Have you ever dreamt of taking your investment game to the next level? Maybe you’ve heard the whispers about the potential gains offered by options trading, but the thought of navigating this complex world feels daunting. You’re not alone. Options trading has long been perceived as a high-stakes game reserved for experienced Wall Street veterans. But the truth is, with the right knowledge and preparation, even seasoned investors can unlock the power of options and make smart, strategic moves in the market.

Image: speedtrader.com

Getting approved for options trading is the first hurdle you’ll need to clear. While it may seem like a complicated process, it’s really about demonstrating your financial literacy and understanding of the risks involved. Think of it as applying for a “license” to access the world of options, ensuring you’re equipped to handle the complexities that come with this powerful financial instrument. This comprehensive guide will walk you through the steps, requirements, and strategies for navigating this approval process and unlocking the potential of options trading.

Understanding the Importance of Options Approval

Options Trading: A Powerful Tool

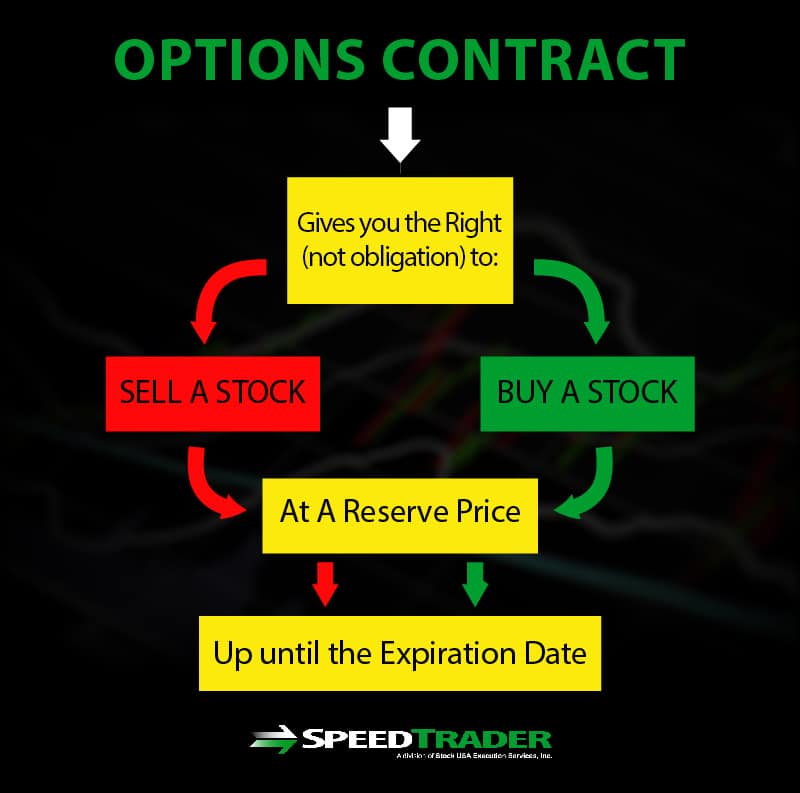

Before diving into the approval process, it’s essential to understand what makes options trading such a powerful financial tool. Options contracts give you the right, but not the obligation, to buy or sell an underlying asset (like stocks) at a specific price on or before a specific date. This “right” provides traders with a unique leverage advantage, allowing them to potentially amplify their returns (or losses) with a smaller amount of capital.

The Importance of Risk Awareness

While the potential rewards are enticing, options trading also carries significant risk. The leverage that makes options powerful can also magnify losses if your trades don’t go your way. It’s crucial to understand the dynamics of options trading and to approach it with a sound investment strategy that considers your risk tolerance, financial goals, and the potential for both gains and losses.

Image: learnwealthwise.com

Stepping Into the World of Options: Requirements and Approval Process

The approval process for options trading is primarily designed to ensure that investors have a sufficient understanding of the inherent risks and strategies involved. While the specific requirements may vary between brokerages, here’s a general overview of what you can expect:

The First Step: Choose a Reputable Broker

The first step is to choose a reputable brokerage that offers options trading. Some popular options include:

- TD Ameritrade

- E*TRADE

- Interactive Brokers

- Fidelity

- Schwab

Research each platform to determine which one aligns best with your trading style and investment goals. Look for platforms with user-friendly interfaces, robust educational resources, and a reputation for reliable customer support.

