A Comprehensive Overview

Are you an active investor looking to delve into the world of options trading? If so, understanding the nuances of a particular stock’s trading history is crucial. In this article, we will explore the specific timeline of when options trading commenced for the stock symbol APRN, also known as Blue Apron Holdings, Inc.

Image: www.hotzxgirl.com

Blue Apron is a publicly traded company operating in the meal-kit industry. Its stock, denoted by the symbol APRN, has been a subject of interest for both retail and institutional investors. Therefore, knowing when options trading became available for APRN can provide valuable insights for informed decision-making.

Initial Public Offering (IPO) and Stock Listing

Blue Apron conducted its IPO on June 29, 2017, offering shares at $10 each. The company’s stock began trading on the New York Stock Exchange (NYSE) under the ticker symbol APRN.

Commencement of Options Trading

The precise date for the commencement of options trading on APRN shares is August 18, 2017. This marked the official availability of options contracts for the stock, allowing investors to engage in options trading strategies.

The Evolution of APRN Options Trading

Since its inception, the options market for APRN has witnessed notable growth and developments. The availability of options has provided investors with additional avenues to manage risk, speculate on potential price movements, and generate income.

The options trading ecosystem for APRN encompasses a wide range of options contracts with varying expiration dates and strike prices. This allows investors to tailor their trading strategies based on their individual risk tolerance, investment horizon, and market outlook.

Image: www.facebook.com

Latest Trends and Developments

The APRN options market remains dynamic and responsive to market conditions. Recent trends have included:

- Increased trading volume and open interest

- Expansion of options offerings, including the introduction of weekly options

- Growing interest from institutional investors

These developments underscore the continued evolution and maturity of the APRN options market, attracting a diverse range of participants.

Tips and Expert Advice for Options Trading

Navigating the options market requires a blend of knowledge, experience, and strategic decision-making. Here are some tips for effective options trading:

- Educate Yourself: Understand the nuances of options trading, including contract types, pricing, and risk management.

- Choose Suitable Strategies: Identify options strategies that align with your investment goals, risk tolerance, and market outlook.

- Manage Risk: Utilize tools like stop-loss orders and position sizing to mitigate losses and protect your capital.

Consult with reputable brokers or financial advisors for personalized guidance and tailored recommendations based on your specific circumstances.

FAQs on APRN Options Trading

Q: What is the underlying asset for APRN options?

A: The underlying asset for APRN options is the common stock of Blue Apron Holdings, Inc.

Q: What is the minimum premium to trade APRN options?

A: The minimum premium required to trade APRN options varies depending on market conditions and contract specifications.

Q: Is there an options chain for APRN?

A: Yes, there is an options chain available for APRN, providing a range of contracts with different expiration dates and strike prices.

Whan Did They Start Trading Options Onthe Stock Symbol Aprn

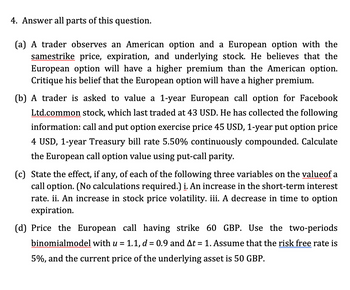

Image: www.bartleby.com

Conclusion

The commencement of options trading on August 18, 2017, marked a significant milestone in the trading history of the stock symbol APRN. The ensuing years have witnessed the growth and evolution of the APRN options market, offering investors diverse opportunities to enhance their trading strategies.

Are you interested in learning more about APRN options trading or other investment topics? Stay connected for insightful articles, expert perspectives, and market updates that can assist you in making informed decisions and navigating the financial markets effectively.