Introduction

Option trading can be a lucrative endeavor, but it’s crucial to have a comprehensive understanding of the market to succeed. One key element in making informed trading decisions is identifying trends. Trends provide insights into market direction and can signal potential profit opportunities. In this article, we will explore how to find trends in option trading, leveraging various technical analysis tools and market indicators.

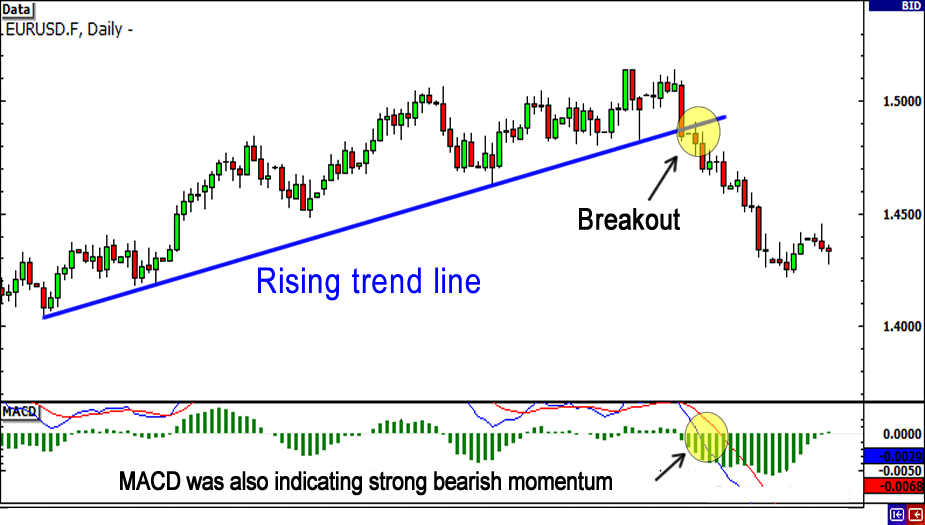

Image: www.blogforex.org

Identifying Trends through Technical Analysis

Technical analysis involves studying historical price patterns to identify potential market trends. There are numerous technical indicators that can aid in this process:

- Moving averages: Calculate the average price of a stock or option over a specific period, smoothing out price fluctuations and identifying underlying trends.

- Trendlines: Connect two or more price points on a chart to form a line that represents the price’s general direction.

- Relative Strength Index (RSI): Measures an asset’s price momentum, indicating when it is overbought or oversold.

- Bollinger Bands: Create bands around a moving average, providing insights into price volatility and potential trend reversals.

Understanding Market Indicators

Market indicators provide a broader view of market conditions and can help identify larger trends. These include:

- Economic indicators: GDP, unemployment rate, and consumer confidence data provide insights into economic health and its potential impact on markets.

- News: Major news events and company announcements can cause significant market reactions, influencing trends.

- Seasonality: Demand and supply patterns can vary throughout the year, creating predictable price swings.

Identifying Trends with Candlesticks

Candlestick charts are a visual representation of price movement that provides insights into market psychology. Each candlestick represents a specific price range over a given period. The colors of the candlesticks (green or red) indicate whether the closing price is higher or lower than the opening price.

- Bullish engulfing: A green candlestick that completely engulfs a previous red candlestick, indicating a potential trend reversal to the upside.

- Bearish engulfing: A red candlestick that completely engulfs a previous green candlestick, signaling a potential trend reversal to the downside.

- Hammer: A candlestick with a long lower shadow and a small body near the high, potentially indicating a trend reversal to the upside.

- Shooting star: A candlestick with a long upper shadow and a small body near the low, potentially signaling a trend reversal to the downside.

Image: www.pinterest.fr

Tips and Expert Advice

- Avoid Trading Against the Trend: Trade in the direction of the identified trend to increase your chances of success.

- Confirm Trends with Multiple Indicators: Use a combination of technical analysis and market indicators to confirm trends and reduce false signals.

- Consider Time Frames: Analyze trends on different time frames to identify short-term and long-term trading opportunities.

- Manage Risk: Implement stop-loss orders to limit potential losses if the market moves against you.

- Stay Informed: Regularly monitor economic news, company announcements, and market sentiment to stay abreast of potential trend influencers.

Frequently Asked Questions

-

Q: What is the most effective technical indicator for trend identification?

A: There is no single best indicator. Combining multiple indicators provides more reliable results. -

Q: How can I identify a trend without using charts?

A: Monitor market news, economic data, and follow reputable market analysts and traders on social media. -

Q: How long should I hold a trade based on a trend?

A: Hold positions as long as the trend remains intact. Exit the trade when trend indicators signal a reversal.

How To Find Trend In Option Trading

https://youtube.com/watch?v=rylvC1J1FgQ

Conclusion

Identifying trends in option trading is essential for informed decision-making. By leveraging technical analysis, market indicators, and candlestick charts, traders can gain insights into market direction and capitalize on potential profit opportunities. Combining multiple tools and adhering to expert advice can help traders increase their success rate and navigate the dynamic world of option trading effectively.

So, are you ready to embark on your journey to identify trends and unlock the secrets of profitable option trading?