Introduction

For years, Vanguard has been synonymous with low-cost index funds and ETFs, catering to the savvy investor seeking long-term growth. But did you know that the investment giant also offers a robust options trading platform? I, for one, was surprised, as I always associated Vanguard with passive investing strategies. But as I delved deeper, I realised the potential of Vanguard options trading could benefit a wide range of investors, from experienced traders seeking to enhance returns to beginners looking to explore the options market.

Image: tradingplatforms.com

This article will guide you through the world of Vanguard options trading, unravelling its intricacies and exploring its potential benefits. We’ll provide insights into its features, advantages, and considerations, helping you determine if it’s the right fit for your investment goals.

Vanguard Options Trading: A Detailed Exploration

Vanguard options trading allows you to buy and sell options contracts on a range of underlying assets, including stocks, ETFs, and index funds. These contracts offer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specific date. Options trading can be a powerful tool for investors, providing opportunities to leverage their investments, manage risk, and generate income.

Understanding Vanguard’s Options Trading Platform

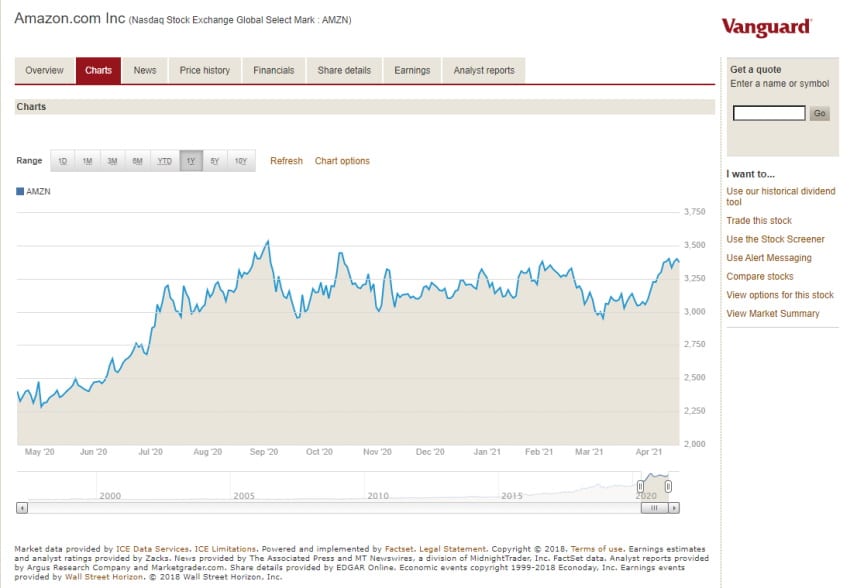

Vanguard’s options trading platform offers a user-friendly interface, making navigating the complex world of options more accessible. You can easily track your trades, manage your positions, and explore a wide variety of options strategies. The platform also boasts access to real-time market data, research tools, and educational resources, empowering you to make informed decisions.

Key Features of Vanguard Options Trading

- Wide range of options contracts: Vanguard offers options on a broad selection of stocks, ETFs, and index funds, allowing you to find the right instruments for your investment strategy.

- Low commission fees: Vanguard’s commitment to low costs extends to options trading, offering competitive commission rates, making it an attractive option for budget-conscious traders.

- Powerful trading tools: The platform provides real-time market data, charting tools, and research resources to support your trading decisions.

- Educational resources: Vanguard offers extensive educational resources, including articles, videos, and webinars, to guide you through the intricacies of options trading.

- Dedicated support: Vanguard’s customer support team is available to assist you with any questions or concerns you may have regarding options trading.

Image: www.youngresearch.com

Benefits of Options Trading with Vanguard

There are several advantages to utilising options trading through Vanguard:

- Leverage: Options trading allows you to control a larger position in an underlying asset with a relatively smaller investment. This can amplify potential gains but also magnify losses.

- Risk management: Options contracts can be used for hedging against potential losses on your existing investments. For example, a put option provides insurance against a decline in the value of your shares.

- Income generation: You can earn income from selling options or through strategies such as covered call writing, generating potential premium income from selling call options.

- Flexibility: Options trading provides flexibility in managing your investment strategy. You can use options to generate income, protect your portfolio or take more directional bets with higher leverage.

Considerations for Options Trading

Before venturing into options trading, it’s crucial to consider the following factors:

- Sophistication: Options trading is complex and requires a strong understanding of financial markets and how options contracts work.

- Risk management: It’s crucial to develop a solid risk management plan and understand the potential for losses with leverage and options strategies.

- Time decay: Option contracts have an expiration date, and they lose value as they approach expiry. This is known as “theta” decay. You need to manage your option positions wisely, especially as they approach the expiration date.

- Liquidity: Not all options contracts have high liquidity. Ensure your chosen options have enough liquidity to easily enter and exit positions at favourable prices.

The Future of Vanguard Options Trading

Vanguard’s options trading platform is continually evolving, staying abreast of the latest technological advancements and adapting to the changing needs of traders. They are consistently adding new features and functionality to their platform, making it more intuitive and powerful. As online trading continues to transform, Vanguard is likely to further refine its options trading platform, offering traders access to advanced tools, educational resources, and a user-friendly experience.

Tips for Success with Vanguard Options Trading

Starting with options trading can be daunting. To enhance your success with Vanguard’s options platform, consider these tips:

- Start small: Begin with a modest amount of capital and gradually increase as you gain experience and confidence.

- Focus on education: Take advantage of Vanguard’s educational resources and invest time in understanding the fundamentals of options trading.

- Develop a trading plan: Define your investment objectives, risk tolerance, and trading strategies before you start actively trading.

- Practice paper trading: Familiarise yourself with the Vanguard platform and different options strategies through paper trading. This allows you to experiment without risking real capital.

- Manage your risk: Set stop-loss orders to limit potential losses and understand the potential risks associated with options strategies.

Remember, options trading should never be undertaken without a thorough understanding of its complexity and inherent risks. Consider your investment goals, risk tolerance, and knowledge before embarking on this journey.

Frequently Asked Questions (FAQ)

Q: What is the minimum account balance required to trade options with Vanguard?

A: There is no specific minimum balance required to trade options with Vanguard, although you might need to meet certain requirements for specific options strategies.

Q: How do I open a Vanguard account for options trading?

A: You can open a Vanguard brokerage account online or by phone. Be sure to indicate your interest in options trading when applying.

Q: What are the commission fees for options trading with Vanguard?

A: Vanguard has competitive commission fees for options trading. You can check their current fee schedule on their website.

Q: Is there a learning curve associated with options trading?

A: Yes, options trading has a significant learning curve. It requires a strong understanding of financial markets, options contracts, and various trading strategies.

Q: Is options trading suitable for all investors?

A: Options trading can be beneficial for experienced investors with a strong understanding of financial markets. However, it may not be suitable for all investors, especially those with limited experience and risk tolerance.

Vanguard Options Trading

Conclusion

Vanguard options trading offers a platform for experienced traders and those venturing into the world of options. It provides a user-friendly interface, competitive fees, and educational resources to support your journey. However, remember that options trading involves inherent risks. Do your research, understand your risk tolerance, and explore Vanguard’s resources before you begin. Are you ready to embark on your journey with Vanguard options trading?