Introduction

Image: www.cmcmarkets.com

In the realm of investing, options trading offers a versatile and potentially lucrative avenue for both seasoned and aspiring traders. CommSec, a renowned Australian financial services provider, boasts a comprehensive options trading platform tailored to cater to the diverse needs of investors across the spectrum of experience. This article delves into the fascinating world of CommSec’s options trading platform, exploring its fundamental concepts, practical applications, and the latest industry trends.

Understanding Options: A Basic Overview

An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specified price and on a predetermined date. Unlike futures contracts, options do not carry an obligation to complete the transaction. The buyer of an option pays a premium to the seller in exchange for this flexibility. There are two primary types of options: calls and puts. Call options grant the holder the right to buy the underlying asset, while put options provide the right to sell.

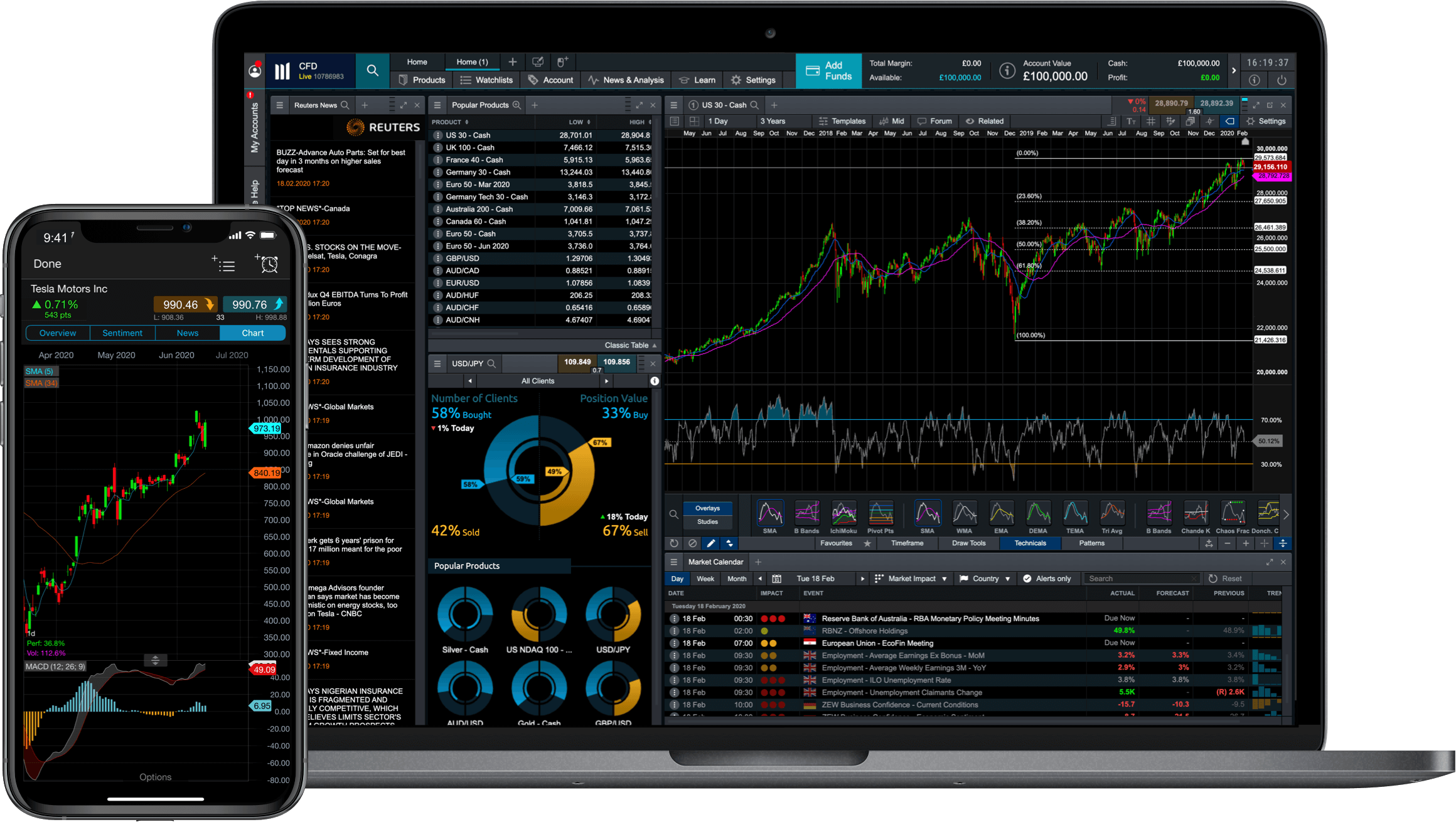

CommSec’s Options Trading Platform: A User-Friendly Interface

CommSec’s options trading platform is designed to provide an intuitive and user-friendly experience for traders of all levels. Its sleek interface offers a customizable workspace, real-time data and analytics, and comprehensive charting tools. The platform seamlessly integrates with CommSec’s other services, such as online banking and share trading accounts, allowing for a streamlined and efficient trading process.

Embracing Strategy: Mastering the Art of Options Trading

Successful options trading hinges on the skillful execution of well-defined strategies. CommSec’s platform empowers traders with a wide range of options strategies to meet their specific investment goals. From conservative covered calls to audacious straddles, the platform offers the flexibility to adopt strategies aligned with individual risk tolerance and market outlook.

Advanced Analytics: Delving into the Market’s Depths

