Image: epsilonoptions.com

Introduction:

In the vast financial arena, options trading stands out as a dynamic and potentially lucrative endeavor. Whether you’re an experienced investor or just starting your journey, delving into the world of options can empower you to enhance your investment strategy and navigate market fluctuations with greater finesse. From seasoned traders to financial enthusiasts, unlocking the intricacies of options trading can open up a realm of opportunities for financial growth.

Demystifying Options: Understanding the Basics

Options, in the simplest terms, are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price, known as the strike price, within a specified time frame. Understanding this core concept is the foundation of options trading, empowering you to harness the power of market predictions and potentially profit from market movements.

Exploring the Trading Landscape: Markets and Instruments

The world of options trading encompasses a diverse array of markets, each boasting its own unique characteristics and opportunities. Equity options, for instance, provide the flexibility to speculate on the price movements of individual stocks, while index options offer a broader market exposure by tracking the performance of market indices, such as the S&P 500 or Nasdaq 100. Moreover, options trading extends beyond stocks and indices, venturing into the realms of currencies, commodities, and bonds, catering to traders with varying risk appetites and investment goals.

Options Strategies: Unveiling a Spectrum of Possibilities

The versatility of options extends beyond the basic call and put options, giving rise to a multitude of trading strategies tailored to diverse market scenarios and investor preferences. Covered calls, for instance, involve selling a call option while owning the underlying asset, potentially generating income through premium payments while limiting potential downside risk. Iron condors, on the other hand, combine multiple put and call options to create a defined risk and reward profile, appealing to traders seeking a more balanced approach. The strategic application of these options strategies empowers traders to navigate market uncertainties and optimize their returns.

The Anatomy of an Options Contract: Key Components

Striking the right options contract involves understanding its fundamental components. The underlying asset, as mentioned earlier, forms the core of an options contract, representing the security or index that is being traded. The strike price, as we know, determines the specific price at which the underlying asset can be bought or sold. The expiration date sets the time frame within which the options contract remains active, dictating the timeframe within which a trader can exercise their right to buy or sell the underlying asset at the strike price.

Assessing Risk and Reward: Navigating the Spectrum

Options trading, by its very nature, encapsulates both significant potential rewards and inherent risks. To succeed in this dynamic arena, a thorough understanding of the risks and rewards associated with each trade is essential. The potential profit from options trading is capped at the premium paid for the option, while the potential loss can extend to the entire investment.

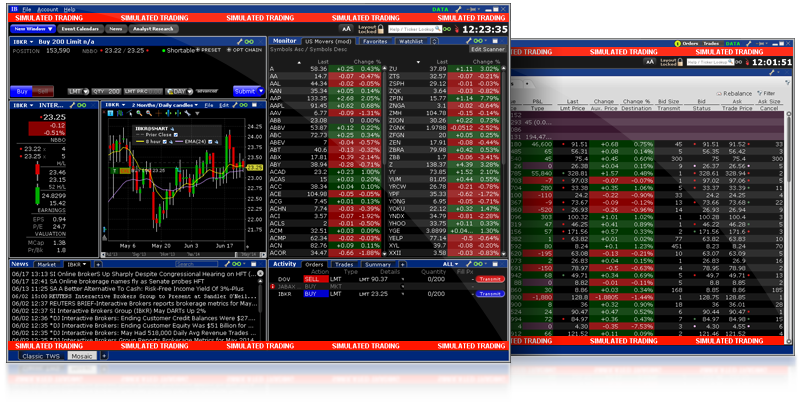

Trading Platforms and Tools: Embracing Technology

Navigating the intricacies of options trading requires the judicious utilization of trading platforms and tools designed to facilitate efficient order execution, real-time market monitoring, and in-depth analysis. These platforms provide a comprehensive suite of features, ranging from intuitive charting tools to advanced order types, empowering traders to make informed decisions and execute their strategies with precision.

Risk Management: Mitigating Volatility

Options trading, while potentially rewarding, is not without its risks. Volatility, the measure of price fluctuations in the underlying asset, plays a critical role in options trading. Understanding how volatility affects option prices and employing appropriate risk management strategies, such as stop-loss orders and position sizing techniques, is crucial to mitigating potential losses and protecting your investment capital.

Educational Resources: Empowering Knowledge

In the quest to master options trading, continuous learning and development are paramount. A plethora of educational resources, both online and offline, exist to enhance your knowledge and understanding of this complex financial instrument. Books, articles, webinars, and specialized courses provide invaluable insights into options strategies, risk management, and market trends, equipping you with the knowledge and skills to trade confidently and effectively.

Conclusion:

Embarking on your options trading journey may seem daunting, but with dedication, perseverance, and an unwavering commitment to education, you can unlock the vast potential that this dynamic financial instrument holds. Whether you’re seeking to enhance your investment returns, hedge against market downturns, or simply explore new trading opportunities, understanding how to learn trading options is the first step towards achieving your financial goals.

Image: www.youtube.com

How To Learn Trading Options