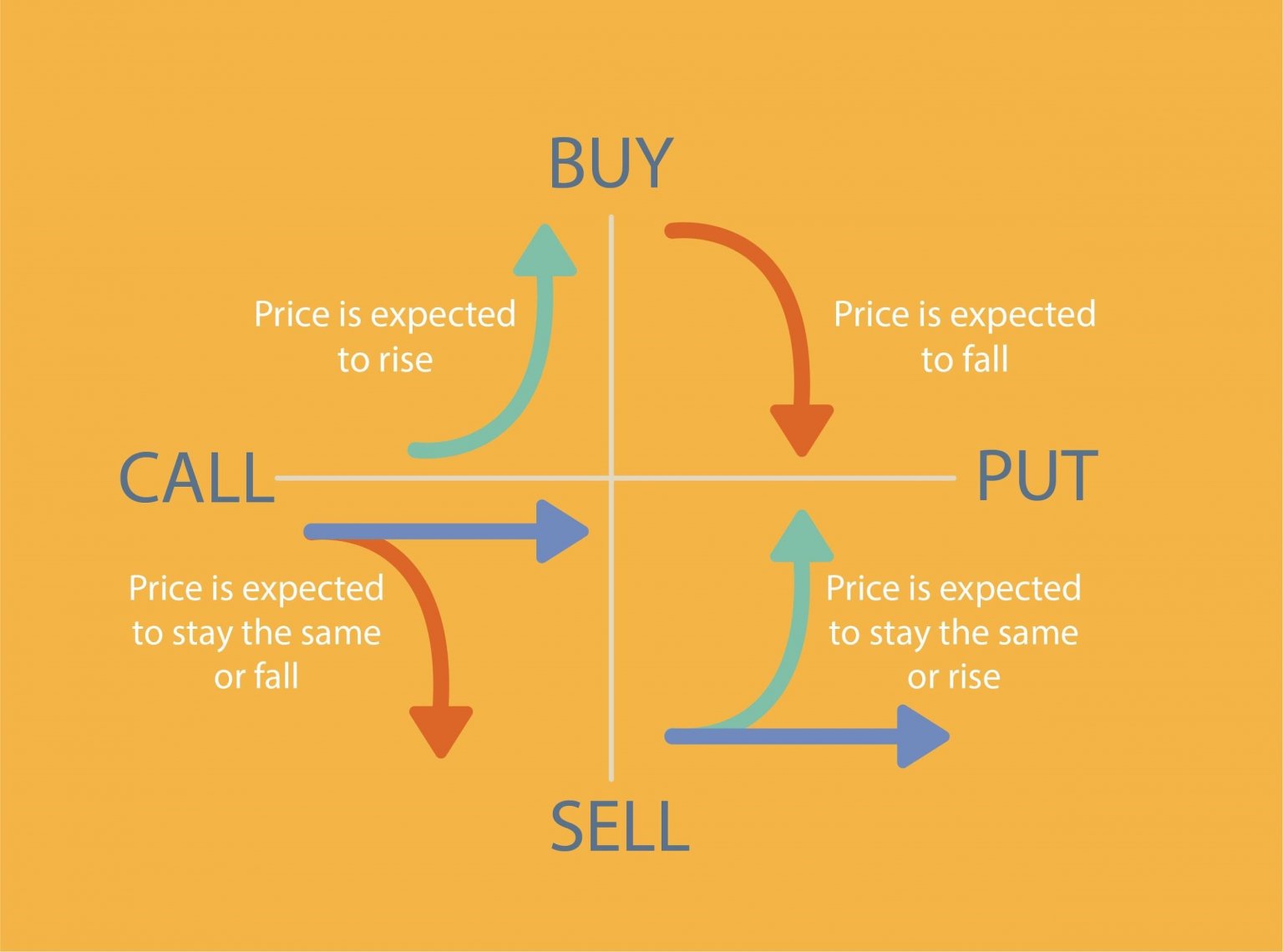

Options contracts grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a specific date (expiration date). By owning an option, you are essentially speculating on the future direction of an asset’s price. If the underlying asset’s price moves in your favor, you can potentially reap substantial profits.

Unveiling the Risks and Rewards

Options trading can be a double-edged sword. While it carries the potential for outsized returns, it also exposes you to significant risks. Call options amplify gains when the underlying asset’s price rises, but losses can mount swiftly if prices decline. Conversely, put options protect you against potential losses if prices fall, but gains are capped at the option’s premium.

Expert Insights for Success

Renowned options expert, Peter Lynch, emphasizes the importance of risk management. He advises against risking more than you can afford to lose and recommends hedging strategies to mitigate losses. Mark Douglas, a renowned trading psychologist, believes that success in options trading hinges on emotional control and developing a disciplined trading plan.

Actionable Tips for Informed Decisions

Before venturing into options trading, consider these crucial steps:

-

Determine your risk appetite and ensure you possess the emotional fortitude to withstand market fluctuations.

-

Develop a comprehensive trading plan that aligns with your objectives, risk tolerance, and market outlook.

-

Invest time in educating yourself about options contracts, market dynamics, and trading strategies.

-

Seek guidance from a qualified financial advisor who can provide personalized advice tailored to your circumstances.

Conclusion

Options trading can be an exhilarating yet demanding investment strategy. By understanding its fundamental principles, carefully assessing its risks and rewards, and leveraging expert insights, you can make informed decisions about whether it aligns with your financial goals. Remember, the path to successful investing is paved with knowledge, discipline, and strategic planning. Whether you choose to embark on this journey or not, empower yourself with knowledge and always prioritize your financial well-being.

Image: www.markettradersdaily.com

Do You Own A Stock In Options Trading

Image: finance.yahoo.com