Introduction

Venturing into the world of options trading can be intimidating, but it doesn’t have to be. Whether you’re a seasoned investor or just starting out, this guide will demystify options trading on Robinhood and equip you with a solid understanding of this powerful investment tool.

Image: belucydyret.web.fc2.com

Options are financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. They provide unique opportunities to enhance portfolio returns, manage risk, and speculate on market movements. Understanding how options work and how to trade them effectively is essential to harnessing their potential.

Understanding Options Basics

An option contract has two key components: the option type and the strike price. The option type determines whether you have the right to buy or sell the underlying asset. A call option gives you the right to buy, while a put option gives you the right to sell.

The strike price is the predetermined price at which you can exercise the option. If you hold a call option, you can buy the asset at the strike price, regardless of its current market value. If you hold a put option, you can sell the asset at the strike price.

Trading Options on Robinhood

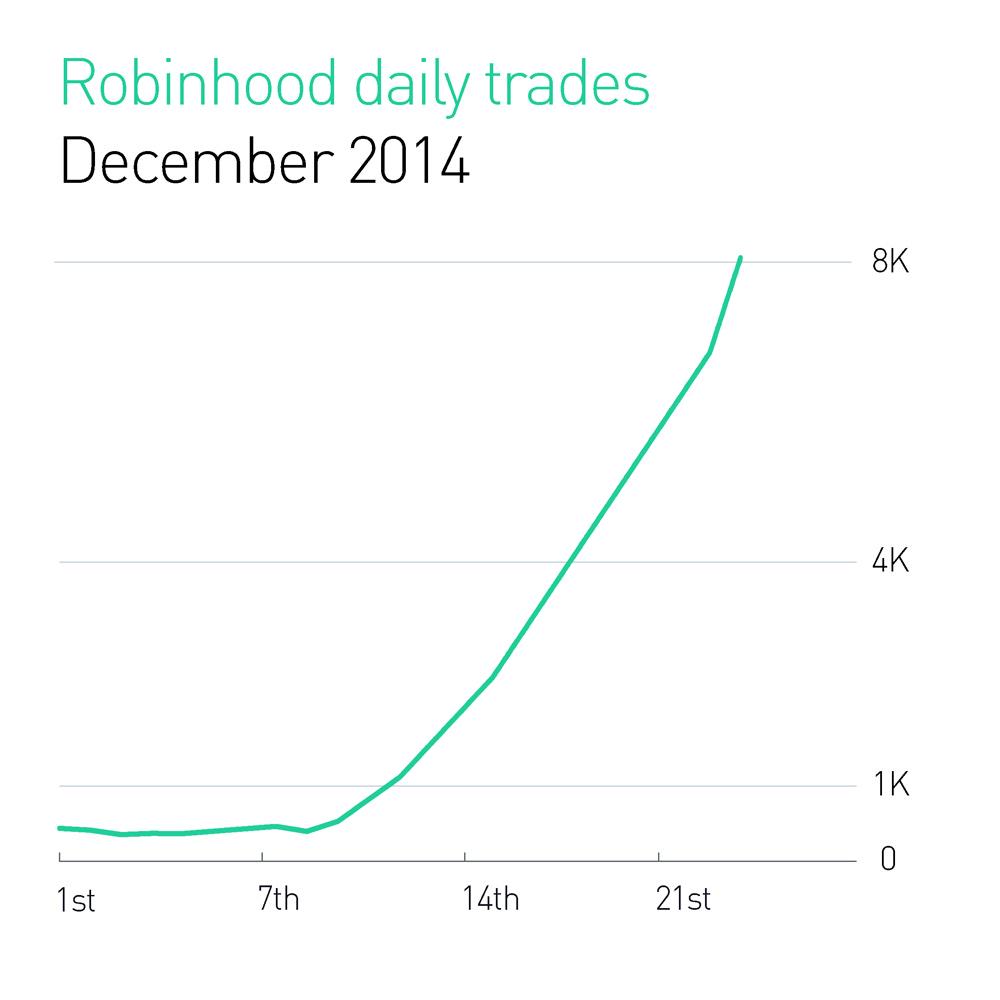

Robinhood is a popular online trading platform that offers commission-free options trading. To start trading options on Robinhood, you need to open an options trading account. Once your account is approved, you can access Robinhood’s options trading platform.

When trading options on Robinhood, it’s crucial to consider factors such as the underlying asset, the option type, the strike price, the expiration date, and the premium. The premium is the price you pay to purchase the option contract.

Strategies for Options Trading

There are numerous strategies you can employ when trading options. Some common strategies include:

- Buying a call option if you believe the underlying asset will increase in value.

- Selling a call option if you believe the underlying asset will decrease in value.

- Buying a put option if you believe the underlying asset will decrease in value.

- Selling a put option if you believe the underlying asset will increase in value.

The choice of strategy depends on your investment goals and risk tolerance.

Image: inflationprotection.org

Managing Risk in Options Trading

Options trading involves inherent risk, so it’s essential to manage risk effectively. One way to manage risk is to diversify your portfolio by trading options on different underlying assets and using different strategies.

Another important risk management technique is to use stop-loss orders. A stop-loss order automatically sells an option contract when it reaches a predetermined price, limiting your potential losses.

Trading Options On Robinhood For Dummies

Conclusion

Trading options on Robinhood can be a lucrative and exciting way to enhance portfolio returns. However, it’s important to approach options trading with a sound understanding of the risks involved and a clear trading plan. By following the principles outlined in this guide, you can increase your chances of success in the options market.

Remember, education and research are key to unlocking the potential of options trading. Consult reliable sources, seek advice from financial professionals if needed, and always trade within your risk tolerance. Happy trading!