Documenting Your Financial Understanding: The Approval Process

Once you’ve selected a brokerage, you’ll need to initiate the options approval process. This usually involves answering questions to assess your financial knowledge and experience. Expect to encounter topics such as:

- Market knowledge: Demonstrating a grasp of basic economic concepts, market dynamics, and trading strategies.

- Options fundamentals: Understanding the basics of options contracts, including terms like strike price, expiration date, and premium.

- Risk tolerance: Assessing your willingness to accept potential losses in exchange for the possibility of larger gains.

- Financial stability: Ensuring you have the financial resources to cover potential losses.

The Minimum Account Balance Requirement: A Security Measure

Many brokerages require a minimum account balance to gain options trading privileges. The specific amount may vary by brokerage but typically falls within a range of $2,000 to $10,000. This requirement acts as a safeguard, ensuring that investors have sufficient resources to manage potential losses and minimize the risk of margin calls.

Tips for Increasing Your Chances of Approval

While you may feel overwhelmed at the prospect of navigating the approval process, keep in mind that it’s designed to ensure responsible trading. Here are some tips to maximize your chances of getting approved and opening the door to the world of options:

1. Invest in Your Knowledge: Education is Key

Before applying, dedicate time to gaining a solid understanding of options trading. Take advantage of free online resources, such as interactive tutorials, videos, and articles. Many brokerages offer their own comprehensive educational materials, often accompanied by quizzes and practice exercises. The more knowledge you acquire, the more confident you’ll feel during the approval process.

2. Practice with a Simulated Trading Environment

Many brokerages offer paper trading accounts, allowing you to practice options trading without risking real money. This valuable tool lets you experiment with different strategies, test your risk tolerance, and refine your understanding of options mechanics before entering the real market.

3. Document Your Investment Experience

If you have any prior experience with trading stocks or other financial instruments, be sure to highlight this in your application. Document your trading history, detailing your strategies, investment goals, and successes. This documentation helps demonstrate your familiarity with financial markets and your ability to make informed trading decisions.

4. Be Transparent About Your Risk Tolerance

One of the vital aspects of the approval process is assessing your risk tolerance. Be honest with yourself and the brokerage about your comfort level with potential losses. If you’re a conservative investor, make sure your trading strategies reflect this.

Making the Most of Options Trading

Congratulations! You’ve successfully navigated the approval process and gained access to the exciting world of options trading. Now, how do you harness the power of this financial instrument to achieve your investment goals? Here are some key considerations:

1. Define Your Investment Goals

What are you aiming to accomplish with options trading? Do you seek to generate income, protect your portfolio, or capitalize on short-term market fluctuations? Defining your goals early on helps you select strategies that align with your objectives.

2. Develop a Sound Trading Plan

Options trading is most successful with a well-defined plan. Carefully consider factors like entry and exit points, risk management strategies, and potential profit/loss scenarios. It’s also crucial to establish stop-loss orders to manage your downside risk and protect your capital.

3. Stay Informed and Continuously Learn

The financial markets are constantly dynamic and evolving. To thrive in options trading, it’s vital to remain informed. Stay up-to-date with market news, economic indicators, and industry trends. Continuously learn new strategies, refine your understanding of options, and seek out reputable resources for ongoing education.

4. Manage Your Emotions: Avoid Impulse Trading

Options trading can be emotionally charged, especially during periods of volatility. It’s crucial to control your emotions and resist making impulsive decisions. Stick to your plan, manage your risks, and avoid chasing quick profits. Discipline and a reasoned approach are key to long-term success in options trading.

How To Get Approved For Options Trading

Conclusion

The path to options trading approval may seem demanding, but it’s a vital step toward unlocking the potential of this versatile financial instrument. By following the tips outlined, you can demonstrate your financial knowledge and commitment to responsibility. Remember, successful options trading requires discipline, ongoing education, and a well-defined strategy. As you embark on this journey, embrace the educational opportunities, practice with simulated accounts, and navigate the world of options with a clear vision for your investment goals.