Introduction

Are you intrigued by the potential rewards of options trading but wary of its risks? Navigating this complex financial landscape requires a solid understanding of options trading strategies and effective risk management techniques. In this comprehensive guide, we will delve into these essential aspects, empowering you with the knowledge and insights to make informed decisions in the world of options trading.

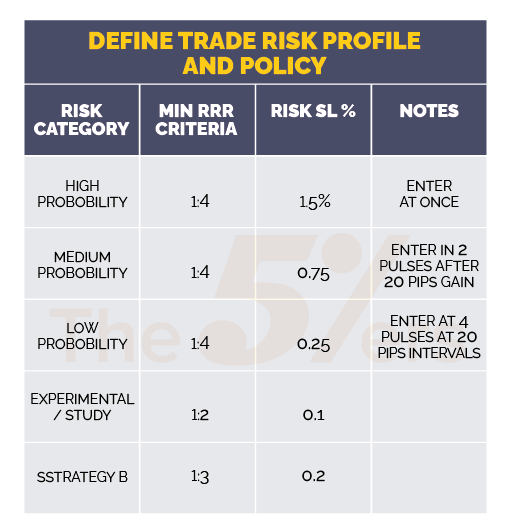

Image: the5ers.com

Understanding Options Trading

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the strike price, on or before a specific date, called the expiration date. This flexibility offers potential for profit or loss based on market movements.

Types of Options Trading Strategies

There are numerous options trading strategies tailored to different market scenarios and risk appetites. Some popular strategies include:

-

Covered Call Strategy:

Selling a call option against an underlying asset you own. You can potentially generate additional income by selling the option premium, but you may forfeit the right to sell the underlying asset at a higher price if it exceeds the strike price.

-

Image: s3.amazonaws.comCash-Secured Put Strategy:

Selling a put option with the funds to purchase the underlying asset if the option is exercised. You can receive an option premium upfront, while simultaneously locking in an obligation to buy the asset at the strike price if the price falls below the predetermined level.

-

Iron Condor Strategy:

Simultaneously selling an out-of-the-money call option and an out-of-the-money put option at different strike prices, aiming to profit from a narrow range of price fluctuations.

Risk Management in Options Trading

The inherent leverage associated with options trading can amplify both gains and losses. Prudent risk management is therefore paramount:

-

Determine Your Risk Tolerance:

Before engaging in options trading, it’s crucial to assess your tolerance for potential losses. Only risk capital that you can afford to lose.

-

Manage Position Size:

Limit the number of options contracts traded in relation to your account size. Avoid overleveraging, which can significantly magnify losses.

-

Use Stop-Loss Orders:

Place stop-loss orders to automatically close losing positions when they reach predetermined levels, thus limiting losses.

-

Monitor Market Conditions:

Stay informed about relevant news, economic events, and market trends that may affect the value of the underlying asset and your options positions.

-

Seek Professional Guidance:

Consider consulting experienced financial advisors who can provide personalized guidance based on your individual circumstances and risk profile.

Options Trading Strategy And Risk Management Pdf

Conclusion

With thoughtful consideration of options trading strategies and diligent risk management practices, you can navigate the options market with confidence. By understanding the different strategies available, implementing robust risk controls, and seeking expert advice when necessary, you can increase your chances of success in this dynamic and potentially rewarding financial arena.