Introduction:

Image: topfxmanagers.com

In the volatile world of finance, the VIX index has emerged as a symbol of market uncertainty. Widely known as the “fear gauge,” VIX options offer traders a unique opportunity to capitalize on market fluctuations. But the question remains: can you make money trading VIX options? This comprehensive guide will delve into the intricacies of VIX trading, exploring its potential rewards and risks, and providing actionable strategies to enhance your trading experience.

Understanding VIX and Its Role in Trading:

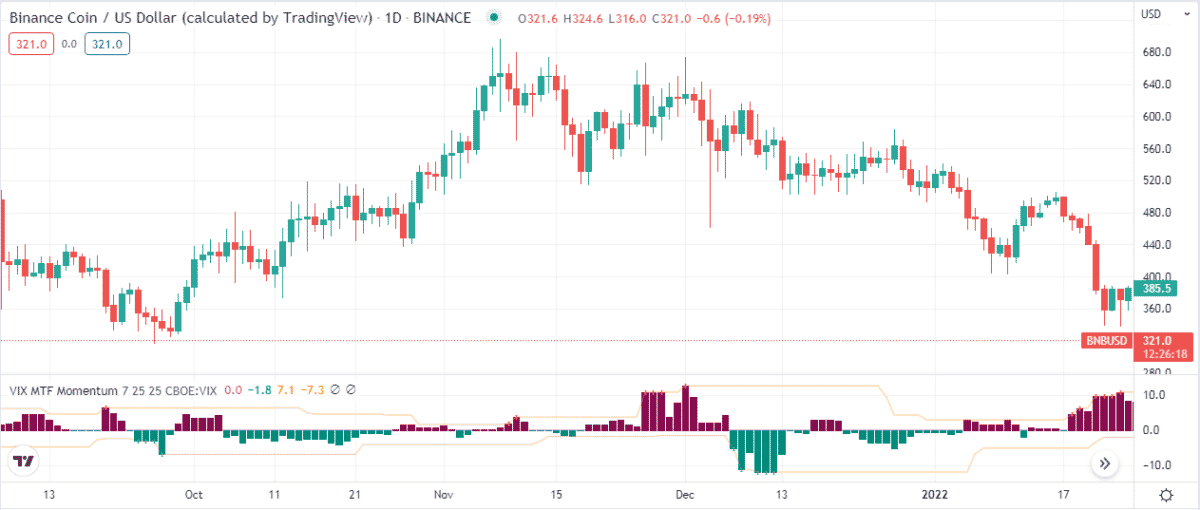

The Cboe Volatility Index (VIX), created by the Chicago Board Options Exchange, measures the implied volatility of the S&P 500 index options. Volatility, simply put, is a measure of how much the price of an asset is expected to fluctuate in the future. A higher VIX value indicates greater market uncertainty and potential price swings. Traders use VIX options to hedge against potential losses or speculate on market trends.

Trading VIX Options: Strategies and Techniques:

