Introduction to Options, Day, and Swing Trading

Trading stocks can be a seductive way to grow your wealth, but it also carries a substantial degree of risk. To be successful in the stock market, it’s crucial to choose a trading strategy that aligns with your specific risk tolerance and financial goals. Three popular trading strategies include options trading, day trading, and swing trading. Each of these approaches carries its unique set of risks and rewards, so it’s essential to understand the distinctions before taking the plunge.

Image: comparebrokers.co

In this comprehensive guide, we will break down the differences between options trading, day trading, and swing trading. We will explore the advantages and disadvantages of each strategy, providing you with the knowledge you need to make an informed decision and embark on your trading journey confidently.

Options Trading: A More Nuance Approach

Options trading involves investing in contracts that give you the right, but not the obligation, to buy or sell a specific asset at a predetermined price on a specified date. Options trading can be a complex and sophisticated strategy, often favored by experienced traders seeking to generate income or hedge against risk.

The primary advantage of options trading is its flexibility. Options contracts can be tailored to the trader’s specific risk tolerance and investment goals and can be used for various strategies, including income generation, hedging, and speculation. However, options trading is also a leveraged investment, which means it can amplify both gains and losses.

Day Trading: The Fast-Paced World of Short-Term Trades

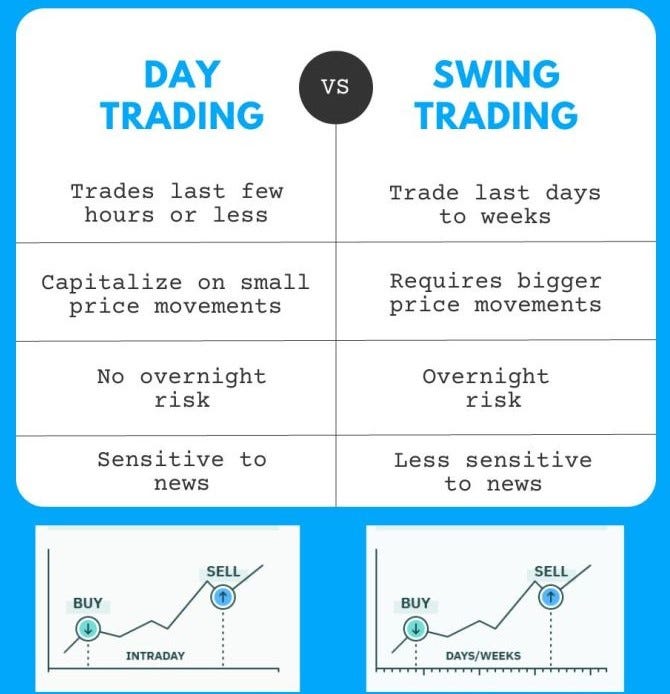

Day trading involves buying and selling stocks, options, or futures contracts within a single trading day. Day traders aim to profit from short-term price movements, and they often rely on technical analysis to identify potential trading opportunities.

The primary advantage of day trading is its potential for quick profits. However, it’s also a high-risk, high-stress strategy that requires significant skill, discipline, and emotional resilience. Day traders must be able to make quick decisions and withstand the pressure of rapid market fluctuations.

Swing Trading: Striking the Balance between Risk and Reward

Swing trading involves holding stocks for anywhere from a few days to a few weeks, with the aim of capturing price swings. Swing traders analyze both technical and fundamental factors to identify potential trading opportunities and typically use short-term moving averages and support and resistance levels to inform their decisions.

Swing trading offers a balance between the risk and reward of day trading and options trading. Swing traders benefit from the potential for higher returns than buy-and-hold investors, but they also face less risk than day traders. However, it’s essential to remember that swing trading can still be a volatile strategy, and traders should be prepared for market downturns.

Image: stockhitter.com

Choosing the Right Trading Strategy for You

The best trading strategy for you depends on your individual risk tolerance, financial goals, and time constraints. If you’re new to trading, it’s crucial to start with a strategy that has a relatively low risk, such as swing trading. As you gain experience and confidence, you can gradually move into more complex strategies like day trading or options trading.

Here’s a summary of the key differences between options trading, day trading, and swing trading:

| Feature | Options Trading | Day Trading | Swing Trading |

|---|---|---|---|

| Risk | Moderate to high | High | Low to moderate |

| Reward | Moderate to high | High | Low to moderate |

| Timeframe | Days to months | Hours | Days to weeks |

| Knowledge required | High | High | Moderate |

| Experience required | High | High | Moderate |

Tips and Expert Advice for Successful Trading

Here are a few tips and pieces of expert advice to help you succeed in your trading journey:

- Start with a small account and gradually increase your trading size as you gain experience and confidence.

- Thoroughly research any company or asset before you trade.

- Don’t overtrade. Focus on a few high-quality trading opportunities and avoid making impulsive decisions.

- Manage your risk by setting stop-loss orders and sticking to them.

- Keep emotions out of your trading decisions. Trade logically and objectively.

FAQ on Options, Day, and Swing Trading

- Q: Which trading strategy is the most profitable?

- A: The profitability of a trading strategy depends on various factors, including market conditions, trader skill, and risk tolerance. There is no one-size-fits-all approach, and the best strategy for you will depend on your individual circumstances.

- Q: Can I make a living from trading?

- A: It’s possible to make a living from trading, but it takes hard work, dedication, and a sound understanding of the market. There are many successful traders, but there are also many who fail. If you’re thinking about becoming a full-time trader, it’s crucial to educate yourself, practice, and have a realistic understanding of the risks involved.

- Q: What are the most common mistakes novice traders make?

- A: Some of the most common mistakes novice traders make include overtrading, not managing their risk, letting emotions guide their decisions, and failing to educate themselves. Avoiding these mistakes can significantly improve your chances of success in the stock market.

Options Trading Vs Day Trading Vs Swing Trading

Image: medium.com

Conclusion

Whether you choose options trading, day trading, or swing trading, it’s essential to approach the stock market with a well-defined strategy and a realistic understanding of the risks involved. Trading can be a lucrative but challenging endeavor, so it’s crucial to educate yourself, practice, and manage your risk carefully.

Are you interested in learning more about swing trading stocks?

If so, I encourage you to explore our extensive library of educational resources, including articles, tutorials, and webinars. We’ve helped thousands of traders achieve their financial goals, and we can help you too!