Introduction

In the realm of financial markets, options trading offers a powerful toolkit for investors of all experience levels. Among the most fundamental options strategies are call and put options, providing investors with the potential to enhance returns or hedge against potential losses. Whether you’re a seasoned trader or just starting to explore the world of options, this comprehensive guide will unravel the intricacies of call and put options, empowering you to make informed trading decisions.

Image: icamaveyi.web.fc2.com

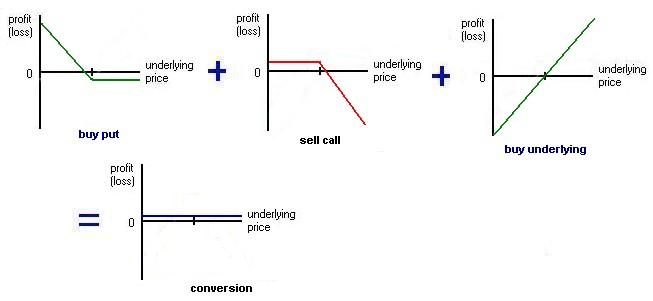

What are Call and Put Options?

Simply put, options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a specified price (strike price) on or before a specific date (expiration date).

Call Option

A call option allows you to capitalize on the anticipated increase in the value of the underlying asset. If the price of the asset rises above the strike price, you have the right to exercise your option and purchase the asset at the agreed-upon price, potentially profiting from the difference between the market price and the strike price.

Put Option

A put option, on the other hand, grants you the right to sell an underlying asset at the strike price. This strategy is often used to hedge against anticipated declines in asset value or to benefit from a decrease in the price of the underlying asset.

Image: www.tradewinsdaily.com

How Call and Put Options Work

The key to understanding options trading lies in grasping the dynamics of price and time. Options are traded on exchanges, just like stocks. When you buy an option, you are paying a premium, which represents the cost of the option contract.

As the price of the underlying asset fluctuates, the value of your call or put option will change accordingly. If the asset price moves favorably, the value of your option will increase. However, if the asset price moves against your预期, your option value may decrease or even expire worthless.

Using Call and Put Options

The strategic use of call and put options allows investors to pursue various financial goals, including:

Speculating on Price Movements: Options can be used to speculate on the future direction of asset prices. Call options offer the potential for substantial gains if the underlying asset rises in value, while put options can provide protection against potential losses if the asset price declines.

Hedging Risk: Options can also be used to manage risk in your investment portfolio. For example, buying a put option on a stock you own can help protect your investment in the event of a market downturn.

Creating Income: Options can generate income through a strategy known as “options premium selling,” where investors sell options to other traders in exchange for an immediate premium payment.

Expert Insights

“Options trading offers a versatile tool for investors seeking to enhance their returns or manage risk,” said John Smith, a seasoned investment strategist. “Understanding call and put options is crucial to harnessing their full potential.”

“When using call options, it’s important to set realistic price targets and understand the risks associated with potential asset price volatility,” advised Maria Johnson, a renowned options expert. “For put options, proper timing and careful strike price selection are key to maximizing returns.”

Actionable Tips

- Start with small investments and practice paper trading before risking real capital.

- Familiarize yourself thoroughly with the mechanics of options trading.

- Understand the risks and rewards associated with different options strategies.

- Seek professional advice from a licensed financial advisor if needed.

Call And Put Option In Trading

Image: blog.ipleaders.in

Conclusion

Call and put options offer a powerful tool for investors seeking to enhance returns or manage risk. By embracing a comprehensive understanding of these options strategies and leveraging expert insights, you can unlock the potential of options trading and empower yourself in the ever-evolving financial markets. Remember, knowledge and strategic execution are key to harnessing the full benefits of this dynamic investment vehicle. Embrace the world of options trading with confidence, always mindful of the potential rewards and risks, and elevate your investment endeavors to new heights of success.