Have you ever wondered about the intricate dance of risk and reward that unfolds in the world of financial markets? Imagine a world where your ability to predict future price movements could translate into potentially significant profits. This, in essence, is the allure of options trading – a strategy that offers the potential for amplified returns, but also carries the risk of substantial losses. While the potential rewards are enticing, the complexity of options trading can seem daunting, especially for those unfamiliar with its intricacies. But fear not! This is where options trading classes come to the rescue, providing a structured and informative path to mastering the art of trading options.

Image: wirafiy.web.fc2.com

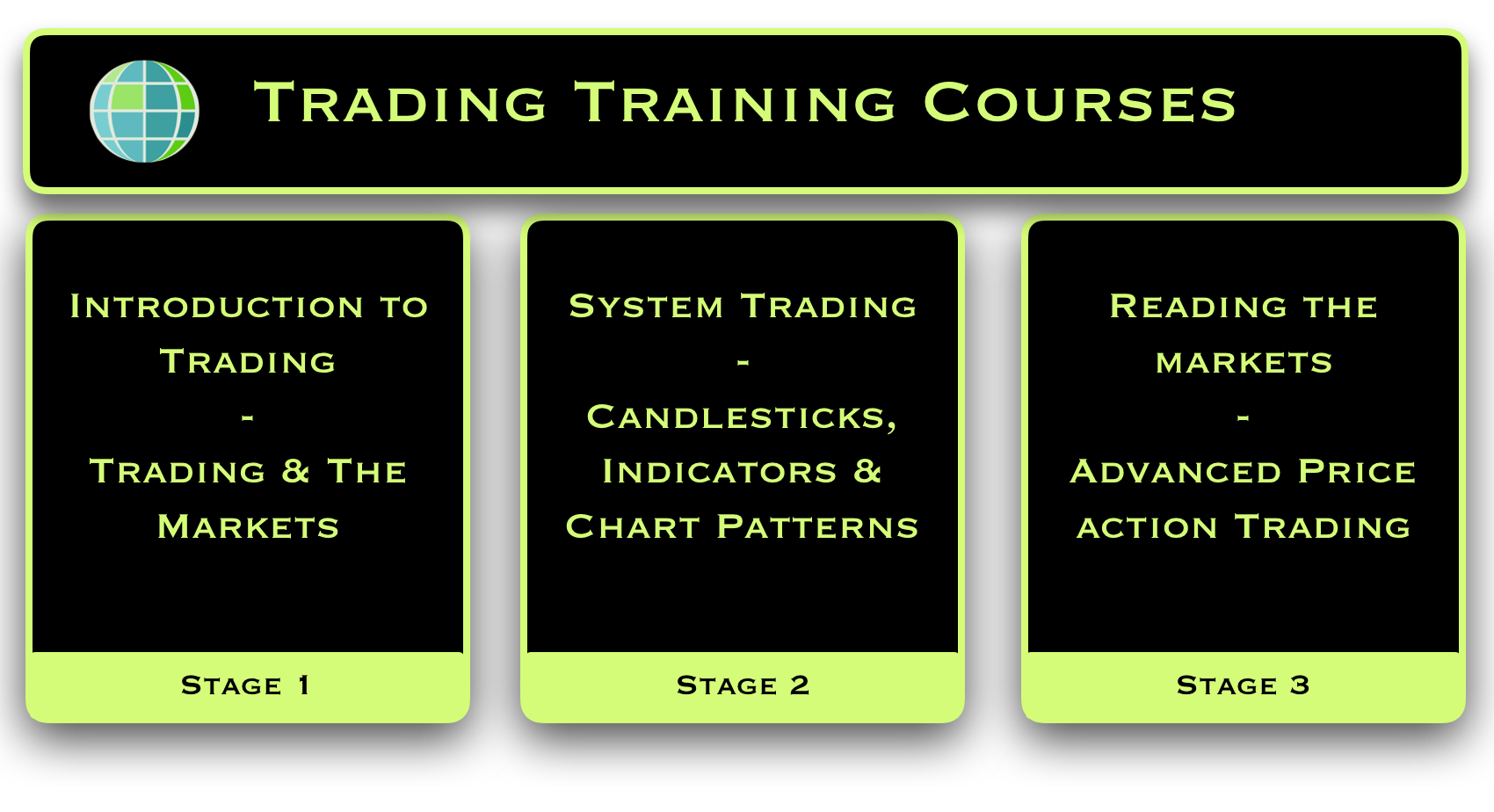

Options trading classes serve as a gateway to a world of possibilities, enabling aspiring traders to understand the mechanics of options contracts, analyze market dynamics, and develop effective trading strategies. These classes are designed to equip individuals with the knowledge and skills necessary to navigate the complexities of options trading, empowering them to make informed decisions and maximize their potential returns. Whether you’re a seasoned investor looking to expand your portfolio or a curious newcomer seeking to unlock the secrets of options trading, these classes offer a valuable platform to enhance your financial acumen.

Fundamentals of Options Trading

Before embarking on the journey of options trading, it’s crucial to understand the foundational concepts that underpin this intricate strategy. Options trading revolves around **contracts** that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the **strike price**) within a specific timeframe (the **expiration date**). These contracts are classified into two primary types:

Calls and Puts

- **Calls:** A call option gives the buyer the right to buy the underlying asset at the strike price. This strategy is typically employed by those who anticipate an increase in the price of the underlying asset.

- **Puts:** A put option grants the buyer the right to sell the underlying asset at the strike price. This strategy is generally favored by traders who believe the price of the underlying asset will decline.

Understanding the basics of calls and puts is fundamental to grasping the mechanics of options trading. Each type offers unique opportunities and risks, and it’s essential to select the appropriate strategy based on your market outlook and risk tolerance.

Understanding the Lingo: Key Terms in Options Trading

Navigating the world of options trading involves familiarizing yourself with a specialized vocabulary. Here’s a breakdown of some key terms that will empower you to understand the language of the options market:

