Seasoned options traders often credit candlestick charts with providing vital price patterns that can enhance trading strategies. This exclusive guide curates a comprehensive insight into reading candlesticks, empowering you to unlock actionable trading signals for potentially profitable outcomes.

Image: app.jerawatcinta.com

Introducing Candlesticks: A Window into Market Sentiment

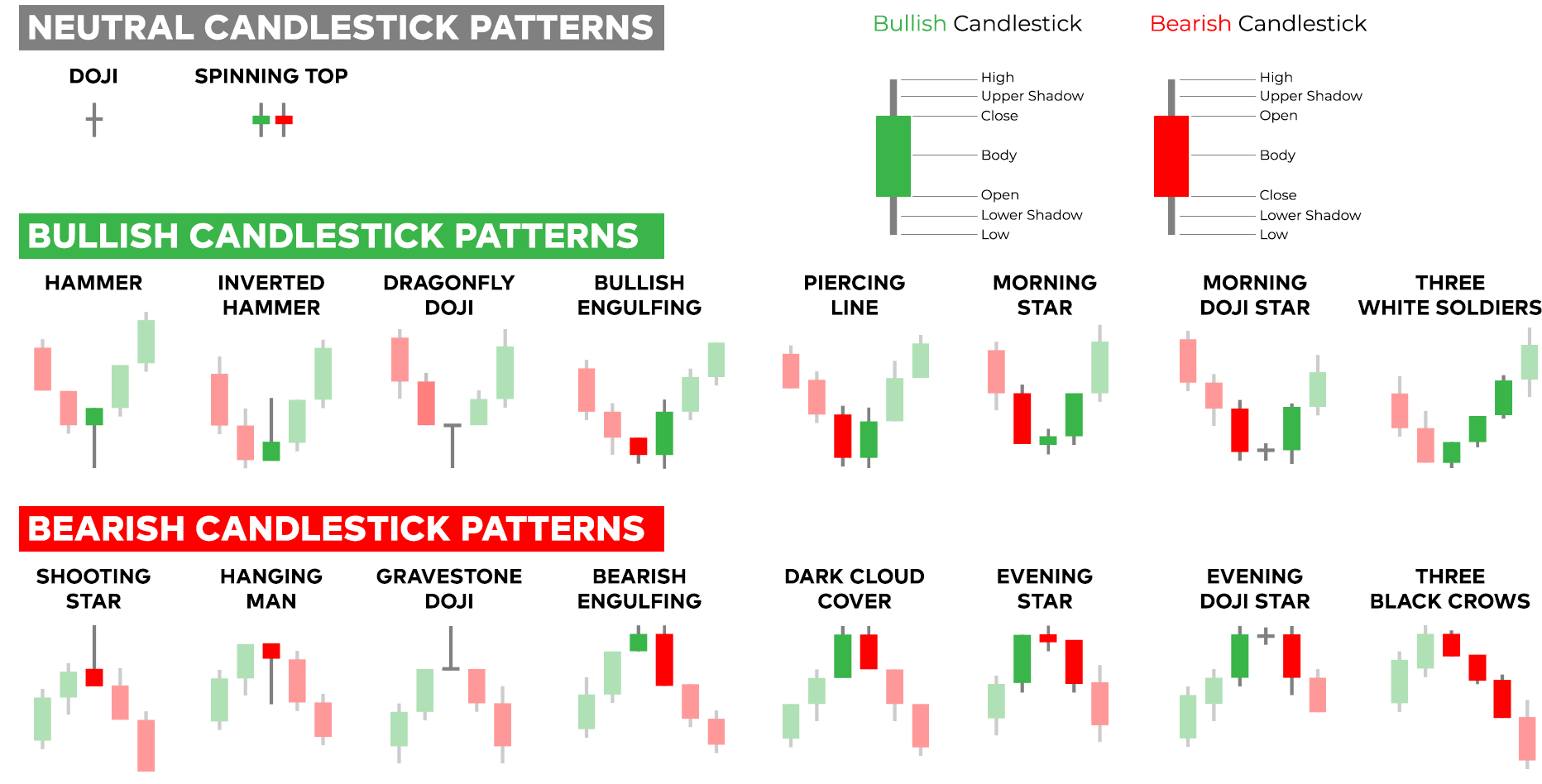

Candlesticks, although unassuming in their appearance, are graphical representations of price evolution within a specific timeframe. Typically divided into body and wick or shadow, they capture four key aspects: open, high, low, and close. This elegant simplicity conceals a wealth of trading possibilities, allowing astute traders to measure market sentiment and discern potential market moves.

Embarking on the Candlestick Odyssey

- Hammer: A bullish reversal pattern, characterized by a small upper body with a prominent lower wick, signaling sellers surrendering to buyers.

- Inverted Hammer: The bearish counterpart of the hammer, with a small lower body and an extended upper wick, indicating a potential downtrend.

- Shooting Star: A bearish reversal pattern, shaped like an inverted hammer but with a long lower wick and a small or nonexistent upper body, suggesting a potential collapse in price.

- Bullish/Bearish Engulfing: Both engulfing patterns possess a body that completely “engulfs” the prior candle’s body, signaling a potential trend reversal. In a bullish engulf, the green candle envelops the preceding red candle, while a bearish engulf features a red candle engulfing a green candle.

- Piercing Line: A bullish reversal pattern, resembling an elongated inverted hammer, comprising a long bottom wick and a candle body that closes within the prior candle’s upper half, signaling a potential reversal.

- Dark Cloud Cover: A bearish reversal pattern, opposite of the piercing line, featuring a red candle with a long upper wick that opens within the prior candle’s upper half and closes within its lower half, suggesting a potential downtrend.

Trading Strategies Fueled by Candlesticks: A Formula for Informed Decisions

Combining multiple candlestick patterns strengthens trading strategies, enhancing risk management, trade timing, and profit potential.

