Introduction: Navigate the Thrilling (and Potentially Lucrative) World of 0 DTE SPX Options

Image: icomedian.blogspot.com

In the fast-paced, adrenaline-pumping world of options trading, there’s a unique and exhilarating subspecies that has captured the attention of traders: 0 DTE SPX options. These zero-day-to-expiration (0 DTE) contracts offer a tantalizing blend of high-stakes thrill and potentially lucrative rewards. But what exactly are 0 DTE SPX options, and how can you tap into their profit-generating potential while managing risk? In this comprehensive guide, we’ll delve deep into the intricacies of this fascinating trading instrument, equipping you with the knowledge and strategies to navigate this exhilarating market.

Unlocking the Enigma of 0 DTE SPX Options: Understanding the Basics

0 DTE SPX options, also known as “zero-day SPX options” or simply “0 DTEs,” are a type of financial contract that derives its value from the S&P 500 Index (SPX). These contracts, as the name suggests, have an expiration date that is the same day as the trade date. In essence, 0 DTE SPX options provide traders with an opportunity to speculate on the short-term price movements of the S&P 500, offering the potential for quick profits but with the inherent risk of rapid losses.

Trading 0 DTE SPX Options: A Primer for Success

Trading 0 DTE SPX options, while alluring, requires a comprehensive understanding of the underlying mechanics and strategies involved. Seasoned traders and beginners alike must possess a deep knowledge of option pricing models, volatility dynamics, and market trends to increase their chances of successful trades. Moreover, risk management techniques become paramount, as the rapid time decay associated with these options can amplify potential losses.

Navigating the Intricacies of 0 DTE SPX Option Pricing

0 DTE SPX option pricing is heavily influenced by several key factors, including the underlying S&P 500 Index price, the option’s strike price, and the time to expiration (which, in this case, is zero). Traders must also consider the Greeks, a set of metrics that measure an option’s sensitivity to various market variables, to refine their pricing models and predict price movements with greater accuracy. By understanding the dynamics of 0 DTE SPX option pricing, traders can make more informed decisions and potentially enhance their profitability.

Mastering Volatility: A Critical Factor in 0 DTE SPX Options Trading

Volatility, a measure of the rate at which an asset’s price changes over time, plays a pivotal role in 0 DTE SPX options trading. High volatility typically leads to higher option prices, as it increases the potential for significant price fluctuations. Traders must analyze historical volatility data and monitor current market conditions to gauge the expected volatility of the underlying S&P 500 Index. Understanding volatility dynamics can help traders identify trading opportunities and adjust their strategies accordingly.

Essential Trading Strategies for 0 DTE SPX Options: A Path to Potential Profits

To harness the profit-making potential of 0 DTE SPX options, traders employ a range of strategies tailored to their risk tolerance and market outlook. Some commonly used strategies include:

-

Delta Neutral Trading: Involves simultaneously buying and selling options with opposing deltas to minimize the impact of price movements and generate income from option premiums.

-

Scalping: A short-term strategy that involves making multiple small trades throughout the trading day, aiming to capture quick profits from small price fluctuations.

