Introduction: The Power of Options

Imagine a scenario where you believe a certain stock is going to rise in the near future. You could buy shares and hope for the best. But what if you could leverage your prediction with a smaller investment and potentially earn a greater return? This is where options trading comes into play. Options contracts offer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a defined timeframe.

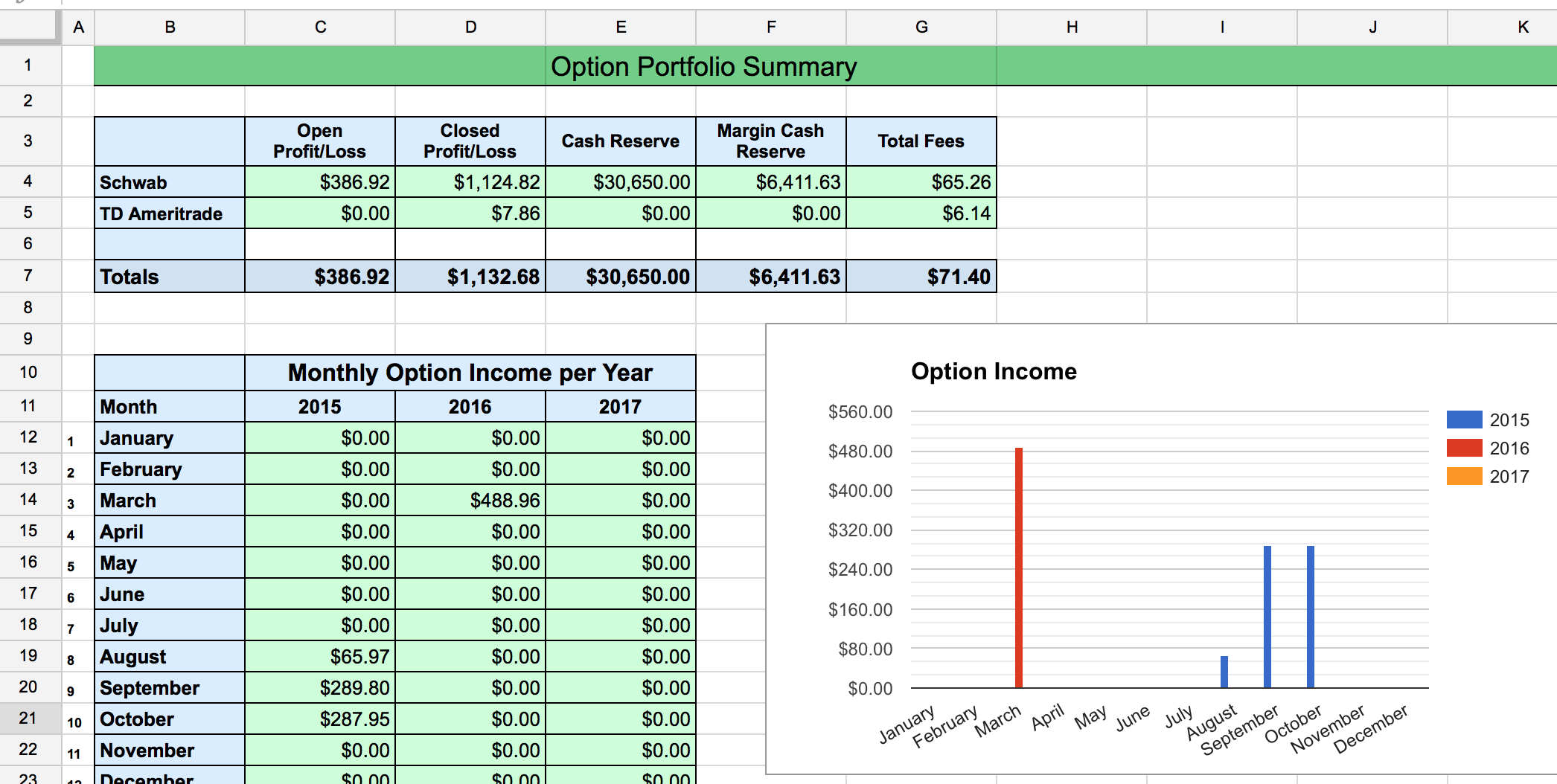

Image: investgrail.com

Options trading is a powerful tool that can be used for both profit and risk management. It allows investors with different risk appetites to capitalize on market movements in various ways. But before diving into the specifics, let’s understand the core concept of options and how they work.

Understanding Option Contracts

Definition and Types

An option contract is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) on or before a certain date (expiration date). There are two primary types of options:

- Call Options: A call option gives the holder the right to buy the underlying asset at the strike price. This is profitable if the asset’s price rises above the strike price.

