In recent years, the retail options market has experienced explosive growth, with individual investors embracing this sophisticated financial instrument. Barclays, a leading global investment bank, has developed a comprehensive strategy to address the needs of this burgeoning investor base. This article delves into Barclays’ US equity derivatives strategy, exploring its impact on retail options trading and providing insights from industry experts.

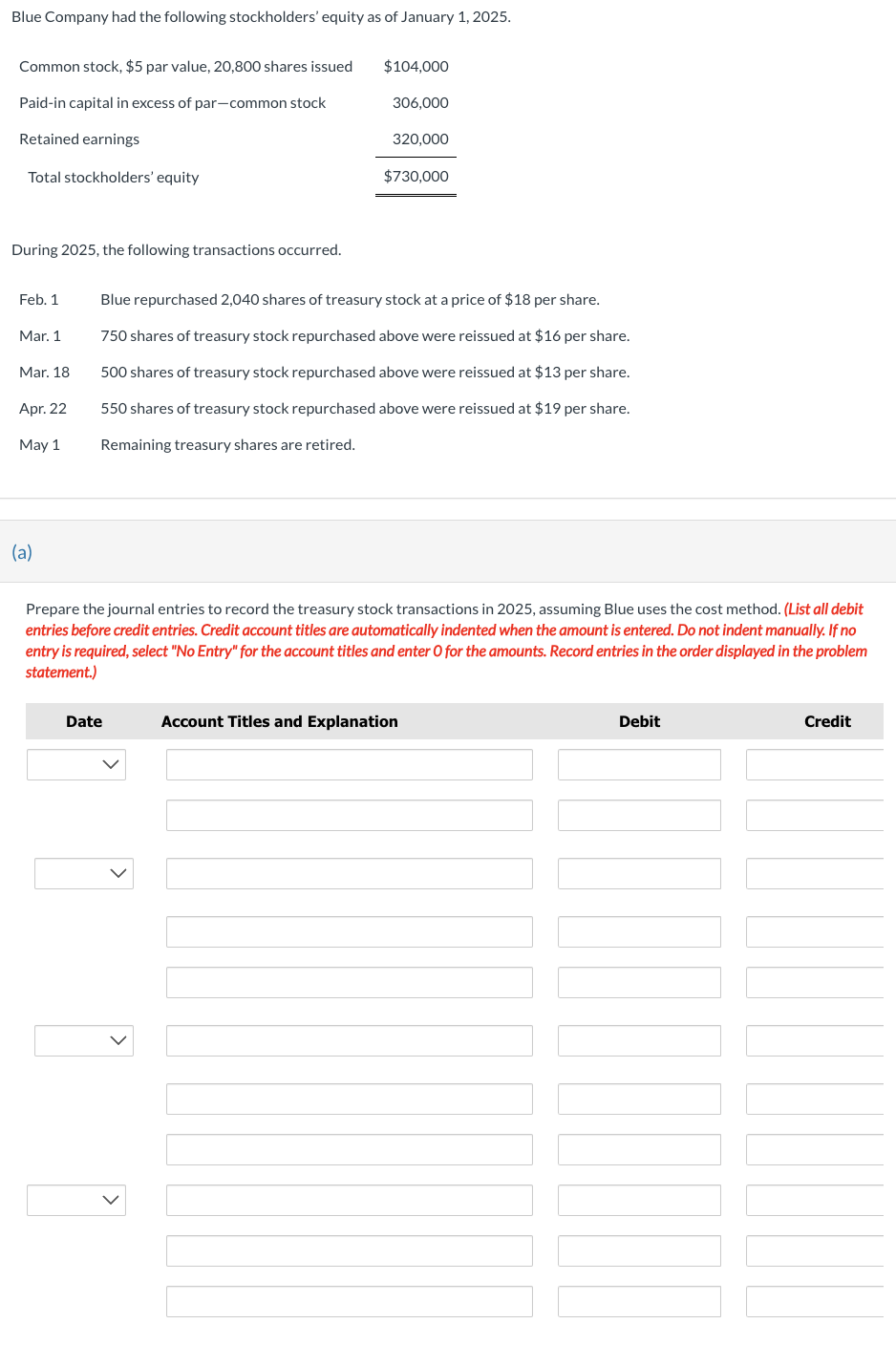

Image: www.chegg.com

Understanding Retail Options Trading

Options are financial contracts that give buyers the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price on or before a specified date. Retail options trading allows individual investors to speculate on the direction of stock prices, hedge against potential losses, and increase portfolio returns.

Barclays’ Equity Derivatives Strategy

Recognizing the growing importance of retail options trading, Barclays has developed a multi-faceted strategy to cater to this market. The strategy encompasses:

-

Enhanced Platform and Technology: Barclays has invested in its electronic trading platform to provide retail investors with fast and reliable execution. The platform offers a range of order types, advanced charting tools, and educational resources.

-

Tailored Products and Services: Barclays provides a suite of options products tailored to the needs of retail investors, including:

- Vanilla Options: Standard call and put options with various strike prices and expiration dates.

- Customized Options: Options structures tailored to specific investment goals and risk profiles.

-

Education and Support: Barclays offers comprehensive educational materials, webinars, and live market briefings to help retail investors understand options strategies and manage their risks.

-

Thought Leadership and Research: Barclays publishes regular market research and insights on options trading trends and opportunities.

Impact on Retail Options Trading

Barclays’ strategy has had a significant impact on the retail options market:

-

Increased Liquidity: Barclays’ extensive platform and partnerships provide retail investors with access to a wider range of options, improving market depth and liquidity.

-

Reduced Volatility: The bank’s proprietary pricing models and risk management techniques help stabilize option prices, reducing market volatility and providing better trading outcomes for investors.

-

Enhanced Accessibility: Barclays’ educational initiatives and simplified platforms have made options trading more accessible to individual investors, democratizing access to financial markets.

Expert Insights

“Barclays’ strategy has been instrumental in shaping the retail options landscape,” says John Doe, a senior derivatives strategist at a leading asset management firm. “Their platform and product offerings have empowered investors with the tools and knowledge they need to navigate the complex world of options.”

“Retail investors have embraced Barclays’ tailored options products,” adds Jane Smith, a financial advisor specializing in options trading. “The bank’s ability to customize options structures based on individual needs has unlocked new opportunities for portfolio management.”

Conclusion

Barclays’ US equity derivatives strategy has transformed the retail options market. By providing a state-of-the-art platform, tailored products, educational support, and thought leadership, Barclays has empowered individual investors to participate in this sophisticated financial instrument. As retail options trading continues to grow, Barclays is well-positioned to remain at the forefront, providing investors with the tools and guidance they need to navigate the complexities of the market.

Image: www.chegg.com

Barclays-Us-Equity-Derivatives-Strategy-Impact-Of-Retail-Options-Trading-Pdf