In the dynamic world of finance, option trading strategies have emerged as a sophisticated tool for investors seeking to navigate market uncertainties. From seasoned veterans to aspiring enthusiasts, understanding these strategies is crucial to maximizing returns and mitigating risks. This comprehensive guide delves into the realm of option trading, providing a comprehensive roadmap to empower you in making informed decisions.

Image: www.stockbrokers.com

1. Delving into the Fundamentals of Option Trading

An option contract is an agreement that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. This unique characteristic differentiates it from traditional stock trading, where investors are obligated to execute the transaction. By leveraging options, traders can gain exposure to the underlying asset without outright ownership, potentially amplifying their profit potential.

2. Embracing Option Trading Strategies: A Multifaceted Arsenal

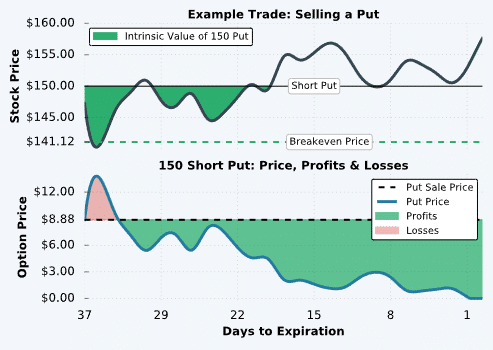

The diverse landscape of option trading strategies offers a wide range of opportunities for investors with varying risk appetites. Covered calls, a conservative approach, involve selling call options against underlying shares that you own, generating income while limiting potential gains. Conversely, protective puts, a defensive strategy, provide downside protection by purchasing put options that can cushion against market downturns.

3. Unraveling the Intricacies of Spreads

Spreads, an advanced option strategy, combine multiple options contracts to create tailored risk and reward profiles. By combining calls and puts with different strike prices and expiration dates, investors can craft strategies that enhance potential returns while managing risk exposure. Understanding the nuances of spreads requires a deep understanding of option pricing and market dynamics.

Image: www.projectfinance.com

4. Seeking Expert Guidance: Unlocking the Secrets of Seasoned Traders

Seasoned traders in the realm of option trading have honed their skills through extensive experience and unwavering dedication. Seek their wisdom through webinars, online forums, and reputable sources. Their invaluable insights can accelerate your learning curve and illuminate the complexities of this multifaceted domain.

5. Mastering the Art of Risk Management

While option trading strategies offer immense potential, it’s imperative to acknowledge and manage the inherent risks involved. Exercise caution by thoroughly understanding the risks associated with each strategy and align your trades with your financial goals and risk tolerance.

6. Leveraging Technology: Embracing Modern Trading Tools

Embrace the power of modern trading platforms that provide real-time data, advanced charting capabilities, and sophisticated risk management tools. These technological advancements empower traders with unparalleled insights, enabling them to make informed decisions in a fast-paced trading environment.

7. The Power of Practice: Simulation and Paper Trading

Before venturing into live trading, consider honing your skills through simulation or paper trading platforms. These environments provide a risk-free testing ground where you can experiment with different strategies and gain valuable experience without risking capital.

Option Trading Strategies Website

https://youtube.com/watch?v=Uy6vsHIQYhg

Conclusion

Option trading strategies present a compelling opportunity for investors to enhance their returns and manage risks. By delving into the complexities of this multifaceted domain, traders can unlock the potential to navigate market uncertainties with greater confidence and precision. Remember, continual learning, strategic thinking, and prudent risk management are the cornerstones of successful option trading. Embrace the guidance of experts, harness the power of technology, and embark on your journey to financial empowerment.