Have you ever wondered how seasoned investors tap into the world of options trading to maximize their returns? Imagine a realm where the possibility of substantial gains awaits, but only for those strategic minds who navigate its complexities with finesse. In this comprehensive guide, we’ll unravel the secrets of option trading, empowering you with a newbie-friendly approach to uncovering its lucrative potential.

Image: www.youtube.com

Options Trading: A Prelude to Success

Options trading offers a versatile platform for leveraging the price movements of underlying assets like stocks, indexes, or commodities. These contracts grant you the right but not the obligation to buy or sell those assets at a set price (known as the strike price) until their expiration date. By engaging in options trading, you wield the power to speculate on market direction and harness its potential.

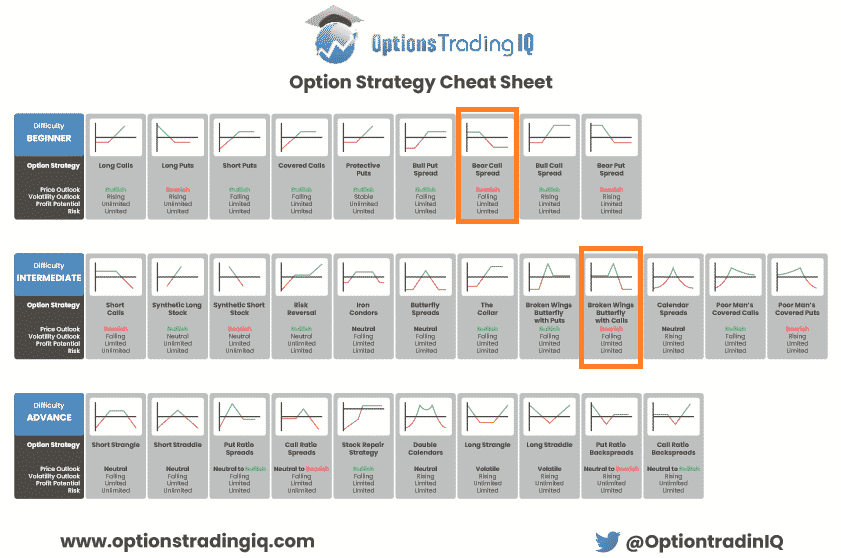

Understanding the Options Basics

There are two prevalent types of options: calls and puts. Call options grant you the right to purchase an asset at the strike price, while put options confer the right to sell. Each contract represents 100 shares of the underlying asset, and their pricing is influenced by factors like the underlying’s price, strike price, expiration date, and volatility.

Going Long with Calls

When you buy a call option, you express optimism that the asset’s price will rise. If it does, you can exercise your right to purchase at the lower strike price, locking in potential gains. Calls are often employed when traders anticipate substantial price appreciation in the underlying asset.

Image: optionstradingiq.com

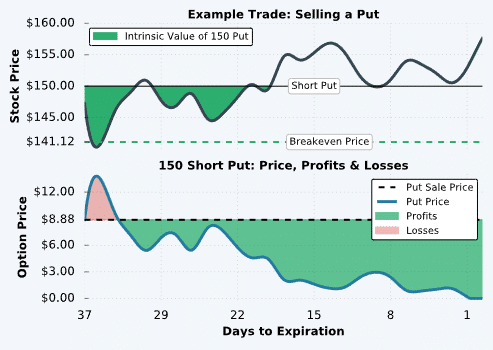

Going Short with Puts

Buying a put option signals your belief that the underlying asset’s price will decline. By exercising your right to sell the asset at the strike price, you profit in an environment of falling prices. Puts cater to bearish market expectations.

Unveiling a Simple Options Strategy: The Covered Call

Consider this simplified yet lucrative options strategy: the covered call. Envision owning 100 shares of Company XYZ, which currently trades at $50. You purchase a call option on those shares with a strike price of $55 and an expiration date one month from now, collecting a premium of $1.50 per share.

Profitability Outcomes

If the stock price at expiration remains below $55, the call option will expire worthless, and you retain your shares while pocketing the premium. On the flip side, if the stock rallies and closes above $55, the call option will be exercised, obliging you to sell your shares for the strike price. In this scenario, your profit includes the initial premium and the difference between the strike price and the higher market price, less the 100-share exercise cost.

The covered call strategy thrives in mildly bullish markets where you anticipate modest price growth while generating premium income.

Expert Tips for Options Trading Success

1. Understand Your Risk Tolerance: Options trading involves significant risk, making self-assessment paramount. Determine your comfort level with potential loss before venturing into this realm.

2. Study, Study, Study: Education is your ally in options trading. Devote time to understanding market dynamics, options pricing models, and risk management strategies.

3. Start Small and Scale Up: Resist the allure of diving into options trading with large sums or complex strategies. Begin with modest trades, gradually increasing your involvement as your knowledge and skills improve.

4. Practice with Virtual Trading: Many platforms offer virtual trading accounts that provide a risk-free environment to test strategies and refine trading maneuvers.

Frequently Asked Questions

Q: Do I need a lot of money to start options trading?

A: No, with proper risk management, starting with a small account is acceptable. Remember, options trading involves the possibility of substantial loss.

Q: What are the most important factors to consider when choosing an option?

A: The underlying asset’s price, strike price, expiration date, and volatility directly impact option pricing and profitability.

Q: Is options trading suitable for beginners?

A: While options trading can be complex, beginners can successfully enter the arena with a grounded understanding of essential principles, risk management, and by engaging in virtual trading.

Simple Options Trading Strategy

Image: www.projectfinance.com

Conclusion

Options trading unveils a boundless realm of opportunities for investors seeking to amplify their returns. By harnessing our simplified approach to option strategies, you empower yourself to navigate the options landscape with confidence. Remember, education, prudent risk management, and a steadfast pursuit of knowledge are the cornerstones of your trading success.

Are you ready to embark on an options trading adventure? Explore the potential of this financial instrument and witness the transformative power of strategic investing.