The allure of quick profits often draws investors towards the complex world of options trading. While options offer the potential for substantial returns, they also come with a higher level of risk. Luckily, technology has stepped in to simplify the process, with a plethora of option trading software solutions designed to empower traders of all levels. But choosing the right software can feel overwhelming. How do you distinguish between the genuine trading tools and the mere marketing fluff?

Image: s3.amazonaws.com

This guide delves into the realm of option trading software, helping you navigate the intricate landscape and ultimately find the tools that align with your trading goals. We will unpack the benefits, explore the various features, and guide you through the selection process, ensuring you make an informed decision.

Demystifying Option Trading Software

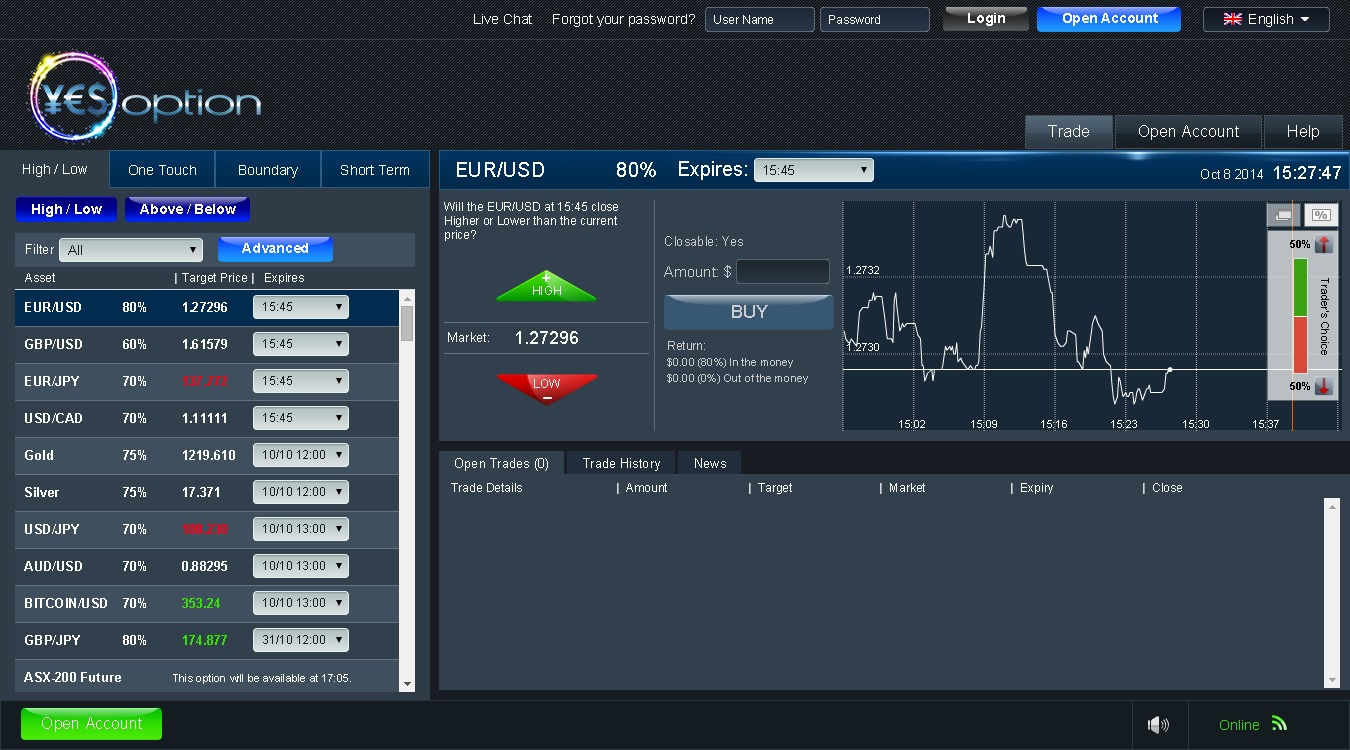

Option trading software refers to computer programs specifically designed to assist traders in making informed decisions about buying and selling options contracts. These software solutions often provide a range of features, including real-time market data analysis, charting tools to identify trends, automated trading strategies, and risk management functionalities. But beyond the technical jargon, what truly sets this software apart?

The core advantage lies in its ability to streamline the often-complex world of options trading, empowering both novice and experienced traders. Imagine having a toolkit that allows you to analyze market fluctuations, visualize price movements, and even automate trades—that’s the power of option trading software. It essentially acts as a personal assistant, taking the guesswork out of making informed trading decisions.