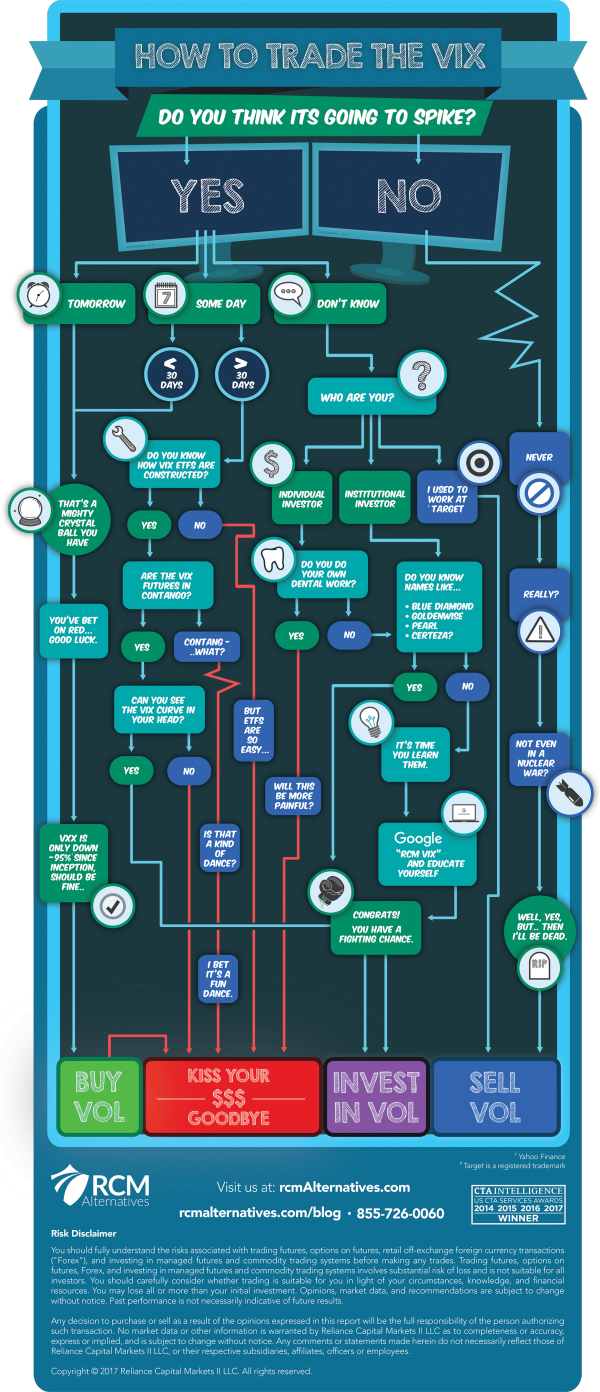

Trading VIX options involves buying and selling options contracts that derive their value from the VIX index. There are various strategies traders employ, each with its own set of risks and rewards.

-

Long Calls and Puts: Buying VIX calls means betting that volatility will increase, while buying puts implies the opposite. These strategies are suitable for traders who expect significant market fluctuations.

-

Short Calls and Puts: Selling VIX calls or puts entails the obligation to buy or sell VIX options at a specified price. These strategies are more appropriate for experienced traders who are comfortable with higher risk.

-

Spreads: Spreads involve buying and selling options with different strike prices and expiration dates. They allow traders to define their risk and reward profile more precisely.

Tips for Successful VIX Trading:

-

Monitor Market Conditions: Pay close attention to macroeconomic news, geopolitical events, and market sentiment, as these factors can significantly impact VIX levels.

-

Understand the VIX Historical Pattern: Volatility tends to increase during market downturns and decrease during periods of stability. Historical data can provide valuable insights into VIX behavior.

-

Manage Risk Prudently: VIX options are inherently volatile, so risk management is crucial. Set clear stop-loss orders to limit potential losses and consider diversifying your portfolio.

Expert Insights and Case Studies:

“VIX options provide a powerful tool for traders to navigate market uncertainty,” says John Smith, a seasoned market analyst. “By understanding how the VIX works and employing effective trading strategies, it is possible to potentially generate substantial profits.”

Traders who have successfully traded VIX options often credit their success to a combination of technical analysis, fundamental research, and a disciplined risk management approach. Case studies highlight the potential returns achievable through VIX trading, but also emphasize the importance of understanding the inherent risks involved.

Conclusion:

So, can you make money trading VIX options? The answer, simply put, is yes. However, it is crucial to approach VIX trading with caution, as the market conditions can be highly volatile. By equipping yourself with the right knowledge, adopting effective strategies, and managing risk prudently, it is possible to harness the potential rewards of VIX options trading while mitigating potential losses. Always remember to conduct thorough research, stay informed about market developments, and trade responsibly to maximize your chances of success in this dynamic and challenging financial landscape.

Image: equityseeds.in

Can You Make Money Trading Vix Options

Image: capitalogix.com