Introduction

Image: www.xtremetrading.net

In the realm of options trading, the concept of implied volatility can be likened to a tempestuous sea—a force that can both uplift and capsize traders. Yet, amidst this market volatility, there lies an undercurrent of opportunity, a path to potentially harness this volatility for strategic gain. Enter the realm of implied volatility options trading strategies, a sextant in the ever-changing ocean of financial markets.

Delving into Implied Volatility

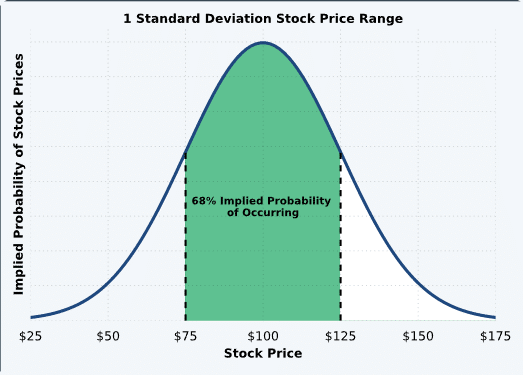

Implied volatility is the market’s forecasted expectation of future volatility. It plays a crucial role in options pricing, as it influences the premium paid for the option contract. Traders can exploit this forecasted volatility by employing strategies that either speculate on or protect against future price fluctuations.

Navigating Implied Volatility Strategies

The spectrum of implied volatility strategies is vast and can be tailored to varying risk appetites and market conditions. Some popular strategies include:

-

Long Volatility: This strategy involves purchasing options with high implied volatility, betting that the actual volatility will exceed the implied forecast.

-

Short Volatility: The inverse of long volatility, this strategy involves selling options with high implied volatility, anticipating that the actual volatility will fall below the implied estimate.

-

Straddle: A straddle involves buying both a call and put option with identical strike prices and expiration dates. This strategy hedges against directional price movements while benefiting from increased volatility.

-

Strangle: A variation of the straddle, the strangle involves buying a call and put option with different strike prices but the same expiration date. This strategy provides a wider range of profit potential but with higher risk.

-

Iron Condor: This multi-leg strategy involves buying an out-of-the-money call spread and selling an out-of-the-money put spread with the same expiration date. It aims to capitalize on low volatility conditions.

Expert Insights and Prudent Practices

Mastering implied volatility options trading strategies requires a blend of market knowledge and strategic precision. Seasoned traders emphasize the following:

-

Utilize historical volatility data and implied volatility models to gauge future volatility expectations.

-

Understand the Greeks, particularly delta, gamma, and theta, to assess the sensitivity of options prices to changes in underlying price and volatility.

-

Manage risk through proper position sizing and prudent hedging techniques.

Conclusion

Navigating the tempestuous waters of implied volatility options trading requires a blend of knowledge, strategy, and prudent risk management. By embracing these strategies and the wisdom of experienced traders, you can harness the power of implied volatility, transforming market uncertainty into an opportunity for potential profit. Remember, the path to options trading success lies in a deep understanding of the markets, a clear strategy, and an unwavering embrace of both opportunity and risk.

Image: www.projectfinance.com

Implied Volatility Options Trading Strategies