The world of finance can be a labyrinth of complex strategies and intricate instruments. Options trading, a realm of leveraged bets, often intimidates newcomers with its seemingly cryptic language. But within this complex landscape lies a chance to unlock significant profits. One tool that can demystify this process is a comprehensive guide on option trading strategies, expertly compiled in a PDF format. This compilation can transform your trading journey by offering actionable insights and strategic approaches.

Image: ualdodikur.blogspot.com

Understanding the Value of Option Trading Strategies

Options trading offers a unique approach to navigating the market, leveraging the power of derivatives. Unlike traditional stock trading, where you directly buy and sell shares, options give you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain timeframe. This flexibility allows you to profit from both rising and falling asset prices, providing diversified opportunities.

A PDF compilation of option trading strategies can serve as your go-to resource, offering insights into various approaches. It can delve into concepts like covered calls, cash-secured puts, straddles, and strangles, helping you grasp the intricacies of different strategies.

Navigating the World of Options

Option trading is a universe of potential, but navigating this realm requires a solid understanding of the basics. Your PDF guide should offer a clear explanation of option contracts, their different types (calls and puts), and their expiration dates. It should also delve into the nuances of options pricing, including premium and strike prices, and explain the factors that influence these values.

Strategic Approaches to Profit from Options

A comprehensive PDF guide should explore various options trading strategies tailored to different market situations and risk appetites.

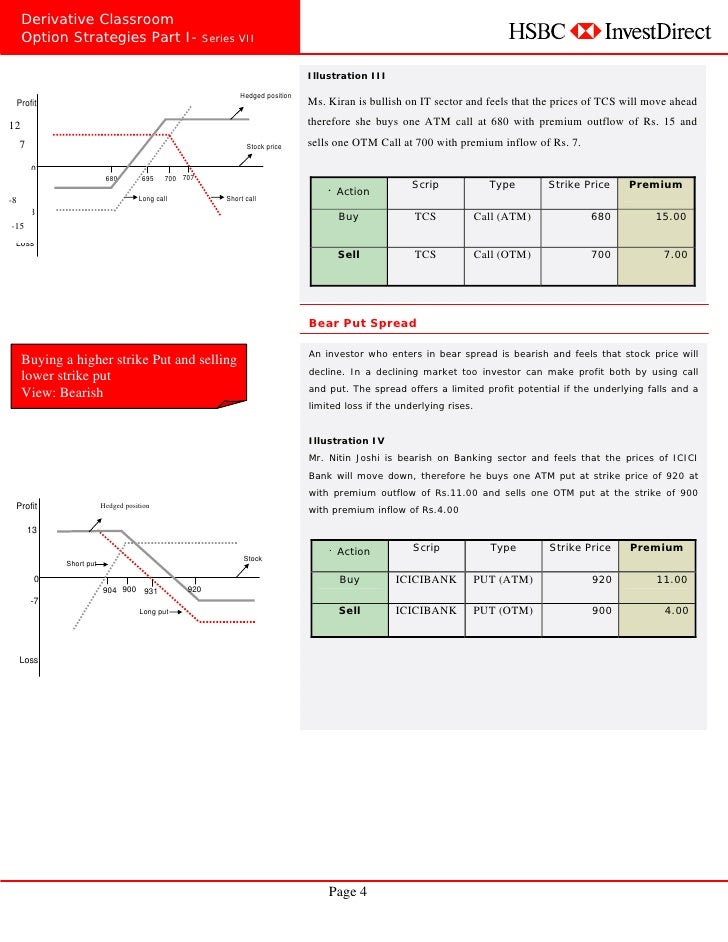

- Bullish strategies like buying call options are suitable when you believe the underlying asset’s price will rise.

- Bearish strategies such as buying put options target scenarios where you expect the asset’s price to decline.

- Neutral strategies, such as straddles and strangles, allow you to profit in volatile markets regardless of the direction of the price movement.

Image: www.pinterest.com

Managing Risk in Your Option Trading Journey

Option trading, while promising, comes with its own set of risks. Understanding these risks and implementing effective risk management techniques is crucial.

- Limit losses with stop-loss orders, which automatically sell your options if the price falls below a predetermined level.

- Diversify your portfolio by investing in different types of options or underlying assets to reduce exposure to any single investment.

- Don’t overleverage your positions. Ensure that the amount of money you are risking on each trade is within a level that you are comfortable with.

Emerging Trends and Innovations in Option Trading

The world of option trading is constantly evolving, with new strategies and platforms emerging. Your PDF resource should highlight these advancements, allowing you to stay ahead of the curve.

For example, the rise of automated trading systems and algorithmic trading strategies is transforming how options are executed. These systems leverage advanced analytics to make trading decisions more efficiently and objectively.

Expert Tips for Successful Option Trading

Experience is the best teacher in the world of trading, but a good options trading PDF guide can provide valuable shortcuts, offering expert tips that can accelerate your learning curve.

- Start small and gradually increase your position size as you gain experience and confidence. This approach minimizes risk and allows you to learn the intricacies of options trading without risking substantial capital.

- Conduct thorough research and due diligence before entering any trade. Analyze the underlying asset’s fundamentals, market conditions, and the potential impact of relevant news events.

- Don’t chase losses. If a trade isn’t going your way, exit gracefully and accept your loss. Don’t try to “average down” or double down on a losing position in an attempt to recover the loss.

FAQ on Option Trading Strategies

What are some common option trading strategies?

Some popular strategies include:

- Covered Call: Selling a call option on an asset you own. This strategy generates income, but limits potential upside gains.

- Cash-Secured Put: Selling a put option while simultaneously holding enough cash to buy the underlying asset if the put is exercised. This strategy can be used to earn a premium or to acquire an asset at a discounted price.

- Straddle: Buying both a call and a put option on the same underlying asset with the same strike price and expiration date. This strategy benefits from high volatility.

- Strangle: Buying both a call and a put option, but with different strike prices.

How can I find a high-quality PDF guide on option trading?

Look for reputable financial institutions, experienced traders, or established online platforms that offer well-researched and comprehensive PDF guides. Check for reviews, testimonials, and user feedback before making a purchase.

Are options trading strategies suitable for all investors?

Not all investors are comfortable with options trading. Options are complex, and understanding their intricacies requires a commitment to learning. Before you consider options trading, ensure you have a good understanding of risk management and the potential for loss.

Option Trading Strategies Pdf

Conclusion

Options trading strategies, when skillfully employed, can be a powerful tool in your investment arsenal. A dedicated PDF guide can serve as your compass, guiding you through the intricate world of options. Ready to take your trading to the next level? Explore the world of options strategies and unlock the potential for consistent returns. Are you interested in learning more about options trading strategies?