Navigating the Options Trading Landscape

In the realm of investing, options trading has emerged as a potent tool, offering investors the potential for significant returns. However, selecting the optimal platform for your options trading endeavors is crucial for maximizing your earnings. This comprehensive guide delves into the depths of options trading platforms, comparing their features, fees, and benefits to equip you with the knowledge necessary to make informed decisions.

Image: www.stockbrokers.com

Unveiling the Options Trading Arena

Options trading grants investors the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specified price within a predetermined time frame. This incredibly versatile strategy empowers traders with the flexibility to hedge risks, speculate on price movements, and enhance returns.

Platform Features: Delving into the Mechanics

Choosing an options trading platform hinges on a meticulous assessment of its features. Consider crucial aspects such as order types, trading tools, and analytical capabilities. Advanced platforms often provide complex order types, such as stop-loss or limit orders, enabling traders to automate their trading strategies. Moreover, sophisticated tools for charting, technical analysis, and real-time market data empower traders to make informed decisions.

Fee Structures: Navigating the Costs

Understanding fee structures is paramount for maximizing profits. Options trading platforms typically charge a commission per trade, which can vary depending on the asset type and trade volume. Whether your focus is on short-term or long-term trading, selecting a platform with competitive fees aligned with your trading style is essential.

Image: www.motivewave.com

Convenience and User-Friendliness: Seamless Trading

The user interface of an options trading platform should not be overlooked. A user-friendly and intuitive interface streamlines the trading process, reducing errors and maximizing operational efficiency. Mobile trading capabilities add an extra layer of convenience, allowing you to monitor and manage your positions on the go.

Top Contenders: Exploring Market Leaders

With the landscape of options trading platforms constantly evolving, understanding the leading options is crucial. TD Ameritrade, Interactive Brokers, and Thinkorswim are powerhouses in the industry, offering a wide range of services tailored to different trader profiles.

TD Ameritrade: A Comprehensive Solution

TD Ameritrade stands as a formidable choice, boasting an impressive platform that caters to various trader needs. Its user-friendly interface, robust educational resources, and extensive trading tools make it an ideal option for both seasoned and novice traders alike.

Interactive Brokers: Low Costs, Advanced Tools

Interactive Brokers excels in providing competitive fee structures, a comprehensive suite of trading tools, and advanced charting capabilities. This platform is particularly well-suited for high-volume traders seeking low trading costs and sophisticated analytical tools.

Thinkorswim: Tailored to Active Traders

Thinkorswim has emerged as a top choice among active traders, offering a vast array of technical indicators, customizable trading panels, and real-time market data. Its advanced platform empowers traders to develop and execute complex trading strategies seamlessly.

Comparing Options Trading Platform

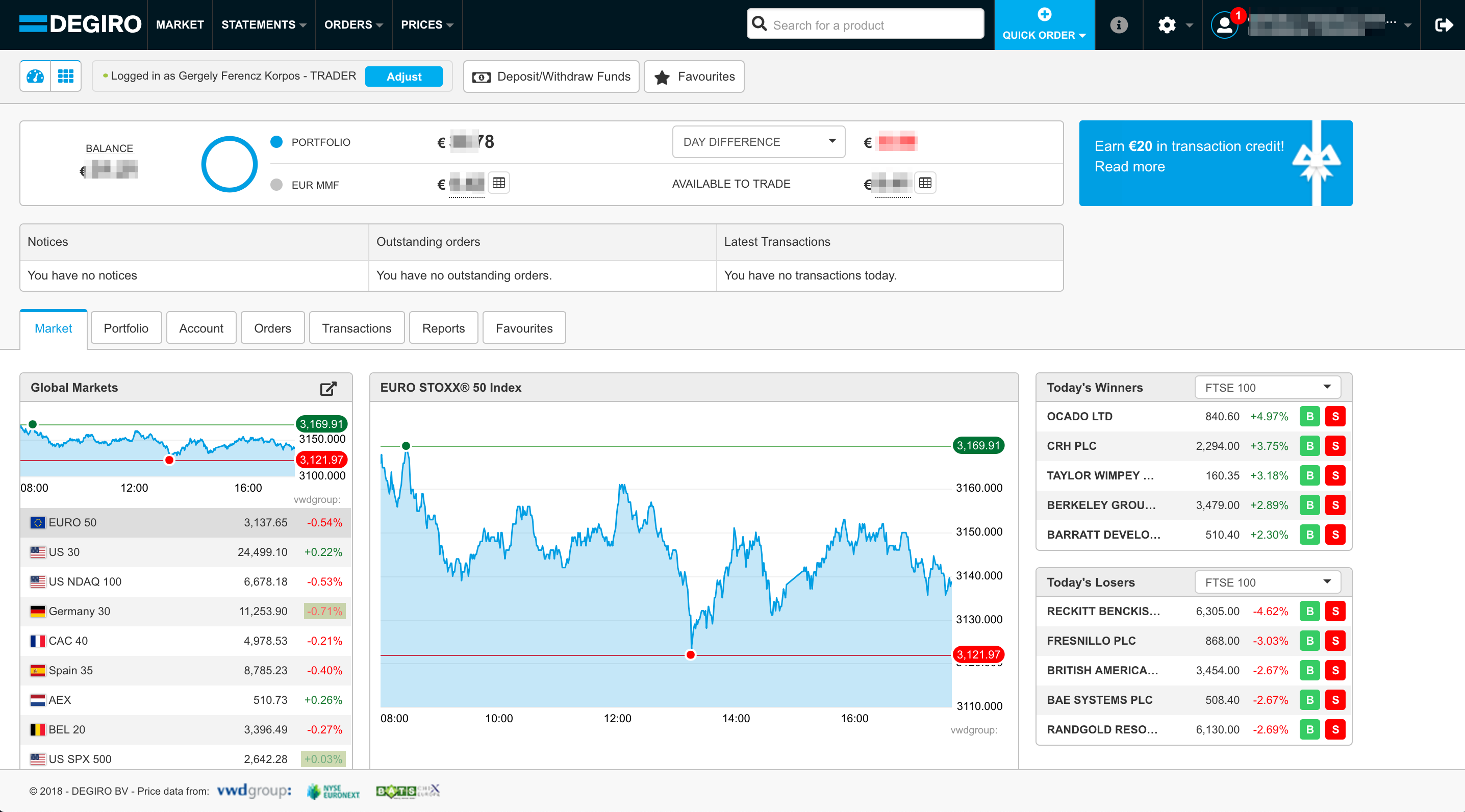

Image: brokerchooser.com

Making an Informed Choice: Synthesizing the Platform Landscape

Ultimately, the choice of the optimal options trading platform lies in the individual trader’s specific needs and preferences. Evaluating fee structures, platform features, user experience, and educational resources is imperative. Armed with this comprehensive guide, you are now equipped to navigate the options trading landscape and select the platform that will propel you towards financial success.