Introduction

In the realm of options trading, where strategic precision is paramount, the Box Strategy stands out as a versatile and potent tool for savvy investors. This time-tested strategy empowers traders to capitalize on market volatility, manage risk, and potentially generate substantial returns. Embark on this comprehensive guide to unravel the intricacies of the Box Strategy and unlock its transformative power.

Image: comparic.com

Defining the Box Strategy

The Box Strategy is an options trading strategy that involves buying and selling an equal number of calls and puts with the same strike price and expiration date. By constructing a hypothetical “box” around the underlying asset’s price, traders aim to profit from the movement of the underlying within a defined price range. The strategy is particularly effective in periods of high volatility when the market’s direction is uncertain, offering a unique opportunity to capitalize on either upward or downward price fluctuations.

The Mechanics of the Box Strategy

To implement the Box Strategy, traders simultaneously buy one call option and one put option at the same strike price. The call option grants the right to buy the underlying asset at the strike price, while the put option grants the right to sell the asset at the same price. By pairing these options, traders create a neutral position, eliminating the directional bias associated with traditional options strategies.

Advantages of the Box Strategy

The Box Strategy offers several advantages that make it an attractive choice for options traders:

- Market Neutrality: Unlike directional strategies, the Box Strategy benefits from market volatility, regardless of the underlying asset’s price direction.

- Defined Risk: The maximum loss is limited to the premium paid for both the call and put options, providing traders with a clear understanding of their financial exposure.

- Income Generation: The strategy can generate income through premium collection if the underlying asset remains within the defined range.

- Flexibility: The Box Strategy can be adjusted to suit varying market conditions by altering the strike price and expiration date.

Image: www.warriortrading.com

Considerations Before Using the Box Strategy

While the Box Strategy can be a profitable strategy, there are a few considerations that traders should keep in mind:

- High Premiums: The strategy requires purchasing both call and put options, which can result in higher upfront costs.

- Time Decay: Like all options, the Box Strategy is subject to time decay, which can erode the value of the options over time.

- Market Volatility: The strategy performs best in volatile markets; however, excessive volatility can also result in losses if the underlying asset moves outside the defined range.

- Expiration Date: The choice of expiration date impacts the strategy’s potential profitability and risk profile.

Practical Implementation of the Box Strategy

To successfully apply the Box Strategy, traders must follow a systematic approach:

- Identify a Tradable Market: Look for markets with high volatility and a clear trend or range-bound movement.

- Determine Strike Price: Select a strike price near the current market price or within a defined support-resistance range.

- Set the Expiration Date: Consider the expected duration of the market’s volatility and fluctuations.

- Calculate Risk and Reward: Use an options calculator or spreadsheet to estimate the potential profit and loss for various market scenarios.

- Monitor the Position: Track the underlying asset’s price and adjust the strategy as needed based on market conditions.

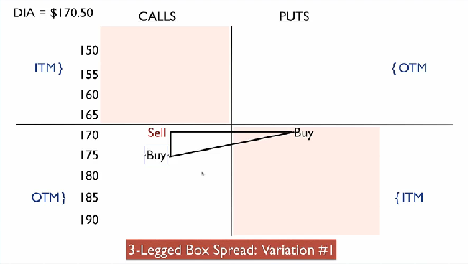

Box Strategy In Options Trading

Image: abizaly.web.fc2.com

Conclusion

The Box Strategy presents a compelling option for traders seeking to mitigate risk while potentially capturing profits from market volatility. By embracing the principles outlined in this guide, investors can enhance their strategic acumen and unlock the potential of this versatile trading tool. As always, market conditions can change rapidly, and it is essential to conduct thorough due diligence, manage risk responsibly, and consult with a financial advisor before making any investment decisions.