CommSec’s options trading platform goes beyond mere order execution. Traders can conduct in-depth analysis of historical data, monitor market trends, and evaluate complex trading scenarios using the platform’s sophisticated analytics tools. These tools provide crucial insights into market behavior, enabling traders to make informed and strategic decisions.

Navigating the Greek Alphabet: Understanding Options Mechanics

Understanding the intricacies of options trading involves becoming acquainted with the Greek alphabet. Greeks, such as delta, theta, gamma, and vega, are metrics that measure an option’s sensitivity to changes in different market variables. CommSec’s platform provides comprehensive Greek analysis, enabling traders to assess risks, manage volatility, and optimize their trading strategies.

Demystifying Volatility: Harnessing Market Fluctuations

Volatility, a measure of price fluctuations, plays a pivotal role in options trading. CommSec’s platform offers advanced volatility analysis tools that help traders identify potential trading opportunities and manage risk in volatile market conditions. By understanding volatility patterns, traders can make informed decisions about option premiums and expiration dates.

Staying Abreast: Tracking Industry Trends and Developments

The options trading landscape is constantly evolving, and staying informed about the latest trends is crucial for success. CommSec’s platform provides up-to-date market news, analysis, and expert commentary. Traders can leverage these resources to stay ahead of the curve and make timely adjustments to their strategies.

Conclusion

CommSec’s options trading platform offers a robust and versatile environment for traders of all experience levels. Its user-friendly interface, advanced analytics tools, and comprehensive support materials empower traders to navigate the complexities of options trading. By embracing strategic decision-making, leveraging advanced analytics, understanding market dynamics, and staying informed about

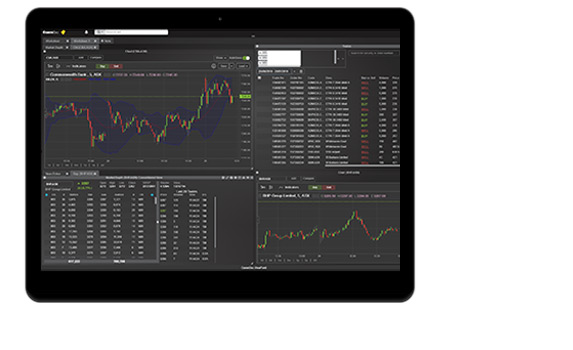

Image: www.commsec.com.au

Commsec Options Trading Platform

Image: www.youtube.com