Frontpage option trading is a powerful strategy that allows investors to gain exposure to the underlying asset without having to purchase the asset itself. This can be a cost-effective way to trade the markets, and it gives investors the ability to hedge their positions or speculate on the movement of the underlying asset.

Image: www.stockbrokers.com

In this blog post, we will provide a comprehensive overview of frontpage option trading. We will discuss the basics of option trading, the different types of options, and the strategies that you can use to trade options effectively. We will also provide tips and expert advice to help you get started with option trading.

Understanding Option Trading

An option is a contract that gives the buyer of the option the right, but not the obligation, to buy or sell the underlying asset at a specified price on or before a specified date. The buyer of the option pays a premium to the seller of the option for this right. The value of an option is determined by several factors, including the price of the underlying asset, the time value of the option, and the volatility of the underlying asset.

There are two types of options: calls and puts. A call option gives the buyer the right to buy the underlying asset at a specified price. A put option gives the buyer the right to sell the underlying asset at a specified price.

Types of Options

There are many different types of options available, each with its own unique characteristics and uses.

Call Options

- American-style call options can be exercised at any time before the expiration date.

- European-style call options can only be exercised on the expiration date.

Image: www.youtube.com

Put Options

- American-style put options can be exercised at any time before the expiration date.

- European-style put options can only be exercised on the expiration date.

Other Types of Options

- Covered calls are a type of option strategy that involves selling a call option against the stock that you own.

- Protective puts are a type of option strategy that involves buying a put option against the stock that you own.

Strategies for Option Trading

There are many different strategies that you can use to trade options effectively. The strategy that you choose will depend on your individual investment goals and risk tolerance.

Conservative Option Trading Strategies

- Buying a call option is a conservative option trading strategy that allows you to profit if the price of the underlying asset increases.

- Selling a put option is a conservative option trading strategy that allows you to profit if the price of the underlying asset decreases.

- Buying a covered call is a conservative option trading strategy that allows you to generate income on the stock that you own.

- Buying a protective put is a conservative option trading strategy that allows you to protect your stock from downside risk.

Aggressive Option Trading Strategies

- Selling a call option is an aggressive option trading strategy that allows you to generate income if the price of the underlying asset decreases.

- Selling a put option is an aggressive option trading strategy that allows you to generate income if the price of the underlying asset increases.

- Buying a call option at the frontpage is an aggressive option trading strategy that allows you to gain exposure to the underlying asset without having to purchase the asset itself.

- Selling a put option at the frontpage is an aggressive option trading strategy that allows you to generate income if the price of the underlying asset decreases.

Tips and Expert Advice for Option Trading

Here are some tips and expert advice to help you get started with option trading:

1. **Do your research.** Before you start trading options, it is important to do your research and learn about the different types of options, the different strategies that you can use, and the risks involved.

2. **Start small.** When you first start trading options, it is important to start small. This will help you to minimize your risk and get a feel for the market before you start trading larger positions.

3. **Use a stop-loss order.** A stop-loss order is an order that is placed with your broker to sell your option if it falls below a certain price. This will help you to limit your losses if the market moves against you.

4. **Don’t be afraid to ask for help.** If you are not sure how to trade options or if you have any questions during trading, don’t be afraid to ask for help from your broker or a financial advisor.

FAQs on Frontpage Option Trading

Here are some frequently asked questions about frontpage option trading:

- What is frontpage option trading? Frontpage option trading is a strategy that involves trading options that are at the frontpage of the option chain. These options have the shortest time to expiration and the highest implied volatility.

- Why is frontpage option trading risky? Frontpage options are risky because they have a high implied volatility. This means that the price of the option can move quickly, and you could lose your entire investment if the market moves against you.

- What are the benefits of frontpage option trading? Frontpage options can offer a number of benefits, such as the potential for high returns, the ability to hedge your positions, and the opportunity to speculate on the movement of the underlying asset.

- How can I get started with frontpage option trading? If you are interested in getting started with frontpage option trading, it is important to do your research and learn about the different risks involved. You should also start small and use a stop-loss order to protect your losses.

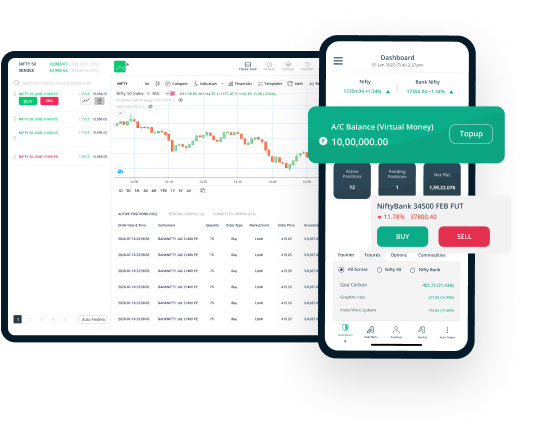

Frontpage Option Trading

Image: neostox.com

Conclusion

Frontpage option trading is a powerful strategy that can be used to generate income, hedge your positions, and speculate on the movement of the underlying asset. However, it is important to understand the risks involved before you start trading options.

If you are interested in learning more about frontpage option trading, I encourage you to do some research and talk to your broker or a financial advisor.