In the realm of options trading, the notion of delta holds immense significance, offering insights into the sensitivity of option prices to underlying asset price fluctuations. Grasping the concept of delta is fundamental to making informed trading decisions and navigating the complex world of options.

Image: www.youtube.com

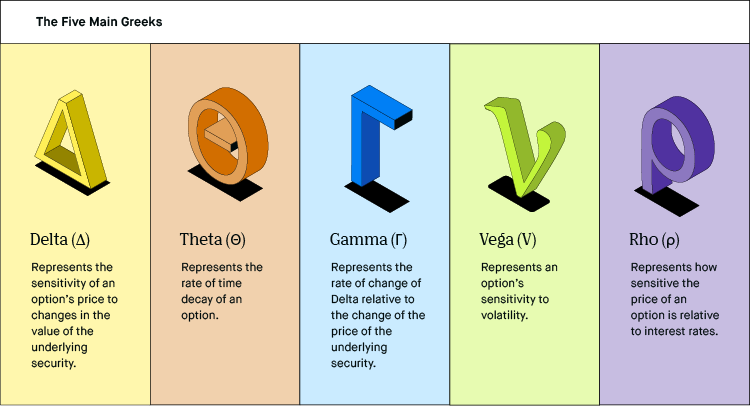

Delta essentially measures the rate of change in an option’s price relative to the corresponding change in the underlying asset’s price. For every $1 increase in the underlying asset’s price, the delta represents the expected dollar change in the option’s price. Understanding delta empowers traders to gauge the potential profitability or loss associated with a particular option strategy.

The scale of delta ranges from -1 to 1 for puts and 0 to 1 for calls. At-the-money (ATM) options exhibit a delta close to 0.5, indicating a near 50% probability of expiring in-the-money. As the option moves in-the-money (ITM), the delta approaches 1, reflecting a higher probability of profitability. Conversely, for out-of-the-money (OTM) options, deltas tend towards 0, signaling a lower likelihood of realizing a profit.

For instance, if an underlying stock trades at $100, and a call option with a delta of 0.6 is purchased, for every $1 increase in the stock price, the call option’s price can be expected to rise by $0.60. It’s worth noting that delta is a dynamic value, continuously adjusting in accordance with the movement of the underlying asset’s price.

Delta plays a crucial role in option pricing, as it provides traders with a valuable metric to evaluate the sensitivity of their strategies. It enables them to assess the potential impact of market movements on their options positions, enabling informed decisions about position sizing and risk management.

Traders should be cognizant that delta is only a snapshot of an option’s sensitivity at a specific point in time. It can change rapidly as the underlying asset’s price and time to expiration fluctuate, necessitating frequent monitoring and adjustment of strategies.

Mastering the intricacies of delta is paramount to success in options trading. By understanding how delta impacts option prices and profitability, traders gain a distinct advantage in navigating the ever-evolving market landscape.

Image: mxschumacher.substack.com

Delta Meaning In Options Trading

Image: dividendonfire.com