Option spread trading is a versatile strategy that can offer both income and risk management opportunities for traders of all levels. By combining two or more options with different strike prices and expiration dates, traders can create customized positions that meet their specific risk and reward objectives. To help traders navigate the complexities of option spread trading, we present a comprehensive PDF guide that delves into proven strategies and provides actionable insights.

Image: kumeyuroj.web.fc2.com

Unveiling the Power of Option Spreads

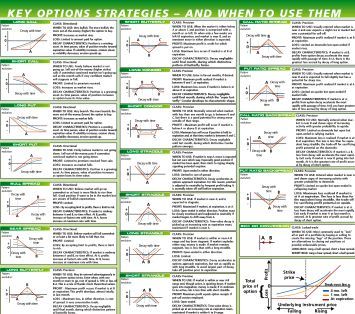

Option spreads involve the simultaneous buying and selling of options with varying strike prices and expiration dates. This approach allows traders to tailor their positions to suit their risk tolerance, time horizon, and market outlook. Unlike single-leg options, option spreads offer a wider range of profit potential and risk management options, making them a popular choice among seasoned traders.

Strategies for Every Market Condition

Our proven option spread trading strategies PDF provides a deep dive into various strategies designed for different market conditions and trading objectives. Whether you seek income generation, speculative profit, or downside protection, we present strategies that align with your goals. From bullish to bearish spreads and neutral strategies, our guide covers the gamut of option spread techniques.

Unraveling Vertical Spreads

Vertical spreads, involving options with the same expiration date but different strike prices, form the cornerstone of option spread trading. We introduce you to bull call spreads, bear put spreads, and more, explaining their mechanics, risk-reward profiles, and optimal market conditions for implementation.

Image: www.pinterest.com

Mastering Horizontal Spreads

Horizontal spreads, characterized by options with the same strike price but varying expiration dates, offer distinct advantages for traders. Our guide elucidates strategies such as calendar spreads, butterfly spreads, and straddles, highlighting their strengths and limitations.

Advanced Strategies for Sophisticated Traders

For experienced option spread traders, our guide delves into advanced strategies that leverage complex combinations of options to create highly customized positions. We explore diagonal spreads, backspreads, and iron butterflies, arming you with the knowledge to execute sophisticated trades.

Risk Management in Option Spread Trading

Understanding risk management is paramount in option spread trading. Our PDF guide dedicates a section to risk assessment, detailing the factors that influence the risk of option spreads. We provide practical tips to manage risk effectively, ensuring that your trading aligns with your risk tolerance.

Proven Option Spread Trading Strategies Pdf

Empowering Traders with Knowledge and Confidence

Our proven option spread trading strategies PDF is an invaluable resource for traders of all levels, from beginners seeking to unravel the complexities of option spreads to experienced individuals looking to refine their strategies. Whether you are looking to generate income, capitalize on market movements, or mitigate downside risk, this comprehensive guide provides the knowledge and confidence you need to excel in the dynamic world of option spread trading.