In the ever-evolving financial landscape, futures trading has emerged as a powerful tool for savvy investors seeking to hedge risks and maximize returns. To navigate this complex realm effectively, understanding the intricacies of best options futures trading is paramount. In this comprehensive guide, we’ll delve into the fundamentals, strategies, and practical tips that empower traders to harness the potential of this dynamic market.

Image: www.options-trading-mastery.com

Demystifying Best Options Futures Trading: A Foundation for Success

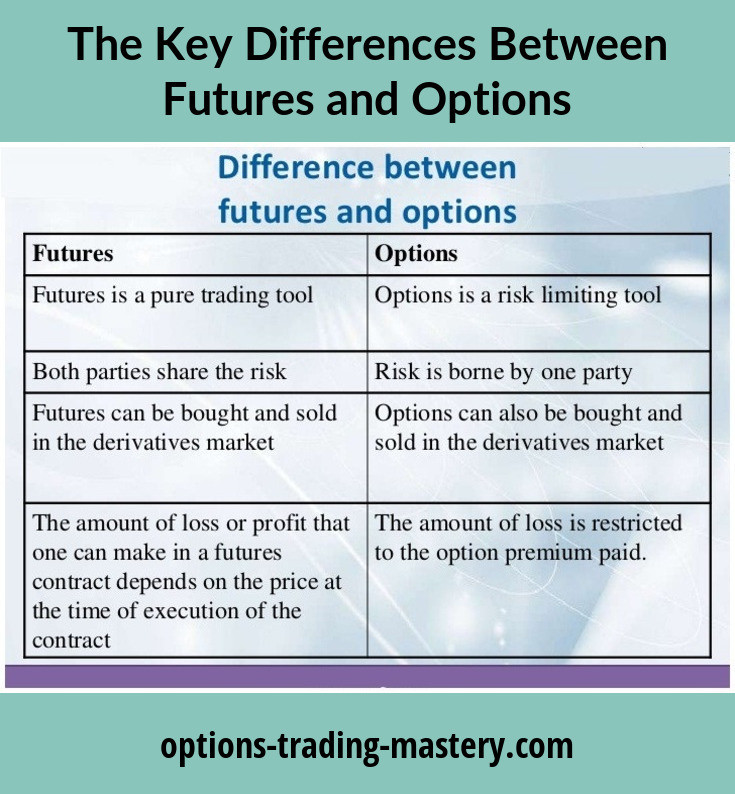

Futures trading involves the buying or selling of contracts that obligate the buyer to purchase or the seller to deliver an underlying asset at a predetermined price on a specified future date. In the realm of options futures, traders speculate on the price movements of underlying futures contracts rather than the underlying asset itself. This provides a unique layer of flexibility and leverage, offering traders greater potential for both profits and losses.

To fully comprehend best options futures trading, it’s essential to grasp the dynamics of futures contracts. Each contract represents a specific quantity of the underlying asset, such as a commodity, index, or currency. Futures prices fluctuate constantly, reflecting market expectations of the future value of the underlying asset. Traders can take advantage of these price movements by entering into long or short positions in futures contracts.

Unveiling the Strategies: Mastering the Art of Options Futures Trading

In the options futures arena, traders have at their disposal a versatile array of strategies to adapt to varying market conditions. These strategies encompass both simple and complex approaches, allowing traders to tailor their trading plans to their risk tolerance and trading objectives.

For conservative traders seeking to mitigate risks, long option positions can provide a defensive strategy. By purchasing long calls or puts, traders can lock in the right, but not the obligation, to buy or sell an underlying futures contract at a specified price. This strategy effectively limits potential losses while offering the potential for unlimited profits.

Alternatively, for those with a higher risk appetite, short option positions present opportunities for substantial gains. By selling covered calls or puts, traders can generate immediate income if the underlying futures contract price moves favorably. However, this strategy also entails the obligation to fulfill the contract if the conditions are met, which can result in potentially larger losses.

The art of options futures trading lies in understanding the Greeks – metrics that measure the sensitivity of an option’s price to changes in factors such as underlying futures price, time to expiration, volatility, and interest rates. Mastering these Greeks empowers traders to make informed decisions, adjust their strategies accordingly, and optimize their risk management.

Empowering Traders: Essential Tips for Best Options Futures Trading

To enhance your success in best options futures trading, heed these invaluable tips from seasoned professionals:

-

Start Small and Gradually Increase: Begin with smaller positions and gradually increase volume as you gain experience and confidence in your trading strategies.

-

Manage Risks Prudently: Understand the potential risks associated with options futures trading and implement appropriate risk management techniques, such as stop orders and position sizing.

-

Stay Informed and Continuously Educate: Keep abreast of market news, economic data, and industry analysis to make well-informed trading decisions. Continuous education empowers you to adapt to changing market conditions and refine your strategies over time.

-

Seek Professional Guidance: When venturing into more complex options futures trading strategies, consider consulting with experienced traders or financial advisors to gain insights and mitigate risks.

-

Practice Discipline and Patience: Futures trading requires discipline and patience. Avoid impulsive trading decisions and instead follow a structured trading plan that aligns with your trading goals.

Image: ifmcinstitute.medium.com

Best Options Futues Trading

Conclusion: Harnessing the Power of Best Options Futures Trading

Best options futures trading presents traders with an empowering avenue to navigate financial markets effectively. By embracing the strategies, tips, and fundamental principles outlined in this comprehensive guide, you can unlock the potential of this dynamic market, hedge risks, and maximize your returns. Remember, successful trading lies in a blend of knowledge, adaptability, and a deep understanding of the underlying dynamics. Equip yourself with this vital knowledge and embark on a rewarding journey in the realm of options futures trading.