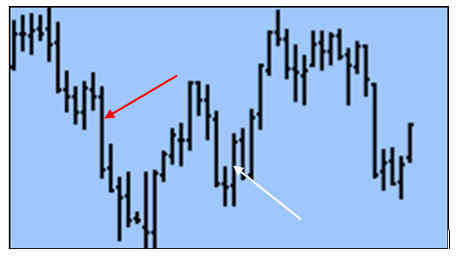

In the realm of financial markets, where time is of paramount importance and opportunities fleeting, traders often seek ways to amplify their returns and offset risk. Enter FD options trading – a high-octane strategy that utilizes short-term options contracts to capitalize on rapid price movements. FD stands for “fixed date,” signifying the predetermined expiration date of these contracts, typically within a month or even a week. This article serves as a comprehensive guide to FD options trading, demystifying its nuances and empowering you with valuable insights.

Image: tradingeducators.com

Understanding the Fundamentals of FD Options Trading

FD options trading involves purchasing or selling financial options that have an expiration date in the near future, often a matter of days or weeks. These contracts grant the holder the right, not the obligation, to buy or sell an underlying asset, such as a stock or ETF, at a predetermined price known as the strike price. The trader has the flexibility to exercise this right anytime before the expiration date. However, the value of the option contract will fluctuate based on factors such as the underlying asset’s price, time decay, and volatility.

Matching Strategy to Market Conditions

The allure of FD options trading lies in the potential for outsized returns, attributed to the high sensitivity of these contracts to market movements. This strategy thrives in volatile markets, where prices fluctuate swiftly, as the rapid price changes can lead to substantial gains for well-timed trades. For instance, if you anticipate a significant upward move in a stock, you could purchase a call option with a strike price slightly above the current market price. If the stock price surges, your call option’s value will skyrocket, presenting an opportunity to sell it for a handsome profit.

Deciphering the Intrinsic Value of FD Options

Calculating the intrinsic value of an FD option is crucial for prudent trading decisions. Intrinsic value represents the profit potential of the option if exercised immediately. It is determined by taking the difference between the underlying asset’s current market price and the strike price, considering the option type (call or put). If the intrinsic value is positive, it indicates the option is currently in the money, meaning it would be profitable to exercise it. Conversely, if the intrinsic value is negative, the option is out of the money, carrying no immediate profit potential.

Image: www.contracts-for-difference.com

Unveiling the Subtle Nuances of Greeks

In the world of FD options trading, mastering the concept of Greeks is paramount. These are variables that quantify the different factors influencing option prices. Among the most crucial Greeks are delta, gamma, theta, and vega, each capturing a distinct aspect of an option’s risk profile and potential movements. Delta measures an option’s sensitivity to underlying price changes, while gamma gauges its rate of delta change. Theta represents the value decay of an option as it approaches expiration, and vega quantifies its sensitivity to volatility. Understanding these Greeks enables traders to fine-tune their strategies and make informed decisions.

Mitigating Risks through Strategic Hedging

Risk management is an integral part of FD options trading, as these strategies can amplify both profits and losses. Hedging techniques play a vital role in mitigating potential risks and enhancing overall return profiles. Popular hedging strategies include delta-neutral trading, which involves pairing multiple options with different strikes and expiration dates to minimize exposure to price volatility. Implementing these strategies helps traders manage risk while capturing upside potential.

Fd Options Trading

https://youtube.com/watch?v=FD1PwCDHUGU

Exploring the Allure and Pitfalls of FD Options Trading

FD options trading presents both enticing opportunities and formidable challenges for traders. The potential for substantial returns, especially in volatile markets, attracts many. However, inherent risks should not be overlooked. The rapid price movements that fuel gains can also lead to swift losses if the trade moves against you. Additionally, the time decay factor can erode option values rapidly, especially as expiration approaches