In the labyrinthine world of finance, derivatives options trading stands as a formidable force, wielding the potential to amplify profits and mitigate risks. If you’re an aspiring investor or a seasoned trader seeking to venture into this realm, this comprehensive guide will illuminate the intricacies of derivatives options trading, empowering you with knowledge and confidence.

Image: answerpapr.blogspot.com

What are Derivatives Options Trading?

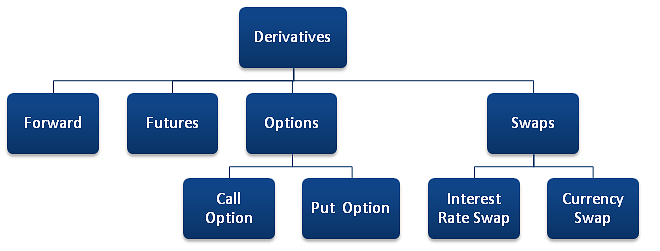

Derivatives options are financial contracts that derive their value from an underlying asset, such as stocks, bonds, or commodities. They offer traders the flexibility to speculate on the future price movements of these assets without owning them outright. Unlike futures contracts, which obligate the holder to buy or sell the underlying asset at a predetermined price, options provide the holder with the right but not the obligation to do so.

Types of Options Contracts

There are two primary types of options contracts: calls and puts. Call options give the holder the right to buy the underlying asset at a specified price (strike price) on or before a certain date (expiration date). Put options, on the other hand, grant the holder the right to sell the underlying asset at the strike price before the expiration date.

Advantages of Options Trading

Options trading offers several benefits to investors:

-

Leverage: Options provide traders with access to significant leverage, allowing them to control a large position with a relatively small investment.

-

Risk Management: Options can be used to hedge against potential losses in the underlying asset. By purchasing a put option, for example, investors can limit their downside risk in case the asset price falls.

-

Speculation: Options provide a platform for traders to speculate on market movements without having to own the underlying asset.

Image: www.finideas.com

Understanding Options Pricing

The value of an option is determined by several factors, including the underlying asset price, time to expiration, interest rates, and volatility. Options pricing models, such as the Black-Scholes model, are used to calculate the fair value of an option contract.

Expert Insights and Actionable Tips

To succeed in derivatives options trading, it is crucial to seek guidance from industry experts. Listen to webinars, attend conferences, and read books authored by renowned traders.

-

Master Risk Management: Options trading involves inherent risks. Before entering the market, develop a robust risk management strategy that defines your risk tolerance, entry and exit points, and stop-loss levels.

-

Stay Informed: Stay abreast of market news and economic events that can impact option prices. Monitor the performance of the underlying assets and watch for changes in volatility.

Derivatives Options Trading

Image: www.armstrongeconomics.com

Conclusion

Derivatives options trading is a complex yet rewarding investment technique. By understanding the fundamentals, leveraging expert insights, and implementing sound risk management practices, you can unlock the potential of derivatives options and navigate the financial markets with confidence. Remember, the path to success in options trading lies in continuous learning, disciplined execution, and a relentless pursuit of market knowledge. Embrace the challenge and discover the transformative power of derivatives options trading.