In the enigmatic realm of options trading, gamma stands as an enigmatic concept that can both amplify profits and magnify risks. Envision yourself standing amidst a roiling sea of financial instruments, each with its unique characteristics and potential pitfalls. Gamma is akin to a powerful current, capable of sweeping you away towards extraordinary gains or treacherous losses.

Image: support.geojit.com

Understanding Gamma Options Trading

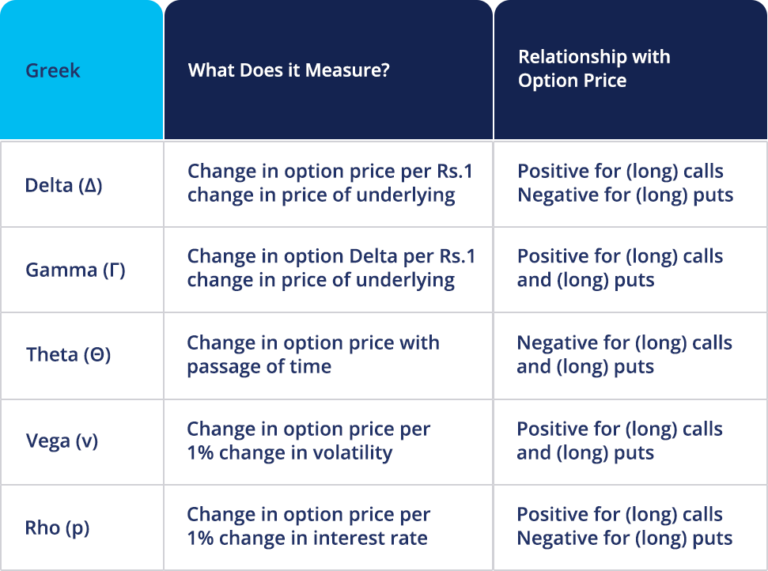

Gamma measures the change in an option’s delta for every unit change in the underlying asset’s price. A positive gamma indicates that the delta increases as the asset’s price rises, while a negative gamma implies a decrease in delta with rising prices. Grasping the intricacies of gamma is paramount for navigating the volatile waters of options trading with confidence.

Interpreting Gamma Values

Delta is essentially the sensitivity of an option’s price to changes in the underlying asset’s price. Gamma, in essence, gauges the sensitivity of delta to these price fluctuations. A positive gamma translates to increasing delta as prices rise, giving rise to explosive profit potential. Conversely, a negative gamma indicates diminishing delta, potentially limiting gains or even leading to losses.

Positive Gamma vs. Negative Gamma

Positive gamma options strategies typically involve buying options as the underlying asset’s price rises, leveraging the potential for magnified gains. Negative gamma strategies, on the other hand, entail selling options during price increases, aiming to capture premium while limiting potential losses.

Image: www.paytmmoney.com

Recent Trends in Gamma Options Trading

In the ever-evolving landscape of financial markets, gamma options trading has witnessed a surge in popularity. Advances in technology have empowered traders with sophisticated tools for analyzing gamma and incorporating it into their strategies. Social media forums and news platforms have fostered vibrant discussions and insights into the nuances of gamma.

Expert Advice and Tips for Gamma Options Trading

Mastering gamma options trading demands a blend of knowledge and experience. Here are some valuable tips from seasoned experts:

Hesitate Before Selling Naked Options

Naked options, referring to selling an option without owning or shorting the underlying asset, carry substantial risk. Unforeseen price movements can lead to catastrophic losses. Tread cautiously before engaging in such strategies.

Study the Impact of Other Greeks

Gamma is but one facet of options pricing. Consider the interplay of other Greeks, such as delta, theta, and vega, to gain a comprehensive understanding of an option’s behavior.

FAQ on Gamma Options Trading

Q: Is gamma a measure of risk?

A: Gamma can indeed indicate potential risk, particularly in negative gamma scenarios where option value can deteriorate rapidly with adverse price movements.

Q: Can I manipulate gamma to my advantage?

A: Yes, by carefully selecting option strikes and expiration dates, traders can craft strategies that capitalize on favorable gamma dynamics.

Gamma Options Trading Meaning

Image: speedtrader.com

Conclusion: Unlocking the Potential of Gamma Options Trading

Gamma options trading empowers traders to amplify potential gains and mitigate risks through a sophisticated understanding of delta sensitivity. While gamma can be both a lucrative and perilous force, armed with knowledge and expert advice, you can navigate the options market with increased confidence. Are you ready to explore the mesmerizing world of gamma options trading and harness its power to elevate your financial pursuits?