The Building Blocks of Option Trading Software

To fully understand option trading software, let’s break down its essential components:

1. Real-Time Market Data

This is the backbone of any successful trading strategy. Real-time market data provides instant updates on the prices of underlying assets, option prices, and other relevant market indicators. This information allows traders to identify potential profit opportunities quickly and act accordingly.

Image: www.tradethetechnicals.com

2. Charting and Technical Analysis Tools

Visualizing the market’s movement is crucial for effective trading. Charting tools enable traders to create various graphical representations of price movements, volume, volatility, and other indicators. Technical analysis tools provide insights into market trends and patterns, allowing traders to predict potential future price movements.

3. Option Strategies and Order Types

Option trading software facilitates diverse trading strategies, providing a plethora of options like covered calls, put selling, straddles, and more. It also supports various order types, such as limit orders, market orders, stop orders, and trailing stop orders, allowing traders to customize their trade execution according to their risk tolerance and profit goals.

4. Backtesting and Simulated Trading Environments

Before committing real capital, many traders prefer to test their strategies in a simulated environment. Backtesting allows users to evaluate past trading performances based on historical data, while simulated trading environments provide a risk-free platform to practice and refine strategies before venturing into live trading.

5. Risk Management Features

Options trading inherently involves risk, and option trading software equips users with powerful tools to manage this risk. Features such as stop-loss orders, position limits, and profit targets help traders define acceptable levels of risk, limiting potential losses and maximizing potential gains.

6. Automated Trading

Some advanced software packages offer automated trading features, such as pre-programmed trading algorithms or expert advisors. These systems can execute trades based on predefined criteria, eliminating the need for manual intervention and allowing traders to pursue other activities.

Navigating the Software Landscape

With a diverse range of option trading software available, the selection process can seem daunting. Here are key considerations to guide your decision:

1. Trading Experience and Goals

New traders might benefit from user-friendly software with clear tutorials and comprehensive learning resources. Experienced traders may prefer advanced platforms with customizable features, advanced analytics, and real-time data access.

2. Features and Functionality

Consider your trading style and needs. Do you primarily focus on day trading, swing trading, or long-term investments? Each approach requires different sets of functionalities within the software.

3. Cost and Pricing Structure

Option trading software comes with various pricing models, from flat monthly fees to commission-based structures. Evaluate your budget and choose a plan that aligns with your trading frequency and activity level.

4. Customer Support and Resources

Ensure the software provider offers adequate customer support channels, such as phone support, email support, live chats, or online forums. Access to educational resources, tutorials, and online documentation can be invaluable for learning and problem-solving.

5. Reputation and Reviews

Research the software provider’s reputation, carefully review online customer feedback, and consider the software’s track record. User reviews and independent ratings can shed light on the software’s strengths and weaknesses.

Tips and Expert Advice

Here are some insider insights to empower your option trading journey:

– Start small and gradually scale up your trading activity. Begin with a small amount of capital and focus on mastering the fundamentals before expanding your investments.

– Practice with a demo account. Most option trading software providers offer free trial periods or demo accounts, allowing you to experiment with the platform’s features and strategies without risking real capital.

– Always practice thorough risk management. Define your risk tolerance, set stop-loss orders, and manage your position size according to your risk appetite.

– Invest in continuous learning. The world of option trading is constantly evolving. Stay updated on market trends, refine your strategies, and seek expert advice to enhance your understanding and skillset.

Frequently Asked Questions

What is the best option trading software?

The “best” software depends on your individual needs and trading style. There is no single best option; it’s crucial to consider factors like experience level, trading strategies, cost, and support.

Is option trading software safe and secure?

Reputable software providers prioritize security and user data protection. Look for platforms that use industry-standard encryption protocols and security measures to safeguard your account information and transactions.

Is option trading software worth the investment?

If you’re serious about option trading and want to gain an edge, option trading software can be a valuable tool. It can provide crucial insights, automate processes, and help you manage risk effectively, ultimately improving your trading outcomes.

Option Software Trading

Wrapping Up: Empowering Your Trading Journey

Option trading software can be a powerful ally in navigating the dynamic world of options trading. By understanding the key features, carefully evaluating your needs, and choosing the right software, you can unlock the potential for greater profit and minimize risk. Remember to approach this journey with due diligence and continuous learning to make informed decisions that align with your trading goals.

Are you ready to embark on your option trading adventure? Share your thoughts and questions in the comments below. Let’s discuss how option trading software can empower your journey to success!