Options Trading: A Brief Introduction

Options trading is a powerful financial tool that allows investors to speculate on the future price of an underlying asset, such as a stock, bond, or commodity. Options contracts give the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price on or before a certain date.

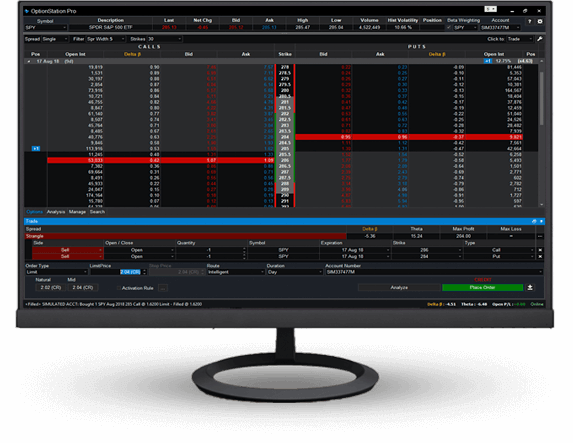

Image: www.tradestation.io

Options can be used for a variety of purposes, including hedging, speculation, and income generation. They are a versatile financial instrument that can be used by investors of all experience levels.

The Benefits of Options Trading

There are several benefits to options trading, including:

- Leverage: Options provide leverage, which means that investors can control a larger position with a smaller amount of capital.

- Flexibility: Options are a flexible financial instrument that can be used for a variety of purposes.

- Potential for high returns: Options have the potential to generate high returns, especially if the underlying asset moves in the predicted direction.

The Risks of Options Trading

There are also some risks associated with options trading, including:

- Losses: Options can result in losses, especially if the underlying asset moves in an unexpected direction.

- Complexity: Options are a complex financial instrument that can be difficult to understand for new investors.

- Time decay: Options have a limited lifespan, which means that their value decays over time, even if the underlying asset does not move.

Choosing the Right Options Trading Platform

When choosing an options trading platform, there are several factors to consider, including:

- Platform fees: Some platforms charge fees for trading options, while others do not.

- Trading tools: Different platforms offer different trading tools, such as charting, technical analysis, and news feeds.

- Customer support: It is important to choose a platform that offers good customer support in case you have any questions or problems.

Image: kongashare.com

The Best Options Trading Platforms of 2016

Based on the factors listed above, the following are the best options trading platforms of 2016:

- TD Ameritrade: TD Ameritrade is one of the largest and most popular options trading platforms in the United States. It offers a wide range of trading tools and resources, including charting, technical analysis, and news feeds.

- Interactive Brokers: Interactive Brokers is a popular options trading platform for experienced traders. It offers a wide range of trading tools and features, including advanced order types, real-time streaming quotes, and a powerful options trading platform.

- E*Trade: E*Trade is another popular options trading platform that offers a wide range of trading tools and resources. It is a good option for beginner and intermediate traders.

- Understand the risks: Before you start trading options, it is important to understand the risks involved. You should only trade with money that you can afford to lose.

- Do your research: Learn as much as you can about options trading before you start trading. There are many resources available online, including books, articles, and websites.

- Start small: When you start trading options, it is important to start small. This will help you to manage your risk and learn the ropes.

- Use a stop-loss order: A stop-loss order is an order that will automatically sell your options contract if the price of the underlying asset falls below a certain level. This will help you to protect your profits and limit your losses.

- What is an option? An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

- What are the different types of options? There are two main types of options: calls and puts. Call options give the buyer the right to buy the underlying asset at a specified price. Put options give the buyer the right to sell the underlying asset at a specified price.

- How do I trade options? Options are traded on options exchanges. To trade options, you need to open an account with an options broker.

How to Get Started with Options Trading

If you are new to options trading, it is important to do your research and learn the basics before you start trading. There are many resources available online, including books, articles, and websites.

Once you have a good understanding of options trading, you can open an account with an options trading platform. The process of opening an account is typically quick and easy. However, you will need to provide some personal information, such as your Social Security number and bank account number.

Once you have opened an account, you can start trading options. However, it is important to remember that options trading can be risky. Only trade with money that you can afford to lose.

Tips for Successful Options Trading

Here are a few tips for successful options trading:

Frequently Asked Questions About Options Trading

Here are some frequently asked questions about options trading:

Best Options Trading Platform 2016

Conclusion

Options trading can be a powerful financial tool for investors of all experience levels. However, it is important to understand the risks involved before you start trading. By following the tips in this article, you can increase your chances of success in options trading.

Are you interested in learning more about options trading? If so, please leave a comment below and I will be happy to provide you with additional resources.