In the realm of option trading, comprehending the nuances of ITM, ATM, and OTM is crucial for informed decision-making. These acronyms, commonly used in the trading lingo, represent different market positions of an option contract in relation to the underlying asset’s price. A thorough understanding of these concepts will empower traders to navigate the complexities of option trading and maximize their potential returns.

Image: www.avatrade.fr

Types of Option Contracts

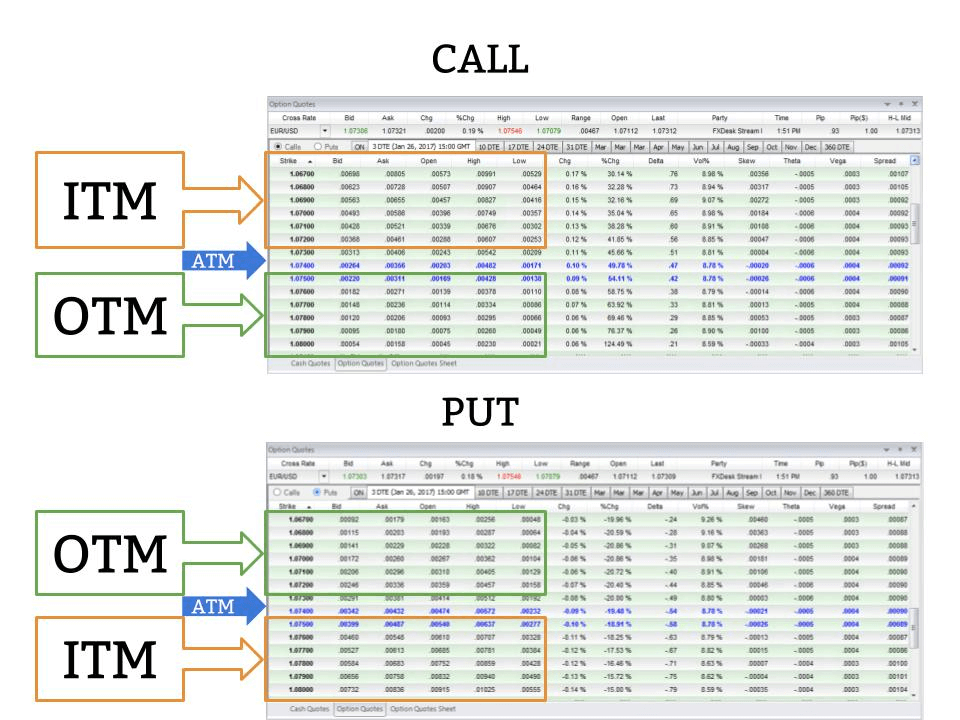

Options contracts come in two forms: calls and puts. Call options give the holder the right to purchase the underlying asset at a predetermined price, known as the strike price. Put options, on the other hand, provide the right to sell the underlying asset at the strike price.

In-the-Money (ITM) Options

ITM options are those whose strike prices are favorable to the holder. For call options, an ITM contract means that the strike price is below the current market price of the underlying asset. This gives the holder the immediate option to exercise their right and purchase the asset at a lower price, resulting in a potential profit.

Similarly, for put options, an ITM contract is one whose strike price is above the current market price. This means that the holder can immediately sell the underlying asset at a higher price than what they could get in the market, leading to potential gains.

At-the-Money (ATM) Options

ATM options are those whose strike prices exactly match the current market price of the underlying asset. These options do not provide any intrinsic value to the holder at the time of purchase. However, as the market price fluctuates, ATM options can quickly become either ITM or OTM, offering significant trading opportunities.

Image: www.youtube.com

Out-of-the-Money (OTM) Options

OTM options are those whose strike prices are less favorable to the holder than the current market price. For call options, an OTM contract has a strike price higher than the market price. This means that the holder would need a substantial increase in the underlying asset’s value to make a profit.

For put options, an OTM contract has a strike price lower than the market price. The holder would require a significant decline in the asset’s value to realize a profit. OTM options are generally considered higher-risk, but can offer potentially high rewards if the market price moves drastically in the desired direction.

Key Considerations for ITM, ATM, and OTM Options

Traders must carefully weigh factors such as the underlying asset price trend, risk tolerance, and investment horizon when considering ITM, ATM, or OTM options. ITM options offer the greatest potential profit in the short term, but they also carry the highest purchase price and are less suitable for long-term trades.

ATM options provide a good balance between price and potential profit. They may be suitable for traders looking for a combination of higher leverage and moderate risk. OTM options offer the lowest purchase price, but they require a significant market price movement to become profitable. They are typically used by traders willing to take on more risk for potentially higher rewards.

Frequently Asked Questions about ITM, ATM, and OTM Options

- Q: Which type of option is more likely to expire worthless?

A: OTM options are more likely to expire worthless as they require a significant price movement to become profitable.

- Q: Can I exercise an ITM option on the day of purchase?

A: Yes, you can exercise an ITM option at any time up to the expiration date.

- Q: What happens if I do not exercise an ITM option before expiration?

A: An ITM option will automatically expire and become worthless if it is not exercised before the expiration date.

What Is Itm Atm And Otm In Option Trading

Conclusion: Mastering the Nuances of Option Trading

Understanding the nuances of ITM, ATM, and OTM options is a fundamental skill for successful option trading. By thoroughly grasping these concepts, traders can devise informed trading strategies and optimize their returns. Whether you’re a seasoned pro or a novice entering the thrilling world of option trading, staying updated on latest trends and seeking expert advice will empower you to navigate the complexities of the market and maximize your potential profits.

Are you ready to embark on the exciting journey of option trading? Remember, knowledge is power. Dive deeper into the world of ITM, ATM, and OTM options to unlock the secrets of informed decision-making and reap the rewards of this dynamic financial instrument.