-

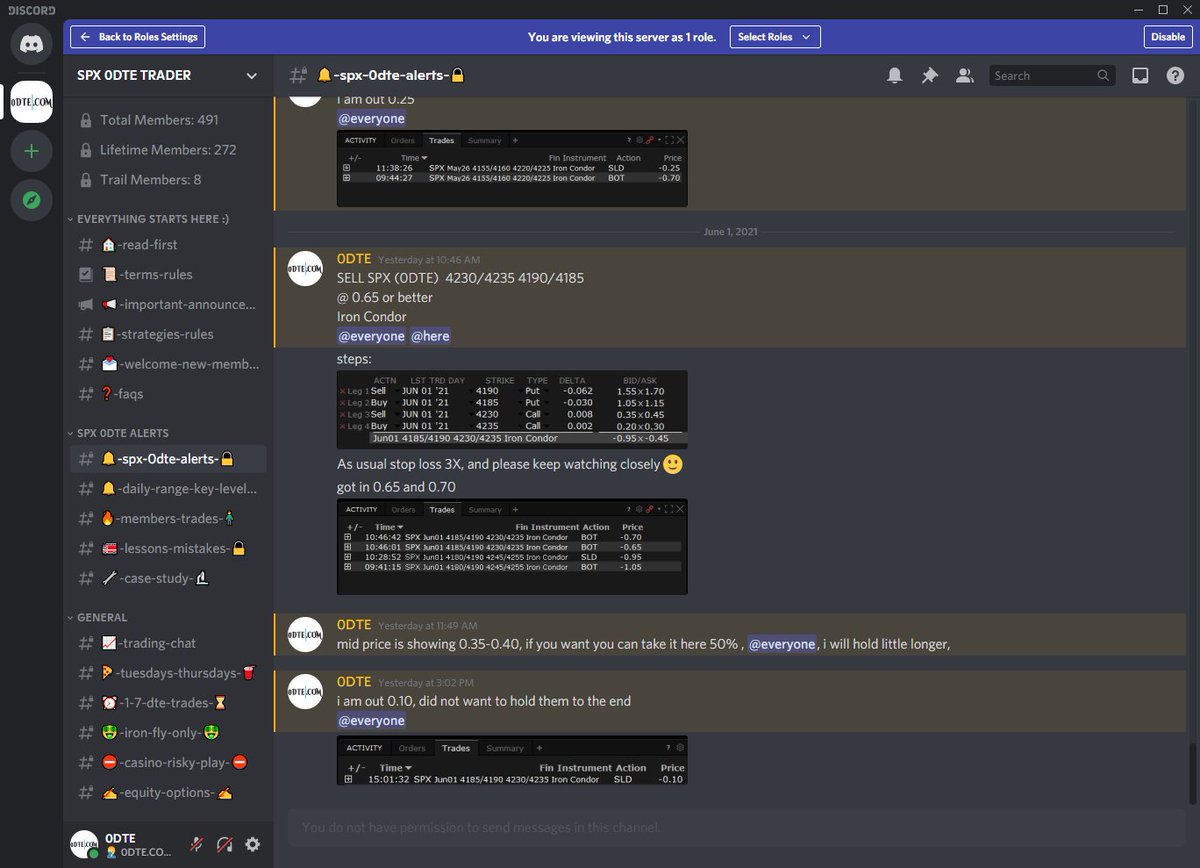

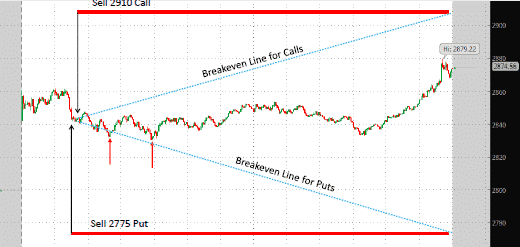

Iron Condor Trading: A neutral strategy that involves selling an equal number of out-of-the-money call and put options at different strike prices to profit from a narrow range of underlying price movements.

Risk Management: A Cornerstone of Successful 0 DTE SPX Options Trading

Risk management is paramount in 0 DTE SPX options trading, given the high potential for rapid losses. Traders must implement robust risk management strategies to mitigate potential setbacks and preserve capital. These strategies include:

-

Position Sizing: Prudent traders determine the appropriate number of contracts to trade based on their account size and risk tolerance, avoiding overleveraging.

-

Stop-Loss Orders: Traders can employ stop-loss orders to automatically exit positions when predetermined loss limits are reached, limiting potential losses.

-

Defined Risk Strategies: Iron condors and other defined risk strategies limit the maximum possible loss, providing traders with a predefined risk profile.

Seeking Expert Insights: Wisdom from Seasoned 0 DTE SPX Options Traders

Seasoned 0 DTE SPX options traders offer invaluable insights that can enhance your trading journey. Here are some of their wisdom-filled nuggets:

-

“Discipline is essential in 0 DTE SPX options trading. Stick to your trading plan and avoid emotional decision-making,” advises Mark Douglas, a renowned trading psychologist.

-

“Thoroughly understand the Greeks and their impact on option pricing. This knowledge will empower you to make informed trading decisions,” emphasizes Tom Sosnoff, founder of Tastytrade.

-

“Risk management is not an option, it’s a necessity. Implement robust risk management strategies to safeguard your capital,” cautions Chris Butler, a veteran options trader.

Conclusion: Embracing the Thrill and Potential Rewards of 0 DTE SPX Options Trading

Trading 0 DTE SPX options offers a unique combination of excitement and profit-making opportunities. However, to succeed in this fast-paced trading arena, traders must equip themselves with a comprehensive understanding of option pricing models, volatility dynamics, and market trends. By employing effective trading strategies and implementing robust risk management practices, traders can potentially reap the rewards of 0 DTE SPX options trading while navigating the inherent risks. Remember, knowledge and discipline are your allies in this exhilarating world of financial markets, empowering you to make informed decisions and potentially achieve your trading goals.

Image: cerlimelisa.blogspot.com

Trading 0 Dte Spx Options