Introduction: Embarking on the Options Market Adventure

Imagine yourself standing on the threshold of the bustling options market, eager to explore its vast potential but unsure where to begin. Call options, in particular, hold immense allure for both seasoned traders and novice investors alike. They offer a potent tool to leverage market trends, enhance portfolios, and potentially generate substantial returns. However, venturing into this intricate realm can be daunting, especially for beginners. This comprehensive guide will serve as your compass, offering a clear path through the complexities of call options trading.

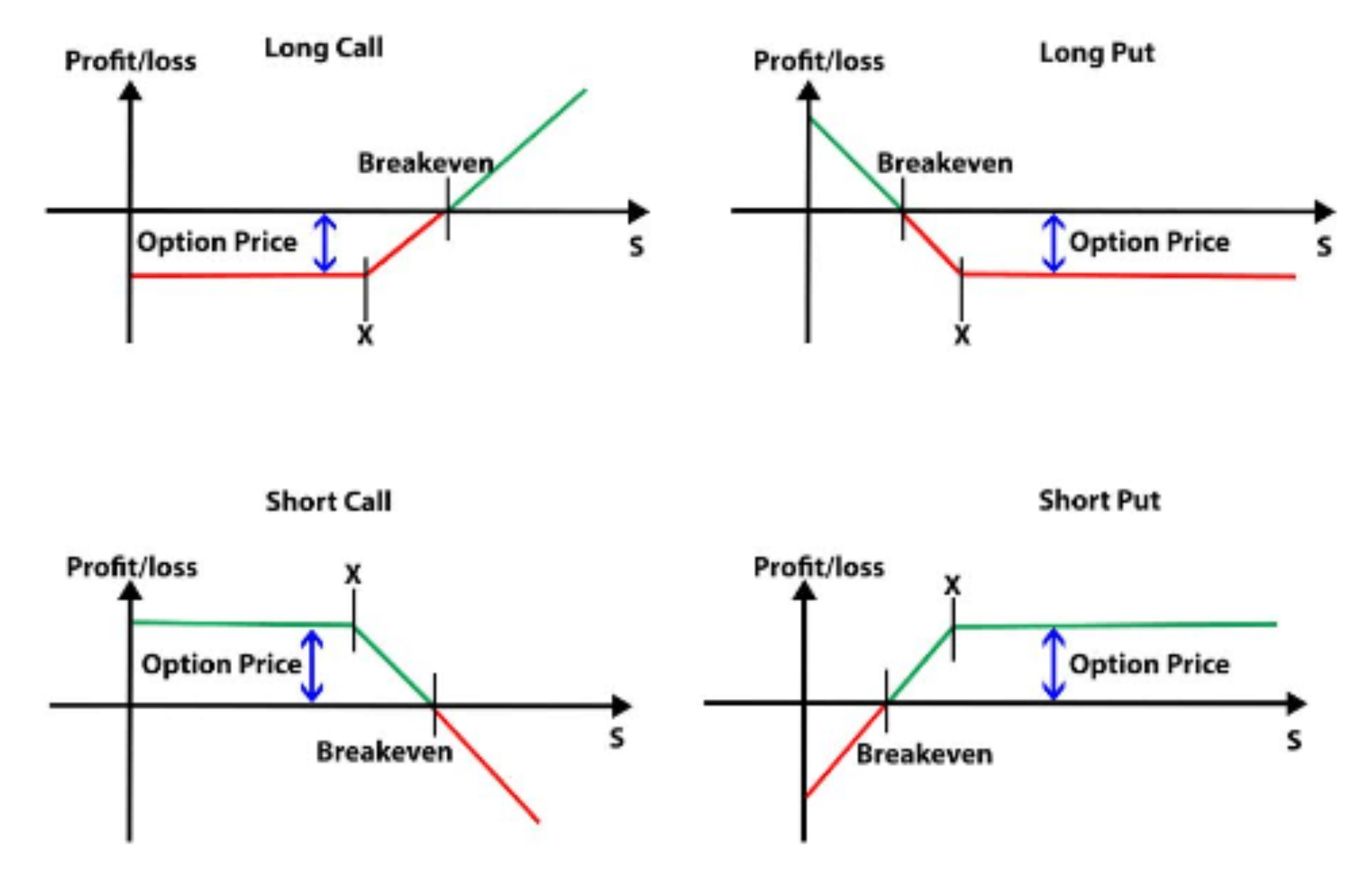

Image: marketrealist.com

What are Call Options and How Do They Work?

In the realm of finance, a call option grants its holder the right, but not the obligation, to buy a specific asset at a specified price (known as the strike price) on or before a predetermined date (the expiration date). When you trade call options, you speculate that the underlying asset will rise in value beyond the strike price before the expiration date. If your prediction holds true, you can capitalize on the opportunity to purchase the asset at a more favorable price, profiting from its ascent.

Understanding Call Option Terminology

Call options are characterized by a unique lexicon. Here’s a quick breakdown of key terms:

- Option Premium: This represents the upfront cost of purchasing the call option. It factors in variables such as the asset’s price, volatility, time to expiration, and interest rates.

- Strike Price: The predetermined price at which the holder can exercise or “call” the option.

- Expiration Date: The day after which the option expires and can no longer be exercised.

- Underlying Asset: The underlying asset, such as a stock, bond, or commodity, whose price determines the call option’s value.

- In-the-Money: Call options are considered “in-the-money” when the underlying asset’s price is above the strike price. This grants the holder the potential for profit.

- Out-of-the-Money: Call options are classified as “out-of-the-money” when the underlying asset’s price is below the strike price. In such instances, the holder may not be able to exercise the option profitably.

Expert Tips and Advice for Trading Call Options

Navigating the options market effectively requires a strategic approach. Here are some expert tips to guide your journey:

- Set Realistic Expectations: Option trading involves inherent risks, and it’s crucial to approach it with a well-informed mindset. Don’t expect to become a millionaire overnight.

- Thoroughly Research the Underlying Asset: Conduct in-depth analysis of the asset underlying the option to assess its historical performance, industry dynamics, and future prospects.

- Choose Appropriate Leverage: Balance the potential returns against the risks involved. Options can amplify gains and losses, so select leverage that aligns with your risk tolerance.

- Manage Your Risk: Options trading can lead to substantial financial losses. Implement prudent risk management strategies, such as setting stop-loss orders, to safeguard your capital.

Image: tme.net

Frequently Asked Questions (FAQs)

Q: How do I get started with call options trading?

A: Begin by selecting a reputed broker that offers options trading. Open an account, fund it, and familiarize yourself with the trading platform’s functionality.

Q: When is the ideal time to trade call options?

A: The best time to purchase call options is when you anticipate a rise in the underlying asset’s price within a given timeframe. Consider factors like market trends, news events, and economic data.

Q: What are the risks involved in call options trading?

A: Options trading entails various risks, including potential for financial losses beyond the initial investment, fluctuating market dynamics, and the time value decay of options.

Q: How can I enhance my call options trading skills?

A: Attend workshops, read articles, and engage in online forums dedicated to options trading. Consider practicing strategies using virtual trading accounts or simulators.

Trading Call Options For Beginners

https://youtube.com/watch?v=lhXYSb45UMs

Conclusion: Embracing the Power of Call Options

Trading call options presents a gateway to unlocking market opportunities and potentially boosting financial returns. However, it’s imperative to approach it with a well-informed and calculated strategy. By understanding the basics, embracing expert advice, and continuously learning, you can navigate the complexities of call options trading with confidence.

Are you ready to embark on this exciting journey and explore the world of call options?