- Put Options: A put option gives the holder the right to sell the underlying asset at the strike price. This is profitable if the asset’s price falls below the strike price.

Option Premium

To acquire an option contract, the buyer pays a premium to the seller. This premium reflects the value of the option based on various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. The premium can be seen as the price of the “right” to buy or sell the underlying asset.

Image: www.twoinvesting.com

Understanding the Value of an Option

The value of an option depends on several key factors:

- Underlying Asset’s Price: The price of the underlying asset is directly related to the value of options. For call options, a higher underlying asset price will result in a higher option value, while for put options, a lower underlying asset price will result in a higher value.

- Strike Price: The strike price determines the price at which the option holder can buy or sell the underlying asset.

- Time to Expiration: Options lose value as their expiration date approaches. This decay in value is known as “time value.”

- Volatility: Higher volatility in the underlying asset’s price generally leads to higher option premiums.

- Interest Rates: Interest rates can also affect the value of options, particularly for longer-term contracts.

A Practical Example: Call Options on Apple Stock

Let’s illustrate the concept of options trading with a real-world example.

Imagine you believe Apple stock (AAPL) is going to rise in the coming weeks. You could buy shares of AAPL directly, hoping for price appreciation. However, you could also consider using a call option.

Scenario: AAPL is currently trading at $150 per share. You buy a call option on AAPL with a strike price of $160 and an expiration date in three months, for a premium of $5 per share.

- If AAPL rises to $170 by the expiration date: Your call option is “in the money” as the underlying asset’s price is higher than the strike price. You have the right to buy AAPL at $160, and can then sell it in the market for $170, making a profit of $10 ($170 – $160) per share. This profit, however, needs to be reduced by the premium you paid ($5), resulting in a net profit of $5 per share.

- If AAPL falls to $140 by the expiration date: Your call option is “out of the money” as the underlying asset’s price is lower than the strike price. You would not exercise the option, as it would be more expensive to buy AAPL at $160 through the option when you could buy it in the market for $140. You lose the premium you paid ($5 per share).

Recent Trends and Opportunities in Options Trading

Options trading has recently experienced a surge in popularity, driven by various factors:

- Increased Market Volatility: Fluctuations in stock prices and other assets have encouraged investors to seek strategies for mitigating risks and capitalizing on volatility.

- Growth of Online Trading Platforms: Accessible platforms like Robinhood and Interactive Brokers have made options trading more straightforward for retail investors.

- Popularity of Options Strategies: Advanced option strategies, such as covered calls, protective puts, and straddles, are gaining traction among investors seeking specific risk-reward profiles.

Tips and Expert Advice for Option Trading

Navigating the world of options trading can be complex and requires a strong understanding of risk management and the underlying market dynamics. Here are some expert tips to help you get started:

- Start Small: Begin with a small investment and gradually increase your exposure as you gain experience and confidence.

- Focus on Education: Thoroughly understand the basics of option contracts, pricing, and risk management before trading.

- Develop a Trading Plan: Outline your goals, risk tolerance, and trading strategies before entering any trades.

- Stay Informed: Keep up with market news, economic data, and other factors that can influence the value of options.

- Use Stop-Loss Orders: Protect your capital by setting stop-loss orders to automatically exit a trade when the underlying asset’s price reaches a predefined level.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Invest in a diverse range of assets to reduce overall risk.

Frequently Asked Questions (FAQ)

Q: Is options trading suitable for all investors?

A: Options trading can be highly risky, and it’s not suitable for all investors. It requires a thorough understanding of the underlying market dynamics, risk management, and the potential for losses. It’s essential to understand your risk tolerance and have a clear trading plan before venturing into options trading.

Q: How can I learn more about options trading?

A: There are numerous resources available to help you learn about options trading. Online courses, books, and educational websites can provide valuable knowledge. You can also consult with a financial advisor to discuss your investment goals and risk tolerance.

Q: What are some common options trading strategies?

A: Common options trading strategies include covered calls, protective puts, straddles, and spreads. Each strategy aims to achieve different risk-reward goals, and it’s essential to understand the intricacies of each before implementing them.

Q: Is there a way to lower the risk of options trading?

A: Yes, using stop-loss orders, diversification, and adhering to a well-defined trading plan can help mitigate risk. However, it’s crucial to remember that options trading can involve substantial losses.

Option Trading Example

Conclusion: Embrace the World of Options Trading

Options trading can be an exciting and potentially rewarding venture. However, it’s essential to approach it with caution, a thorough understanding of its complexities, and a solid risk management strategy. By following the tips and advice outlined, you can embark on your options trading journey with a greater chance of achieving success.

Are you interested in exploring the world of options trading further? Let us know your thoughts and questions in the comments below!