In the realm of investing, options trading presents both opportunities and challenges. Carefully selecting the stocks you trade options on can significantly impact your chances of success. Whether you’re a seasoned trader or just starting your options journey, identifying the best stocks to buy is essential.

Image: www.marketoracle.co.uk

Defining Stocks and Options Trading

Stocks represent ownership in a company. When you buy a stock, you become a shareholder and gain the potential to benefit from the company’s growth and profitability. Options, on the other hand, are contracts that give you the right to buy (call option) or sell (put option) a specific number of shares at a set price, called the strike price, by a particular date.

Options trading allows you to leverage your capital by controlling a larger number of shares without actually owning them outright. However, it comes with both potential rewards and risks, and carefully selecting the underlying stocks is pivotal for successful trading.

Factors to Consider When Selecting Stocks for Options Trading

Choosing the right stocks for options trading requires a thoughtful evaluation of several factors:

-

Volatility: High-volatility stocks experience significant price fluctuations, providing ample opportunities for options trades.

-

Liquidity: Stocks with high liquidity ensure that there are always buyers and sellers available, making it easier to execute trades at favorable prices.

-

Earnings: Strong earnings and positive company outlook indicate a stock’s potential for growth, benefiting options traders.

-

News and Events: Major news announcements, product launches, or industry trends can impact stock prices and should be considered.

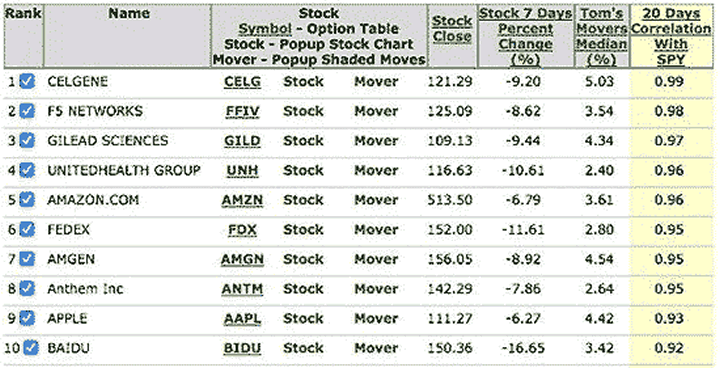

Top Stocks for Options Trading

Based on the factors mentioned above, here’s a curated list of stocks that are considered suitable for options trading:

-

Apple (AAPL): A technology behemoth with consistent earnings and high liquidity, offering ample trading opportunities.

-

Tesla (TSLA): A leader in the automotive industry with strong growth potential, exhibiting high volatility and liquidity.

-

Microsoft (MSFT): A software giant with a well-established business model and high liquidity, providing a reliable option for traders.

-

Amazon (AMZN): An e-commerce powerhouse with ongoing growth prospects and ample liquidity, creating numerous trading scenarios.

-

NVIDIA (NVDA): A semiconductor and gaming industry leader with strong financials and high volatility, offering attractive options opportunities.

-

JPMorgan Chase (JPM): A financial services provider with a stable earnings history and high liquidity, providing options plays with lower volatility.

Image: fitzstock.com

Expert Tips for Options Trading

To enhance your options trading success, consider these expert insights:

-

Understand the Mechanics: Before trading options, thoroughly grasp the underlying concepts and potential risks.

-

Choose Your Options Carefully: Select options with strike prices and expirations that align with your risk tolerance and investment strategy.

-

Manage Your Risk: Spread your trades across multiple stocks and options strategies to avoid significant losses.

-

Monitor the Market: Stay informed about news, events, and economic indicators that may impact stock prices and options values.

Best Stocks To Buy For Options Trading

Image: www.smioptions.com

Conclusion

Choosing the best stocks for options trading is a key step towards increasing your chances of success in this dynamic market. By carefully evaluating factors such as volatility, liquidity, and company fundamentals, you can identify opportunities for profitable trades. Remember to understand the risks involved and seek professional guidance if needed. With knowledge and strategic decision-making, options trading can be an empowering tool for investors looking to enhance their portfolio growth.