Introduction:

Amidst the ever-shifting tides of financial markets, options trading has emerged as a powerful tool for astute investors seeking to navigate volatility and capitalize on market swings. Among the diverse strategies within this realm, the options trading straddle stands out as a formidable technique that harnesses both the upside and downside potential of underlying assets, empowering traders to profit regardless of the market’s direction. Join us as we delve into the intricacies of straddles, unlocking their secrets and equipping you with the knowledge and strategies to harness their potential.

Image: www.xtremetrading.net

Understanding the Options Trading Straddle:

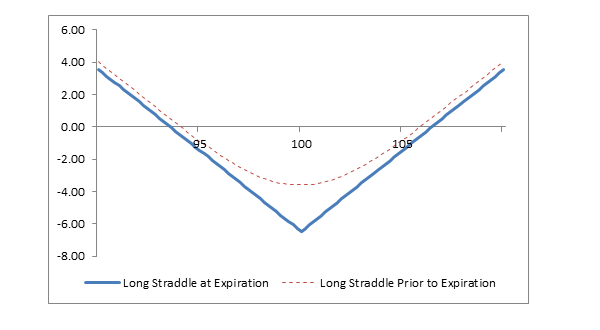

An options trading straddle involves the simultaneous purchase of both a call option and a put option with the same expiration date but different strike prices. The call option grants the holder the right, but not the obligation, to buy the underlying asset at a specified price (strike price) on or before the expiration date. Conversely, the put option grants the holder the right, but not the obligation, to sell the underlying asset at a specified strike price on or before the expiration date.

The beauty of a straddle lies in its versatility. It empowers traders to profit from both upward and downward price movements in the underlying asset. If the underlying asset’s price surges, the call option gains value, potentially generating substantial profits for the holder. Conversely, if the underlying asset’s price plummets, the put option gains value, allowing the holder to capitalize on the decline.

Real-World Applications:

Straddles find widespread use in various scenarios within financial markets. For instance, investors can utilize straddles to:

-

Hedge against market volatility: Straddles offer traders a robust hedging strategy, protecting their portfolios against significant market fluctuations.

-

Speculate on market direction: Traders with a conviction about an upcoming market event, such as an upcoming earnings announcement, can employ straddles to capitalize on anticipated volatility and profit from correctly predicting the market’s direction.

-

Generate income from premiums: By selling straddles, investors can collect premiums from other market participants seeking to hedge or speculate.

Expert Insights and Actionable Tips:

Navigating the complexities of options trading straddles requires a combination of knowledge and strategic implementation. To enhance your understanding and maximize your returns, heed the following insights from industry experts:

-

Thoroughly research the underlying asset: Before executing an options trading straddle, conduct a comprehensive analysis of the underlying asset’s historical price behavior, market sentiment, and any upcoming events or news catalysts that may impact its future performance.

-

Consider implied volatility: Implied volatility measures the market’s perception of an asset’s future price fluctuations. Higher implied volatility typically results in higher premiums for straddles, while lower implied volatility leads to lower premiums.

-

Manage your risk effectively: Options trading, including straddles, carries inherent risk. Implement robust risk management strategies, such as setting stop-loss orders or employing margin cautiously, to mitigate potential losses.

Image: www.fidelity.com

Options Trading Straddle

Conclusion:

Options trading straddles offer investors a powerful instrument to navigate volatile markets and harness the potential for substantial returns. By understanding the fundamentals of straddle strategies, leveraging expert insights, and implementing sound risk management practices, you can unlock the potential of this versatile tool and empower yourself in the ever-evolving financial landscape. As you embark on your options trading journey, remember that knowledge, discipline, and a keen understanding of market dynamics will serve as your guiding compass toward success.