The alluring world of financial markets beckons many with the promise of exponential wealth. Among the various investment vehicles, options trading stands out as a potentially lucrative but equally risky endeavor. Yet, the question lingers: can one truly make money trading options? This in-depth analysis delves into the intricacies of options, their applications, and the potential for profit and loss.

Image: www.forexfactory.com

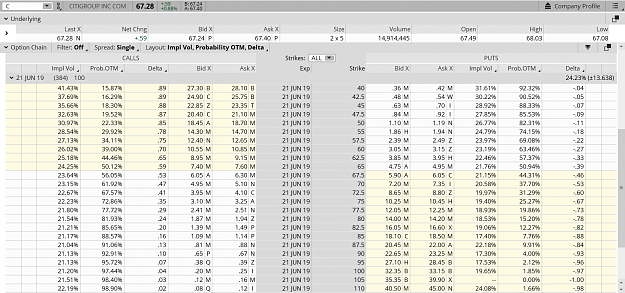

Options are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock or commodity, at a predetermined price on or before a specific expiration date. Unlike stocks, which represent ownership in a company, options provide leverage, allowing traders to potentially profit from price movements without actually owning the underlying asset.

Types of Options and Their Applications

The options market offers two main types: calls and puts. Call options give the buyer the right to buy an underlying asset at a specified price, while put options provide the right to sell. The versatility of options allows for various trading strategies. For instance, a trader can buy a call option in anticipation of a stock price rise or purchase a put option if they expect a decline.

Options can also serve as hedging tools to mitigate risks in portfolio management. By buying a put option on a stock they already own, an investor can protect themselves from potential price drops. Similarly, a trader can employ a call option to speculate on a possible price surge of an underlying asset they wish to acquire at a later date.

Understanding the Risks and Rewards

While options trading undoubtedly presents opportunities for profit, it is crucial to acknowledge the inherent risks involved. Options have a time-sensitive nature, with a finite window during which they can be exercised or expire worthless. This adds an element of urgency to trading decisions, and traders must carefully monitor market conditions and adjust their strategies accordingly.

Moreover, the use of leverage can amplify both profits and losses. While options allow traders to control more significant positions with less capital, this magnification effect can exacerbate losses if the underlying asset’s price moves against their predictions. Thus, understanding the complexities of options trading and exercising proper risk management is essential.

Essential Factors to Consider Before Trading Options

Before embarking on the journey of options trading, several critical factors should be taken into account. Firstly, traders must possess a strong understanding of market dynamics and how options work. This knowledge forms the foundation for making informed decisions and managing risks effectively.

Secondly, a well-defined trading plan is indispensable. Defining clear entry and exit points, as well as risk tolerance and profit targets, helps maintain discipline and avoid emotional trading. Discipline ensures that decisions are driven by strategy rather than impulsive reactions to market movements.

Finally, trading psychology plays a pivotal role in long-term success. Options trading can be a rollercoaster of emotions, with potential profits and losses coexisting. Traders must develop emotional resilience and strict adherence to their trading plan, even during periods of market volatility.

Image: www.youtube.com

Developing a Profitable Trading Strategy

Crafting a successful options trading strategy requires a multifaceted approach. Technical analysis, which examines price charts and patterns, can provide insights into potential trends. Fundamental analysis, focusing on company financials and macroeconomic factors, helps determine the intrinsic value of an underlying asset.

Combining these analytical techniques with a thorough understanding of options trading nuances allows traders to identify potential trading opportunities. Additionally, studying successful traders’ strategies and learning from their experiences can accelerate the learning curve.

Can One Make Money Trading Options

Image: www.vectorvest.com

Conclusion

The question of whether one can make money trading options is complex and depends on various factors. While the allure of exponential wealth is ever-present, it is essential to recognize the inherent risks involved. Thorough research, a disciplined trading plan, and a robust understanding of options trading principles are indispensable for increasing the likelihood of success.