- Seeking Confirmation: A bullish or bearish reversal pattern has a greater likelihood of authenticity when additional candles offer confirmation. This reinforcement signifies a higher probability of success and reduces the chances of false signals.

- Trading with Trend: Candlestick patterns that align with the overall market trend have a better success rate. Rid the mindset of counter-trend trading and capitalize on patterns that harmonize with the trend’s direction.

- Support and Resistance: Candlestick patterns become even more potent when appearing at significant support or resistance levels. These levels act as psychological barriers, making patterns at these points incredibly valuable.

Remember, the art of candlestick trading lies not solely in memorizing patterns but in comprehending and interpreting them in relation to the bigger picture, considering factors like market context, volume, and support/resistance.

Extracting Maximum Insights: A Bird’s-Eye View of Candlestick Trading

Candlestick familiarity unlocks a universe of practical applications:

- Identify Potential Market Tops and Bottoms: Candlestick patterns, particularly reversal patterns, serve as early warning signals, enabling traders to anticipate potential price tops and bottoms.

- Determine Entry and Exit Points: Candlestick patterns can also indicate opportune entry and exit points, reducing uncertainties and optimizing trade execution.

- Gauge Market Momentum: A series of similar patterns often reflects persistent market momentum, supporting the adage “the trend is your friend.”

- Risk Mitigation: Candlesticks aid in defining stop-loss levels by recognizing reversal patterns that can swiftly reverse the trend, preserving capital.

Conclusion: Embracing the Power of Candlestick Mastery

Trading options effectively requires a holistic approach, and candlestick expertise is an invaluable tool. Through meticulous study and application, the intricate world of candlesticks transforms from a foreign language to a second financial tongue, empowering traders to make informed decisions, mitigate risks, and seize profit opportunities in the dynamic options trading world. May this guide serve as a compass in your trading voyage, leading you to a symphony of profitable adventures.

Image: www.pinterest.ch

How To Read Candlesticks For Options Trading

https://youtube.com/watch?v=OEeCk0vgGx0