In the ever-evolving financial landscape, where every trade holds immense potential, selecting the right trading platform discount broker is crucial for your investment success. With a plethora of options available, navigating the myriad of choices can be daunting. This comprehensive guide delves into the intricate details of the best trading platforms discount broker options, equipping you with the knowledge and insights to make informed decisions that will empower your investment journey.

Image: www.stockbrokers.com

The advent of digital trading platforms has revolutionized the way we interact with financial markets. Gone are the days of traditional brokerage houses with hefty fees and limited access. Today, discount brokers offer a compelling alternative, providing investors with a diverse range of tools, low-cost trading, and unparalleled convenience. By leveraging the power of online platforms, retail investors can now compete on equal footing with seasoned professionals, accessing the same sophisticated trading technologies and insights that were once reserved for institutional investors.

Understanding Discount Brokers: A Paradigm Shift in Trading

Discount brokers are online brokerage firms that provide access to trading stocks, bonds, mutual funds, and other investment products. Unlike traditional brokerage houses that charge hefty commissions, discount brokers operate on a leaner business model, offering trades at significantly reduced costs. This democratization of the trading world has enabled countless individuals to participate in the financial markets, regardless of their investment capital or expertise level.

The proliferation of discount brokers has brought about a fundamental shift in the trading industry. With the advent of these online platforms, investors can execute trades directly without the need for intermediaries, resulting in substantial cost savings. The cost-effectiveness of discount brokers makes them an appealing choice for both active traders and long-term investors, offering the ability to execute frequent trades or build diversified portfolios without incurring exorbitant fees that could erode their investment returns.

Key Considerations for Choosing the Best Trading Platform Discount Broker

Selecting the best trading platform discount broker is a multifaceted decision that should be tailored to your individual investment objectives, trading style, and financial situation. Several key factors warrant careful consideration:

-

Trading Costs: The trading costs charged by discount brokers vary widely, ranging from per-trade fees to subscription-based models. The frequency of your trading activity and the types of trades you execute will impact the overall cost of using a particular platform. It is imperative to compare different brokers and choose one that aligns with your trading style to minimize unnecessary expenses.

-

Product Offerings: Discount brokers offer a diverse range of investment products, including stocks, bonds, mutual funds, and options. Consider your investment goals and the asset classes you are interested in trading. Ensure that the discount broker you choose provides access to the specific products you need, as some may specialize in certain asset classes and not others.

-

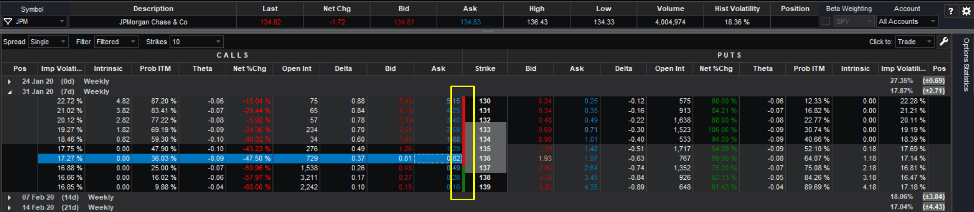

Trading Platform: The trading platform is the interface through which you will execute trades and manage your investments. Usability, functionality, and the availability of advanced features are all important factors to consider. Look for a platform that is intuitive to use, provides real-time market data, and offers the technical analysis and charting tools you require to make informed trading decisions.

-

Customer Service: Excellent customer service can be invaluable when you encounter any difficulties or have questions about your account or trades. Assess the reputation of the discount broker in terms of responsiveness, knowledge, and overall customer satisfaction. A reliable and supportive customer service team can provide peace of mind and save you time and frustration.

Image: www.asktraders.com

Best Trading Platform Discount Broker Options

Image: www.tradestation.io

Unveiling the Top Contenders in Discount Brokerage

The market for discount brokers is highly competitive, with numerous established and emerging players vying for market share. Several trading platforms have emerged as leading contenders, offering a compelling combination of low costs, sophisticated trading tools, and exceptional customer service:

-

Interactive Brokers: Renowned for its robust trading platform, low commissions, and comprehensive product offerings, Interactive Brokers is a top choice for both retail and institutional investors. Its advanced features, including sophisticated order types, real-time market data, and algorithmic trading capabilities, cater to the needs of active traders.

-

Fidelity Investments: A pioneer in the discount brokerage industry, Fidelity Investments offers a wide array of investment products, a user-friendly trading platform, and exceptional customer support. Its extensive research tools, educational resources, and commitment to investor protection make it an attractive option for both novice and experienced investors.

-

Vanguard: Vanguard is synonymous with low-cost index funds and exchange-traded funds (ETFs). Its discount brokerage platform provides access to Vanguard’s family of low-cost funds, ideal for long-term investors focused on portfolio diversification and cost efficiency.

-

Charles Schwab: Charles Schwab has consistently ranked among the top discount brokers, offering a full suite of trading and investment services. Its StreetSmartEdge trading platform is lauded for its intuitive interface, advanced technical analysis tools, and customizable workspaces.

-

TD Ameritrade: TD Ameritrade is renowned for its Thinkorswim trading platform, considered one of the most powerful and versatile platforms in the industry. Its extensive charting and technical analysis capabilities, coupled with paper trading accounts and educational resources, make it a