The Importance of Charting for Option Trading

Charting is an essential tool for option traders as it helps them visualize the past movement of an underlying asset and make informed trading decisions. By analyzing charts, traders can identify trends, patterns, and potential trading levels, giving them an edge in the highly volatile world of options trading. However, with numerous chart types available, choosing the right one can be overwhelming. In this article, we will delve into the various types of charts and explore which ones are most suitable for option trading.

Image: johnhart.z13.web.core.windows.net

Types of Trading Charts

There are primarily three main types of trading charts:

- Line Charts: Represent the closing price of an asset over time, connecting the data points with a single line. They provide a clear overview of the asset’s price action and overall trend but lack detailed information about price fluctuations.

- Bar Charts: Similar to line charts, bar charts show the closing price but also display additional information such as the open, high, and low prices for each period. This detailed view makes them suitable for identifying support and resistance levels.

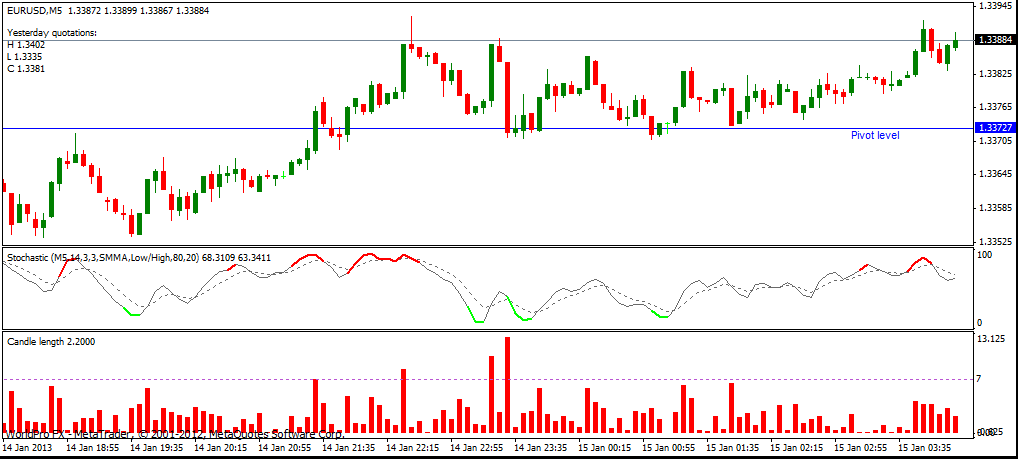

- Candlestick Charts: A combination of line and bar charts, candlestick charts provide extensive visual information. They depict the open, close, high, and low prices with a rectangle (“real body”) and “shadows” (lines) extending above and below. Candlesticks are widely popular among option traders due to their ability to convey complex price movements.

While each chart type has its advantages, candlesticks are the preferred choice for option trading due to their comprehensive visual representation. They provide insights into price behavior, momentum, and trading patterns, making them ideal for identifying potential trading opportunities.

Choosing the Right Chart for Option Trading

The choice between different candlestick chart types also plays a crucial role in option trading. There are many variations of candlestick charts, including Japanese candlesticks, Heikin-Ashi charts, and Kagi charts. Each type has its own characteristics and suits different trading styles.

For scalpers and intraday traders, who make rapid trades based on short-term price movements, Japanese candlesticks are the ideal choice. They provide rapid visual cues and allow traders to quickly identify potential reversal or continuation patterns.

Swing traders who hold positions for a few days to weeks may prefer Heikin-Ashi charts. Heikin-Ashi candlesticks are designed to filter out market noise and create smoother price patterns, making it easier to spot trends.

Kagi charts are suitable for long-term trend followers. They use a unique methodology that combines price and time to identify major market reversals and continuation patterns, making them ideal for longer-term trading strategies.

Image: reportd224.web.fc2.com

For Option Trading Which Chart Is Best

Conclusion

Selecting the right chart for option trading depends on the trader’s experience, trading style, and time horizon. While candlestick charts are generally preferred, the variations within this chart type offer specific advantages tailored to different trading approaches. By understanding the strengths and limitations of each chart type, option traders can optimize their technical analysis and enhance their decision-making process, increasing their chances of success in the dynamic world of options trading.

Would you like to learn more about the best charts for option trading?