Step into the world of option trading and unlock the secrets of the enigmatic risk reversal spread. In this comprehensive guide, we will embark on a profound journey through understanding this sophisticated strategy, empowering you to navigate the complexities of the financial markets with confidence.

Image: investoruplift.com

Defining Risk Reversal Spreads: A Path to Profit

A risk reversal spread, also known as a collar spread, is a multi-faceted option strategy that grants investors the flexibility to mitigate risk while simultaneously seeking profit. These savvy traders simultaneously sell an at-the-money (ATM) call and an at-the-money (ATM) put, coupled with the purchase of an out-of-the-money (OTM) call and an out-of-the-money (OTM) put, each with the same expiration date and strike price.

Deciphering the Mechanics of Risk Reversal Spreads

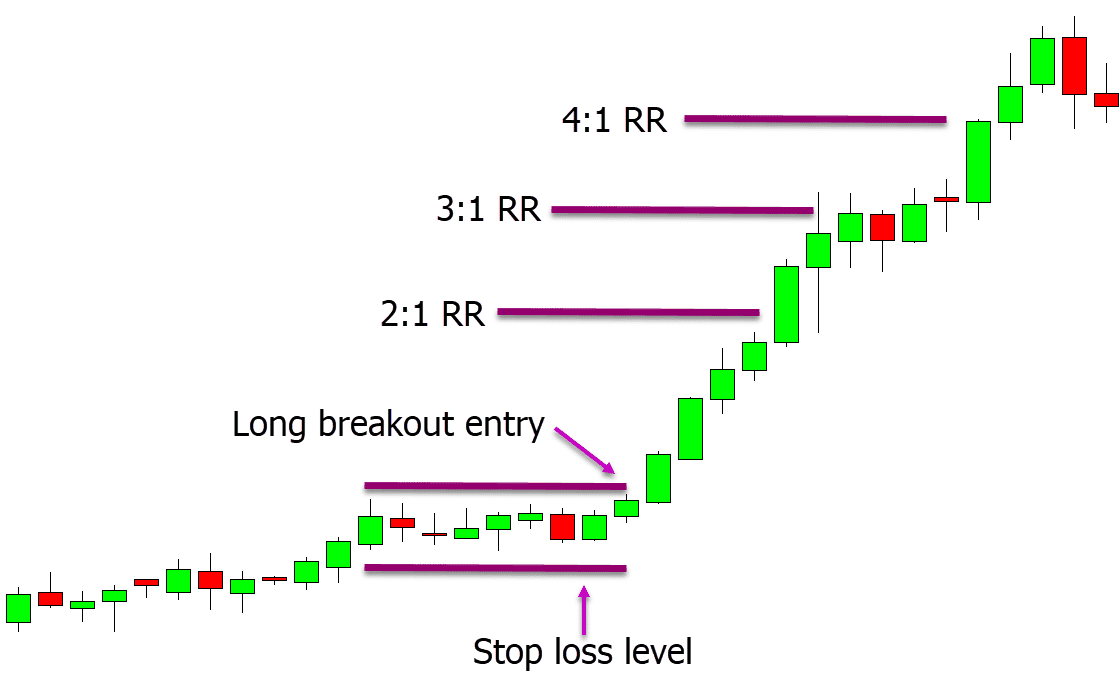

Envision a financial scenario where the underlying asset’s price remains within a defined range. The precise boundaries of this range are determined by the strike prices of the purchased OTM options. If the underlying asset’s price ventures beyond these boundaries, the trader stands to reap handsome profits. Conversely, when the underlying asset’s price remains within the prescribed range, the trader’s profit potential is capped, offering a cushion against severe market fluctuations.

Unveiling the Benefits of Risk Reversal Spreads

Risk reversal spreads have garnered immense popularity amongst astute investors due to their inherent advantages:

-

Risk Management Proficiency: These spreads provide an effective means of hedging against potential losses, making them a valuable tool for mitigating financial risks.

-

Profit Potential: Risk reversal spreads offer the potential for substantial profit when the underlying asset’s price experiences significant movement within the defined range.

-

Versatility: This strategy can be tailored to suit various market conditions, enabling traders to customize their risk management strategies based on their unique objectives.

Image: learnpriceaction.com

Expert Insights: Harnessing the Wisdom of Experience

Renowned option trading expert, Dr. Richard Kim, emphasizes the importance of understanding the unique characteristics of each component option within a risk reversal spread. He stresses the need to thoroughly research the underlying asset and its historical price behavior to make informed trading decisions.

Actionable Tips for Implementing Risk Reversal Spreads

-

Determine Your Comfort Zone: Define your risk tolerance and tailor the strike prices of your options accordingly to ensure the strategy aligns with your financial goals.

-

Time it Right: Choose an expiration date that aligns with your investment horizon and consider the time value decay of options as they approach expiration.

-

Monitor Market Trends: Keep a vigilant eye on the underlying asset’s price movements and adjust your trading strategy as market conditions evolve.

Complete Option Trading Guide To Risk Reversal Spread Book

Image: tradingstrategyguides.com

Conclusion: Commanding Success with Risk Reversal Spreads

Mastering the art of risk reversal spreads empowers traders to navigate the complexities of the financial markets with confidence. By understanding the mechanics, benefits, and expert insights, you can harness the potential of this sophisticated strategy to mitigate risks, capitalize on profit opportunities, and achieve your financial aspirations. Remember, investing involves inherent risks, and it is crucial to conduct due diligence and consult a qualified financial professional before making any trading decisions.