- **Premium:** The premium is the price paid by the buyer of an options contract. It represents the value assigned to the right (but not the obligation) to buy or sell the underlying asset at the strike price.

- **Strike Price:** The strike price is the predefined price at which the underlying asset can be bought or sold within the options contract.

- **Expiration Date:** This is the specified date when the options contract expires. At expiration, the option buyer must decide whether to exercise their right or let the contract expire worthless.

- **In-the-Money (ITM):** An option is in-the-money (ITM) when the underlying asset’s price is higher than the strike price for a call option or lower than the strike price for a put option. In other words, the option has intrinsic value.

- **Out-of-the-Money (OTM):** An option is out-of-the-money (OTM) when the underlying asset’s price is lower than the strike price for a call option or higher than the strike price for a put option. In this case, the option is unlikely to be exercised and has little or no intrinsic value.

- **At-the-Money (ATM):** An option is at-the-money when the underlying asset’s price is equal to the strike price.

Familiarizing yourself with these key terms is essential for comprehending the discussions, analyses, and strategies presented in options trading classes.

Image: excellenceassured.com

Benefits of Taking Options Trading Classes

Options trading presents a world of potential and opportunity, but it also involves inherent risks. Investing in options trading classes can be a wise decision for several reasons:

- **Structured Learning:** Options trading classes provide a structured and systematic approach to learning. They offer a comprehensive overview of options trading concepts, strategies, and market dynamics. This structured format helps you absorb and retain information effectively.

- **Experienced Instructors:** Classes are typically led by experienced professionals with deep knowledge of options trading. These instructors can help you grasp the intricacies of the market, providing valuable insights and guidance.

- **Practical Applications:** Many options trading classes incorporate practical exercises and simulations to reinforce theoretical concepts. These real-world scenarios allow you to apply your knowledge and develop your trading skills.

- **Personalized Feedback:** Some classes offer opportunities for feedback and guidance from instructors. This personalized feedback can help you identify your strengths and weaknesses as a trader.

- **Networking Opportunities:** Classes can create a platform for connecting with fellow traders. This network can provide valuable insights, shared experiences, and support as you navigate the world of options trading.

By investing in options trading classes, you can gain a significant advantage in understanding the intricacies of this complex strategy, minimizing potential risks, and maximizing your potential returns.

