Introduction

Bank Nifty, an index comprising the top 12 liquid bank stocks, offers investors a unique opportunity to tap into the banking sector’s performance. However, to maximize profits and manage risks, option trading in Bank Nifty deserves prime consideration. This article delves into the world of Bank Nifty option trading, providing a comprehensive guide for both novice and experienced traders.

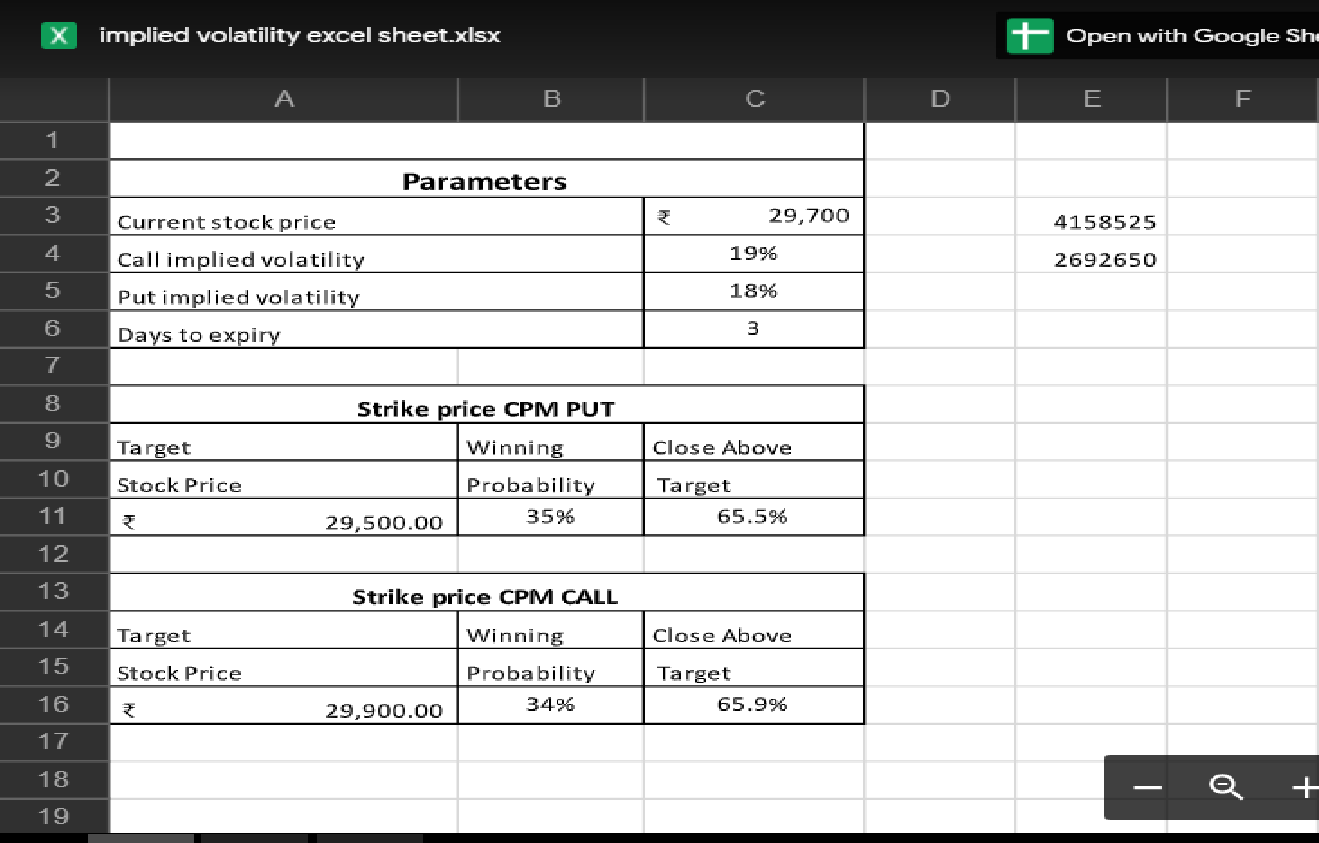

Image: stockfuturesnse.blogspot.com

Understanding Bank Nifty Option Trading

Option trading involves contracts that grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiry). Bank Nifty options allow traders to speculate on Bank Nifty index’s future movements and benefit from its volatility.

Types of Options in Bank Nifty

Call Option:

A call option grants the holder the right to buy Bank Nifty at the strike price. It is ideal when investors anticipate Bank Nifty’s upward movement.

Put Option:

A put option bestows upon the holder the right to sell Bank Nifty at the strike price. It becomes profitable when traders expect Bank Nifty to decline.

Strategies and Techniques in Bank Nifty Option Trading

Covered Call:

A trader with a bullish outlook can sell (write) a call option against existing shares of Bank Nifty in their portfolio. If Bank Nifty rises, the premium received offsets potential losses on shares, while losses occur only if Bank Nifty surges past the strike price.

Naked Call:

A more aggressive technique for bullish traders, where they sell a call option without owning the underlying shares. Potentially high profits accompany elevated risks.

Covered Put:

This conservative strategy suits bearish traders who own Bank Nifty shares. By selling a put option, they receive a premium that reduces the potential decline in their share value.

Naked Put:

Similar to the naked call strategy, this approach involves selling a put option without owning shares. It appeals to traders anticipating a significant drop in Bank Nifty but carries substantial risks.

Image: in.tradingview.com

Factors influencing Bank Nifty Option Trading

Interest Rates:

Changes in interest rates impact Bank Nifty’s valuations, as banks’ profitability is closely tied to lending margins.

Economic Growth:

Robust economic growth boosts corporate earnings and investor confidence, positively impacting Band Nifty.

Policy Announcements:

Government and central bank announcements can significantly affect Bank Nifty’s direction.

Global Market Sentiments:

Global economic events and market trends often influence Bank Nifty’s performance.

Banknifty Option Trading

Conclusion

Bank Nifty option trading provides a powerful tool for investors seeking enhanced returns. By understanding the basics, employing effective strategies, and diligently monitoring market dynamics, traders can harness the immense potential of Bank Nifty options. Remember to approach option trading with measured risks and a comprehensive understanding of the dynamics at play to maximize profits and navigate potential pitfalls effectively.