Types of Options Trading Classes

Options trading classes come in a variety of formats, catering to different learning styles and experience levels. Here are some common types of options trading classes:

- **Online Courses:** These courses offer flexibility and convenience, allowing you to learn at your own pace and on your own schedule. Many online options trading courses feature videos, interactive exercises, and downloadable materials.

- **In-Person Workshops:** These workshops provide a more immersive learning experience with direct interaction with instructors and fellow students. They offer opportunities for hands-on learning and interactive discussions.

- **Boot Camps:** Intensive bootcamps provide a rapid and concentrated learning experience, often spanning over several days or weeks. They cater to individuals seeking to quickly develop their options trading skills.

- **Mentorship Programs:** Mentorship programs pair aspiring traders with experienced professionals who provide personalized guidance, support, and feedback.

The best type of options trading class for you will depend on your individual learning preferences, time constraints, and budget. It’s essential to research and compare different courses before making a decision.

Choosing the Right Options Trading Class

Selecting the right options trading class is crucial for maximizing your learning experience and maximizing returns. Consider the following factors when choosing a class:

- **Experience Level:** Ensure the class aligns with your experience level. Beginner-friendly classes offer a foundational understanding, while advanced courses delve into more complex strategies and techniques.

- **Course Curriculum:** Review the course curriculum to ensure it covers the topics you need to learn. Look for classes that address risk management, trading strategies, market analysis, and real-world applications.

- **Instructor Experience:** Verify the credentials and experience of the instructor. Experienced traders with proven track records can provide valuable insights and guidance.

- **Student Reviews:** Check online reviews and testimonials from previous students to gauge the quality of the course and instructor.

- **Cost and Value:** Compare the cost of different options trading classes and ensure the value proposition aligns with your budget and expected ROI.

By carefully evaluating these factors, you can select an options trading class that meets your needs and helps you reach your financial goals.

Key Skills to Master in Options Trading

Options trading requires a multifaceted skillset that encompasses both technical and analytical abilities. Here are some critical skills to master:

- **Risk Management:** Controlling risk is paramount in options trading. Learning to effectively manage risk helps protect your capital and sustain your trading journey.

- **Market Analysis:** Understanding market trends and drivers is crucial for making informed trading decisions. Develop your ability to analyze market data and identify potential opportunities.

- **Trading Strategy Development:** Cultivate the ability to craft and execute effective options trading strategies based on your market outlook, risk tolerance, and financial goals.

- **Trading Psychology:** Options trading can be emotionally challenging. Develop strong trading psychology to make rational decisions under pressure and avoid impulsive actions.

- **Order Execution:** Becoming proficient in executing orders effectively and efficiently is crucial. Familiarize yourself with different order types and platforms.

Options trading classes provide a structured platform to develop and refine these essential skills, equipping you to confidently navigate the world of options trading.

A Journey of Continuous Learning

The world of options trading is dynamic, with new strategies, tools, and market trends continually emerging. It’s critical to adopt a mindset of continuous learning to stay ahead of the curve. After completing an initial options trading course, consider these strategies for ongoing growth:

- **Attend Webinars and Conferences:** Participate in industry events to gain insights from seasoned traders, learn about cutting-edge strategies, and stay informed about market trends.

- **Read Industry Publications:** Stay updated with the latest market analyses, financial news, and options trading techniques by subscribing to reputable publications and blogs.

- **Join Online Forums and Communities:** Connect with other traders, share insights, and participate in discussions to gain different perspectives and expand your network.

- **Practice and Experiment:** Continuously practice trading strategies using simulated accounts or small real-world investments. Experiment with different approaches to fine-tune your strategies and identify what works best for you.

Options trading classes serve as the foundation for your journey. By embracing continuous learning, you can cultivate the necessary skills and knowledge to succeed in this dynamic and rewarding field.

Classes On Options Trading

Conclusion

Mastering the art of options trading requires dedication, knowledge, and practice. Options trading classes provide a valuable platform to gain a comprehensive understanding of options trading concepts, strategies, and market dynamics. By investing in your education and embracing continuous learning, you can unlock the potential of options trading and enhance your financial journey. Remember, there is no magic formula for success in the financial markets. But by equipping yourself with the right knowledge and skills, you can navigate the world of options trading with greater confidence and maximize your potential for success.